Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Trust Ltd (Trust) is a company listed on the JSE Ltd and has a 30 June financial year end. The following transactions relate to

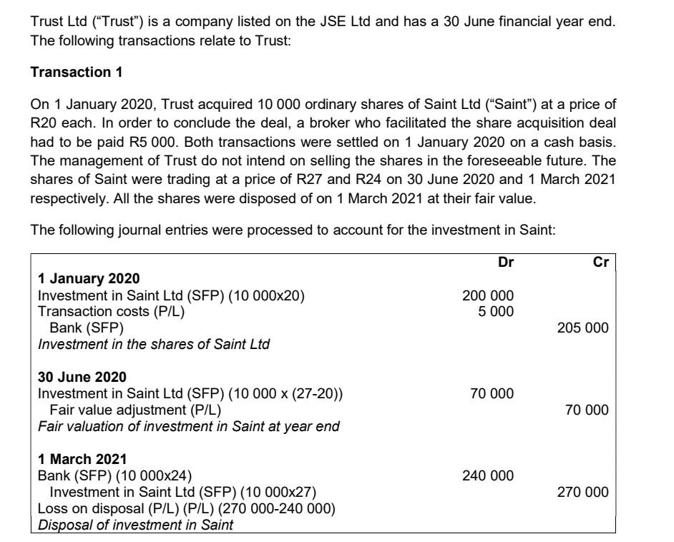

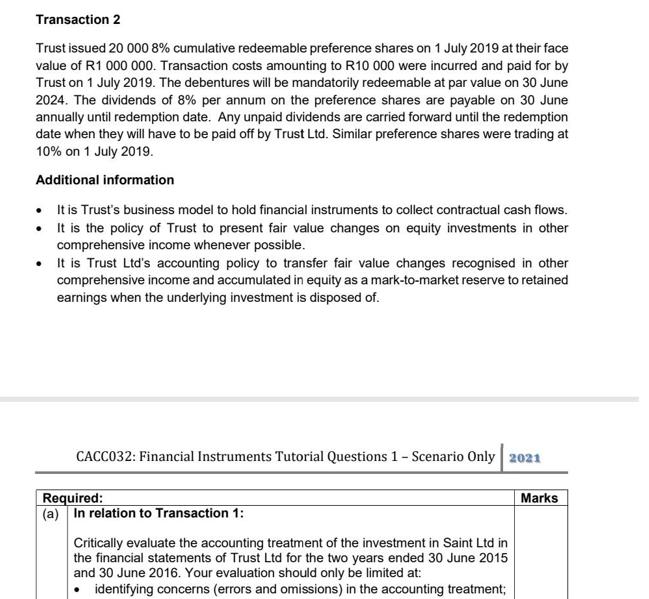

Trust Ltd ("Trust") is a company listed on the JSE Ltd and has a 30 June financial year end. The following transactions relate to Trust: Transaction 1 On 1 January 2020, Trust acquired 10 000 ordinary shares of Saint Ltd ("Saint") at a price of R20 each. In order to conclude the deal, a broker who facilitated the share acquisition deal had to be paid R5 000. Both transactions were settled on 1 January 2020 on a cash basis. The management of Trust do not intend on selling the shares in the foreseeable future. The shares of Saint were trading at a price of R27 and R24 on 30 June 2020 and 1 March 2021 respectively. All the shares were disposed of on 1 March 2021 at their fair value. The following journal entries were processed to account for the investment in Saint: Dr Cr 1 January 2020 Investment in Saint Ltd (SFP) (10 000x20) Transaction costs (P/L) Bank (SFP) Investment in the shares of Saint Ltd 200 000 5 000 205 000 30 June 2020 Investment in Saint Ltd (SFP) (10 000 x (27-20)) Fair value adjustment (P/L) Fair valuation of investment in Saint at year end 70 000 70 000 1 March 2021 Bank (SFP) (10 000x24) Investment in Saint Ltd (SFP) (10 000x27) Loss on disposal (P/L) (P/L) (270 000-240 000) Disposal of investment in Saint 240 000 270 000 Transaction 2 Trust issued 20 000 8% cumulative redeemable preference shares on 1 July 2019 at their face value of R1 000 000. Transaction costs amounting to R10 000 were incurred and paid for by Trust on 1 July 2019. The debentures will be mandatorily redeemable at par value on 30 June 2024. The dividends of 8% per annum on the preference shares are payable on 30 June annually until redemption date. Any unpaid dividends are carried forward until the redemption date when they will have to be paid off by Trust Ltd. Similar preference shares were trading at 10% on 1 July 2019. Additional information Itis Trust's business model to hold financial instruments to collect contractual cash flows. It is the policy of Trust to present fair value changes on equity investments in other comprehensive income whenever possible. It is Trust Ltd's accounting policy to transfer fair value changes recognised in other comprehensive income and accumulated in equity as a mark-to-market reserve to retained earnings when the underlying investment is disposed of. CACCO32: Financial Instruments Tutorial Questions 1- Scenario Only 2021 Required: (a) In relation to Transaction 1: Marks Critically evaluate the accounting treatment of the investment in Saint Ltd in the financial statements of Trust Ltd for the two years ended 30 June 2015 and 30 June 2016. Your evaluation should only be limited at: identifying concerns (errors and omissions) in the accounting treatment; CACC032: Financial Instruments Tutorial Questions 1- Scenario Only 2021 Required: (a) In relation to Transaction 1: Marks Critically evaluate the accounting treatment of the investment in Saint Ltd in the financial statements of Trust Ltd for the two years ended 30 June 2015 and 30 June 2016. Your evaluation should only be limited at: identifying concerns (errors and omissions) in the accounting treatment; justifying why the concerns identified are actually errors and omissions; and providing recommendations to correct the concerns identified. Structure your solution in a table with two columns as follows: Concerns and justifications A single concern may have more than one justificat Recommendations A single concern may have more than one recommendation (b) Discuss the classification of the preference shares issued by Trust Ltd (Transaction 2) in the financial statements of Trust Ltd in terms of IAS 32 Financial Instruments: Presentation. (c) Prepare all journal entries necessary to account for transaction 2 above in the financial statements of Trust Ltd for the two years ended 30 June 2020 and 2021. Please note: Journal narrations are not required. 2 of 2

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Concerns Recommendations on our first entry of 1 Jan 2020 it was wrongly debited to the transactio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started