Answered step by step

Verified Expert Solution

Question

1 Approved Answer

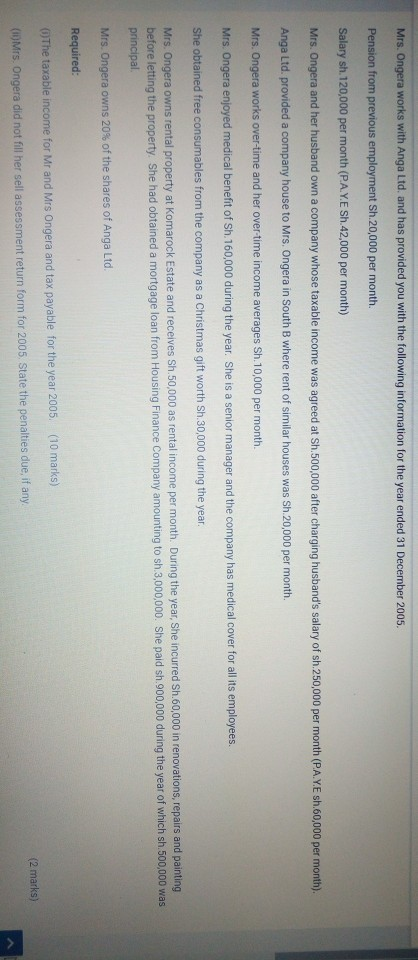

try in 1 hr Mrs. Ongera works with Anga Ltd. and has provided you with the following information for the year ended 31 December 2005.

try in 1 hr

Mrs. Ongera works with Anga Ltd. and has provided you with the following information for the year ended 31 December 2005. Pension from previous employment Sh.20,000 per month. Salary sh. 120,000 per month (P.A.Y.E sh.42,000 per month) Mrs. Ongera and her husband own a company whose taxable income was agreed at Sh.500,000 after charging husband's salary of sh.250,000 per month (PAYE sh 60,000 per month). Anga Ltd. provided a company house to Mrs. Ongera in South B where rent of similar houses was sh 20,000 per month. Mrs. Ongera works over-time and her over time income averages Sh.10,000 per month. Mrs. Ongera enjoyed medical benefit of Sh. 160,000 during the year. She is a senior manager and the company has medical cover for all its employees. She obtained free consumables from the company as a Christmas gift worth Sh 30,000 during the year. Mrs. Ongera owns rental property at Komarock Estate and receives Sh 50,000 as rental income per month. During the year, She incurred Sh.60,000 in renovations, repairs and painting before letting the property. She had obtained a mortgage loan from Housing Finance Company amounting to sh 3,000,000. She paid sh.900,000 during the year of which sh.500,000 was principal Mrs. Ongera owns 20% of the shares of Anga Ltd. Required: (10 marks) (The taxable income for Mr and Mrs Ongera and tax payable for the year 2005 (2 marks) (1) Mrs. Ongera did not fill her sell assessment return form for 2005. State the penalties due, if anyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started