Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Try solving problems 10-12 first without actually calculating prices using the new yields to maturity, using what you know about the relationships between the

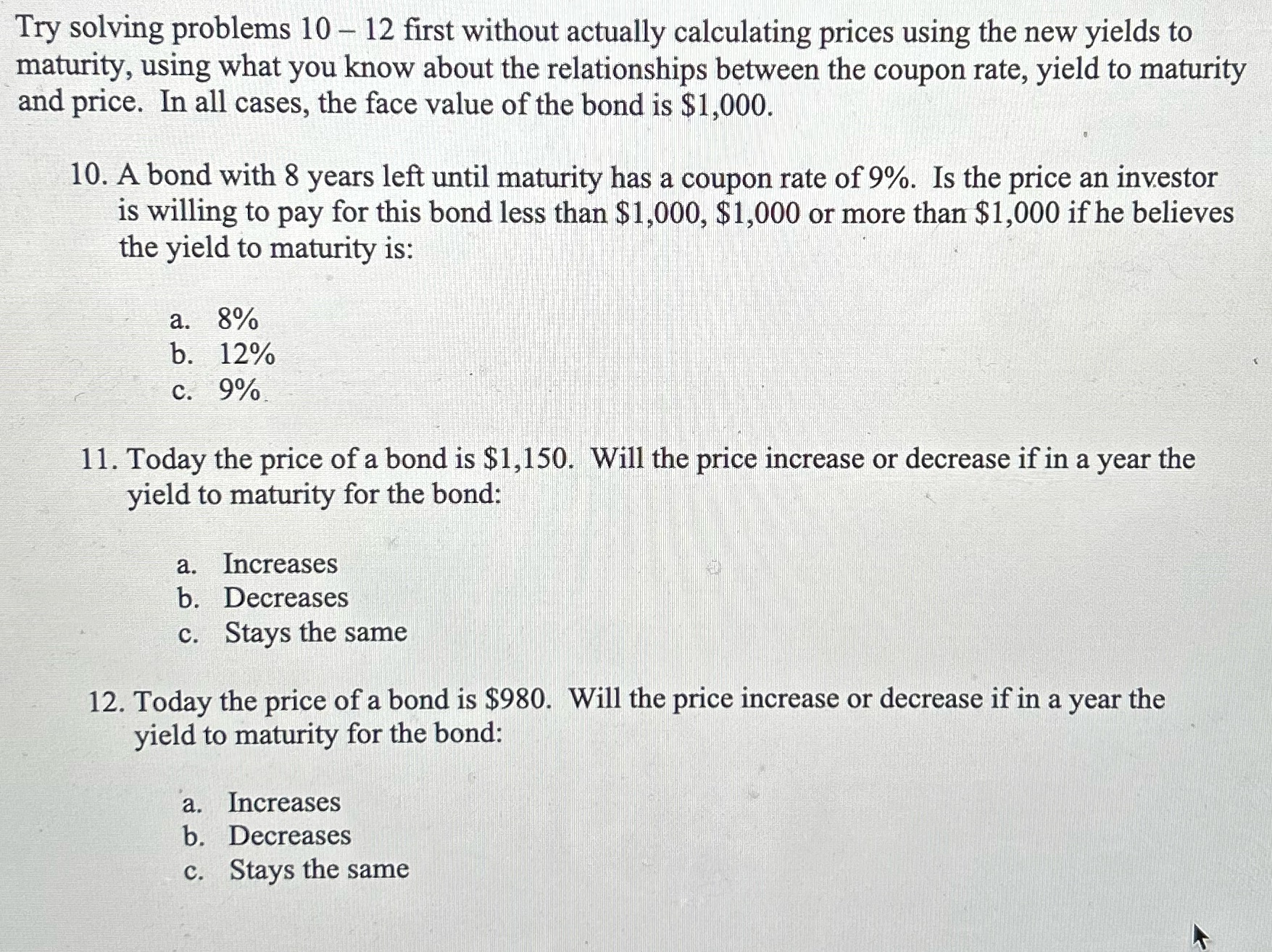

Try solving problems 10-12 first without actually calculating prices using the new yields to maturity, using what you know about the relationships between the coupon rate, yield to maturity and price. In all cases, the face value of the bond is $1,000. 10. A bond with 8 years left until maturity has a coupon rate of 9%. Is the price an investor is willing to pay for this bond less than $1,000, $1,000 or more than $1,000 if he believes the yield to maturity is: a. 8% b. 12% c. 9% 11. Today the price of a bond is $1,150. Will the price increase or decrease if in a year the yield to maturity for the bond: a. Increases b. Decreases c. Stays the same 12. Today the price of a bond is $980. Will the price increase or decrease if in a year the yield to maturity for the bond: a. Increases b. Decreases c. Stays the same

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres the analysis of the problems without calculating actual prices 10 Bond with 8 years to maturit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started