t's about OOEREDOO Telecom Company

please help me answering this question

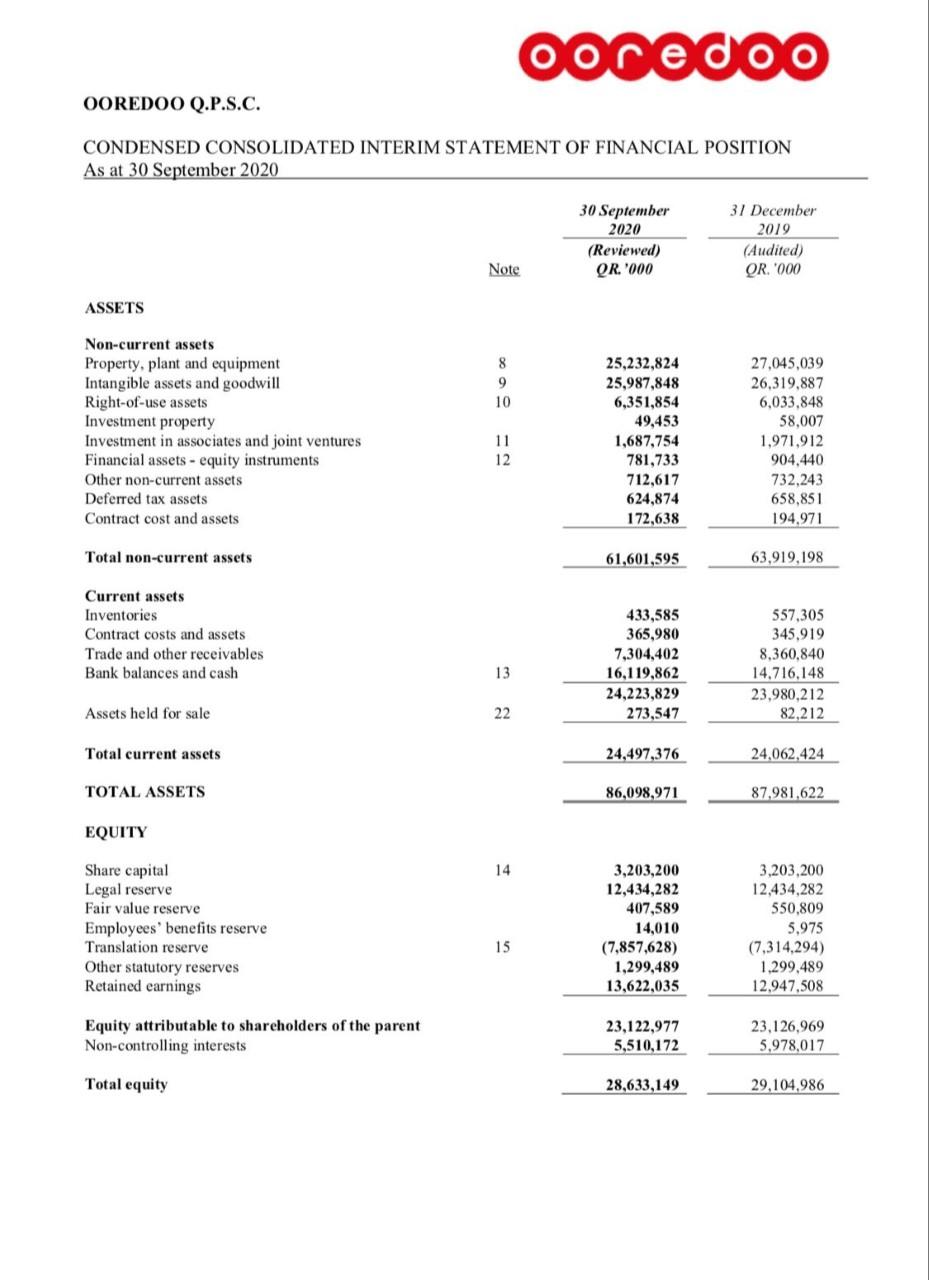

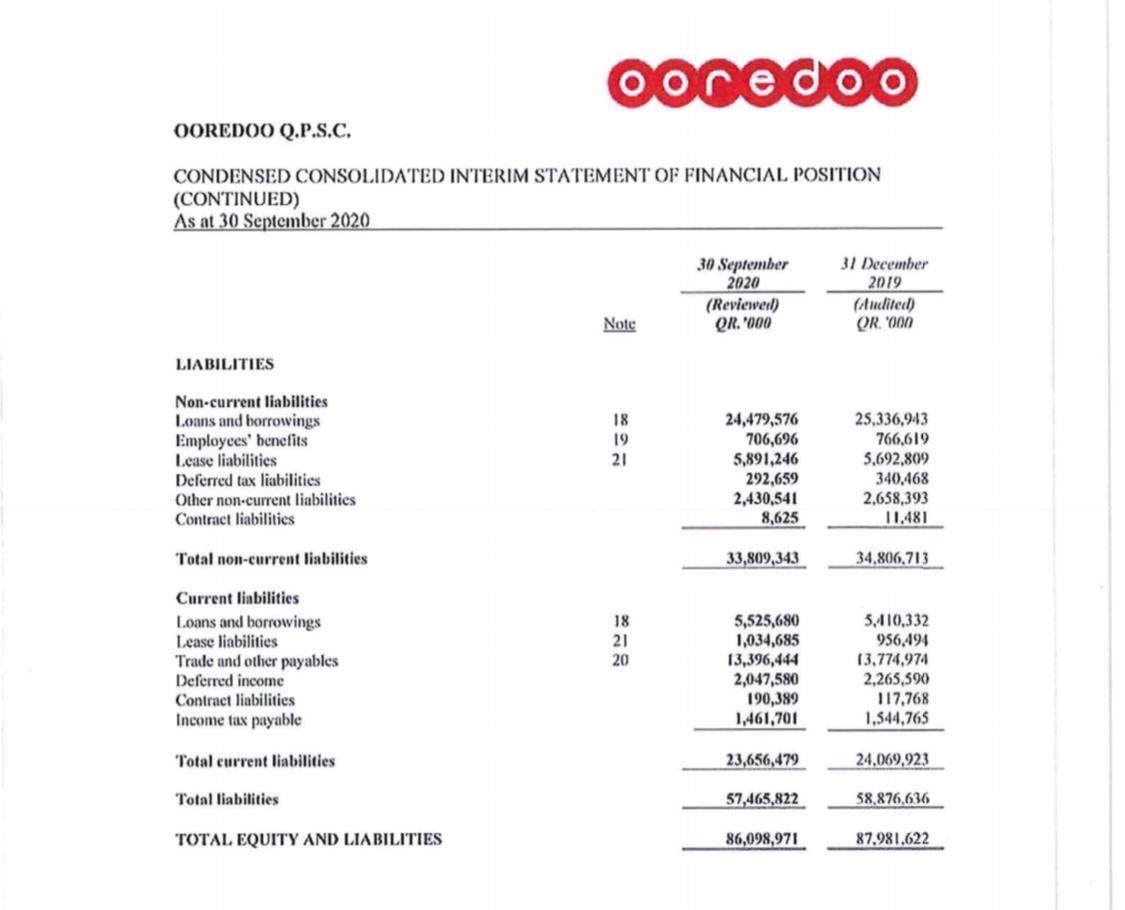

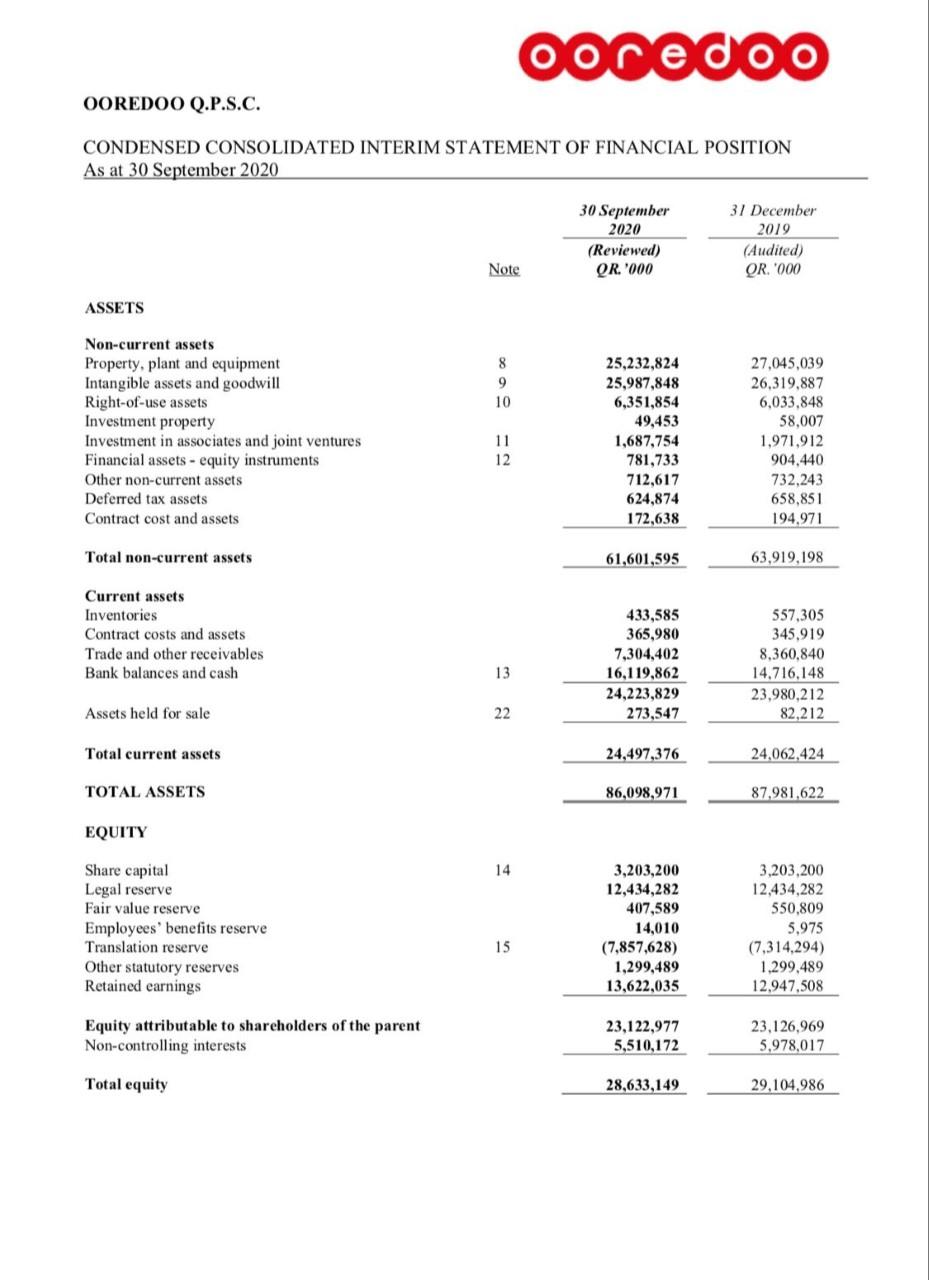

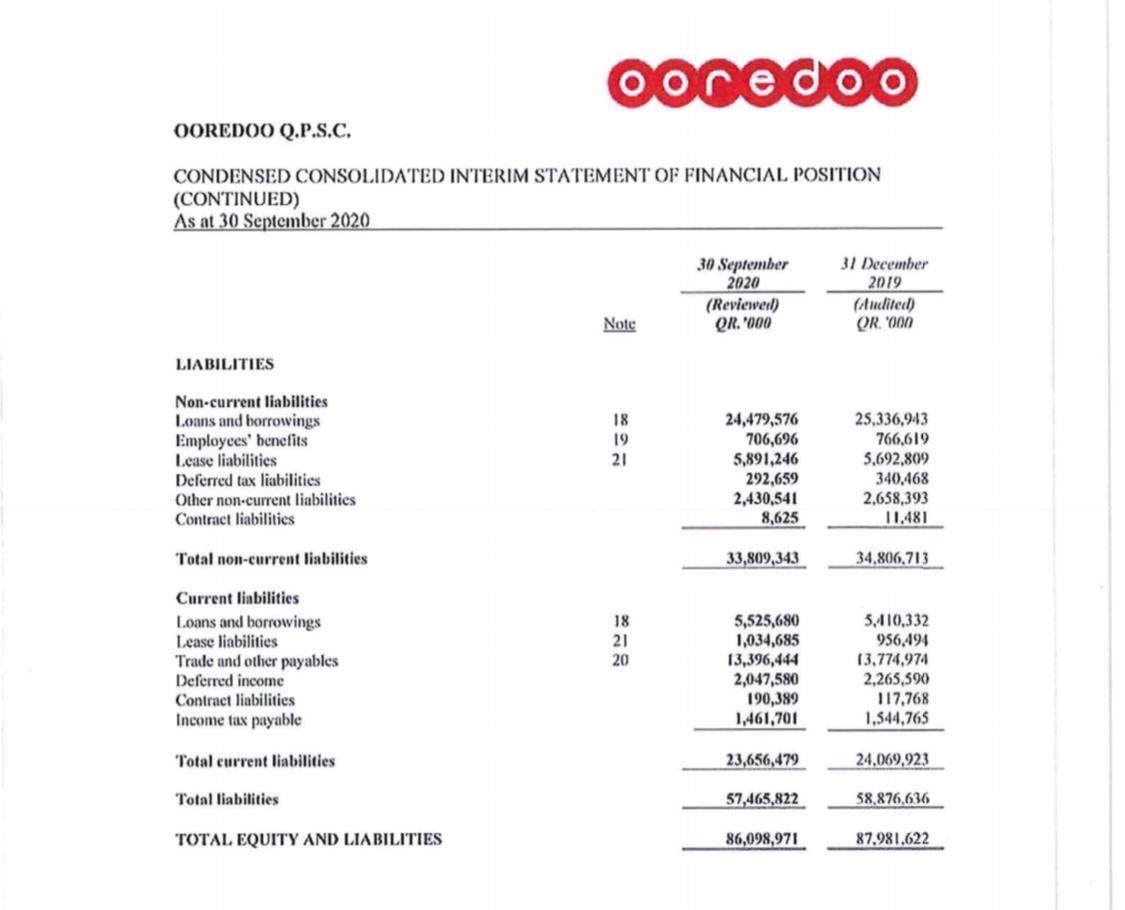

Include in your report Income Statement of your company and Income Statements of other companies that you chose from Kuwait Stock Exchange. In this report you will gather all your findings in one document. This will be your final report, it will include appendices of the excel sheets used to calculate your evaluations. r In this report you will apply Price Multiples Method to further evaluate your company. a) Explain the Price Multiples method using your own words. Mention and explain its three steps." CA b) Evaluate your company by using Price Multiples Method. Choose other four companies from Kuwait stock market which are operating in the same industry with your company, and compute Price/Earnings ratio of the most recent year. Show your calculations. (65 points) Companies Equity Value Price per Number =Price/sharex Earnings share KD of shares Number of KD in shares (in millions) millions) P/E ratio = Equity Value/Earnings No. 1 1 2 2 3 4 c) Calculate the market value of your company at the end of the most recent year and decide whether your company is overvalued or undervalued by the market. Therefore your findings will conclude as whether you think you should invite potential investors to invest their money in buying the stocks of this company and why. (1. Ooredoo OOREDOO Q.P.S.C. CONDENSED CONSOLIDATED INTERIM STATEMENT OF FINANCIAL POSITION As at 30 September 2020 30 September 2020 (Reviewed) QR. '000 31 December 2019 (Audited) OR. '000 Note ASSETS 8 9 10 Non-current assets Property, plant and equipment Intangible assets and goodwill Right-of-use assets Investment property Investment in associates and joint ventures Financial assets - equity instruments Other non-current assets Deferred tax assets Contract cost and assets 11 12 25,232,824 25,987,848 6,351,854 49,453 1,687,754 781,733 712,617 624,874 172,638 27.045,039 26,319,887 6,033,848 58,007 1,971,912 904.440 732,243 658,851 194,971 Total non-current assets 61,601,595 63,919,198 Current assets Inventories Contract costs and assets Trade and other receivables Bank balances and cash 433,585 365,980 7,304,402 16,119,862 24,223,829 273,547 557,305 345,919 8,360,840 14,716,148 23,980,212 82.212 13 Assets held for sale 22 Total current assets 24,497,376 24,062,424 TOTAL ASSETS 86,098,971 87,981,622 EQUITY 14 Share capital Legal reserve Fair value reserve Employees' benefits reserve Translation reserve Other statutory reserves Retained earnings 3,203,200 12,434,282 407,589 14,010 (7,857,628) 1,299,489 13,622,035 3,203,200 12,434,282 550,809 5,975 (7,314,294) 1.299.489 12.947,508 15 Equity attributable to shareholders of the parent Non-controlling interests 23,122,977 5,510,172 23,126,969 5,978,017 Total equity 28,633,149 29,104,986 Ooredoo OOREDOO Q.P.S.C. CONDENSED CONSOLIDATED INTERIM STATEMENT OF FINANCIAL POSITION (CONTINUED) As at 30 September 2020 30 September 2020 (Reviewer QR."000 31 December 2019 (studited) OR. 1000 Note LIABILITIES Non-current liabilities Loans and borrowings Employees' benefits Lease liabilities Deferred tax liabilities Other non-current liabilities Contract liabilities 18 19 21 24,479,576 706,696 5,891,246 292,659 2,430,541 25,336,943 766,619 5,692,809 340,468 2,658,393 11,481 8,625 Total non-current liabilities 33,809,343 34,806,713 Current liabilities Loans and borrowings Lease liabilities Trade and other payables Deferred income Contract liabilities Income tax payable 18 21 20 5,525,680 1,034,685 13,396,444 2,047,580 190,389 1,461,701 5.110,332 956,494 13,774,974 2,265,590 117,768 1,544,765 Total current liabilities 23,656,479 24.069,923 Total liabilities 57,465,822 58,876,636 TOTAL EQUITY AND LIABILITIES 86,098,971 87,981.622 Include in your report Income Statement of your company and Income Statements of other companies that you chose from Kuwait Stock Exchange. In this report you will gather all your findings in one document. This will be your final report, it will include appendices of the excel sheets used to calculate your evaluations. r In this report you will apply Price Multiples Method to further evaluate your company. a) Explain the Price Multiples method using your own words. Mention and explain its three steps." CA b) Evaluate your company by using Price Multiples Method. Choose other four companies from Kuwait stock market which are operating in the same industry with your company, and compute Price/Earnings ratio of the most recent year. Show your calculations. (65 points) Companies Equity Value Price per Number =Price/sharex Earnings share KD of shares Number of KD in shares (in millions) millions) P/E ratio = Equity Value/Earnings No. 1 1 2 2 3 4 c) Calculate the market value of your company at the end of the most recent year and decide whether your company is overvalued or undervalued by the market. Therefore your findings will conclude as whether you think you should invite potential investors to invest their money in buying the stocks of this company and why. (1. Ooredoo OOREDOO Q.P.S.C. CONDENSED CONSOLIDATED INTERIM STATEMENT OF FINANCIAL POSITION As at 30 September 2020 30 September 2020 (Reviewed) QR. '000 31 December 2019 (Audited) OR. '000 Note ASSETS 8 9 10 Non-current assets Property, plant and equipment Intangible assets and goodwill Right-of-use assets Investment property Investment in associates and joint ventures Financial assets - equity instruments Other non-current assets Deferred tax assets Contract cost and assets 11 12 25,232,824 25,987,848 6,351,854 49,453 1,687,754 781,733 712,617 624,874 172,638 27.045,039 26,319,887 6,033,848 58,007 1,971,912 904.440 732,243 658,851 194,971 Total non-current assets 61,601,595 63,919,198 Current assets Inventories Contract costs and assets Trade and other receivables Bank balances and cash 433,585 365,980 7,304,402 16,119,862 24,223,829 273,547 557,305 345,919 8,360,840 14,716,148 23,980,212 82.212 13 Assets held for sale 22 Total current assets 24,497,376 24,062,424 TOTAL ASSETS 86,098,971 87,981,622 EQUITY 14 Share capital Legal reserve Fair value reserve Employees' benefits reserve Translation reserve Other statutory reserves Retained earnings 3,203,200 12,434,282 407,589 14,010 (7,857,628) 1,299,489 13,622,035 3,203,200 12,434,282 550,809 5,975 (7,314,294) 1.299.489 12.947,508 15 Equity attributable to shareholders of the parent Non-controlling interests 23,122,977 5,510,172 23,126,969 5,978,017 Total equity 28,633,149 29,104,986 Ooredoo OOREDOO Q.P.S.C. CONDENSED CONSOLIDATED INTERIM STATEMENT OF FINANCIAL POSITION (CONTINUED) As at 30 September 2020 30 September 2020 (Reviewer QR."000 31 December 2019 (studited) OR. 1000 Note LIABILITIES Non-current liabilities Loans and borrowings Employees' benefits Lease liabilities Deferred tax liabilities Other non-current liabilities Contract liabilities 18 19 21 24,479,576 706,696 5,891,246 292,659 2,430,541 25,336,943 766,619 5,692,809 340,468 2,658,393 11,481 8,625 Total non-current liabilities 33,809,343 34,806,713 Current liabilities Loans and borrowings Lease liabilities Trade and other payables Deferred income Contract liabilities Income tax payable 18 21 20 5,525,680 1,034,685 13,396,444 2,047,580 190,389 1,461,701 5.110,332 956,494 13,774,974 2,265,590 117,768 1,544,765 Total current liabilities 23,656,479 24.069,923 Total liabilities 57,465,822 58,876,636 TOTAL EQUITY AND LIABILITIES 86,098,971 87,981.622