Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tsaurai Makina, CFA, a senior analyst at JOSIE Investments, is reviewing the investment policy statements (IPS) of two new JOSIE clients. The first client,

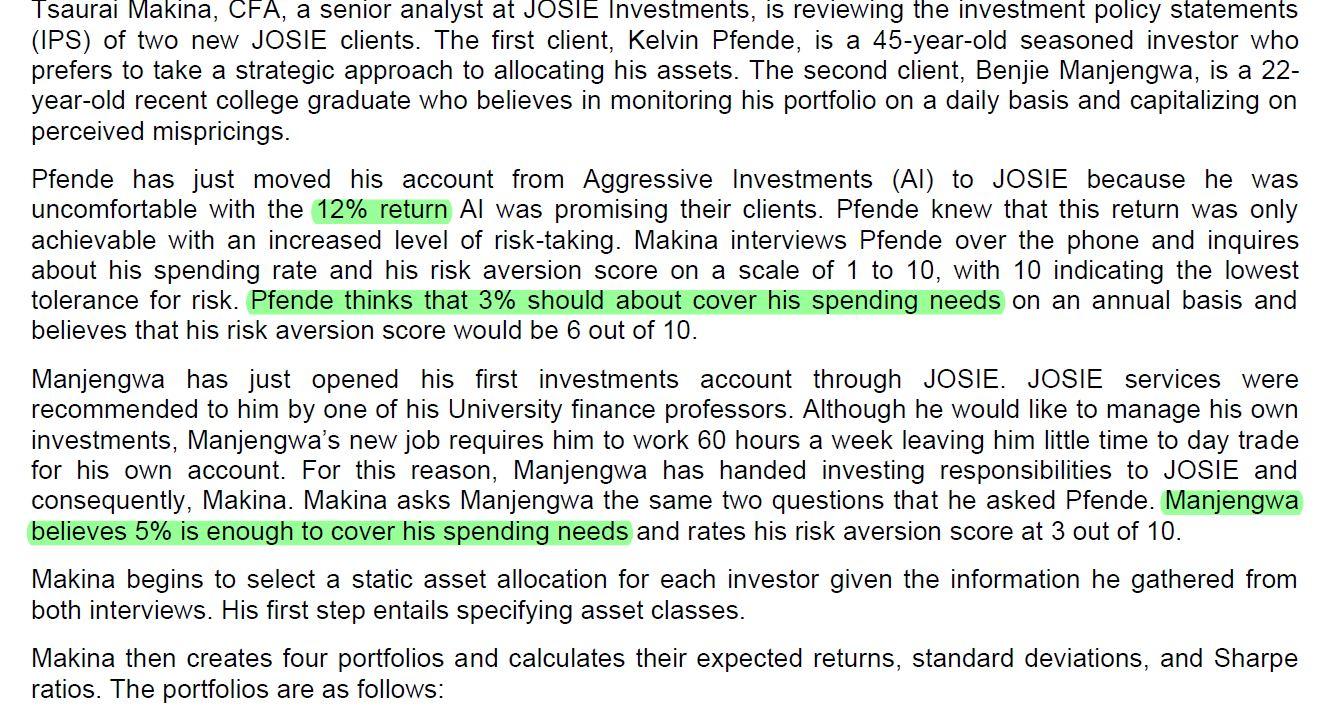

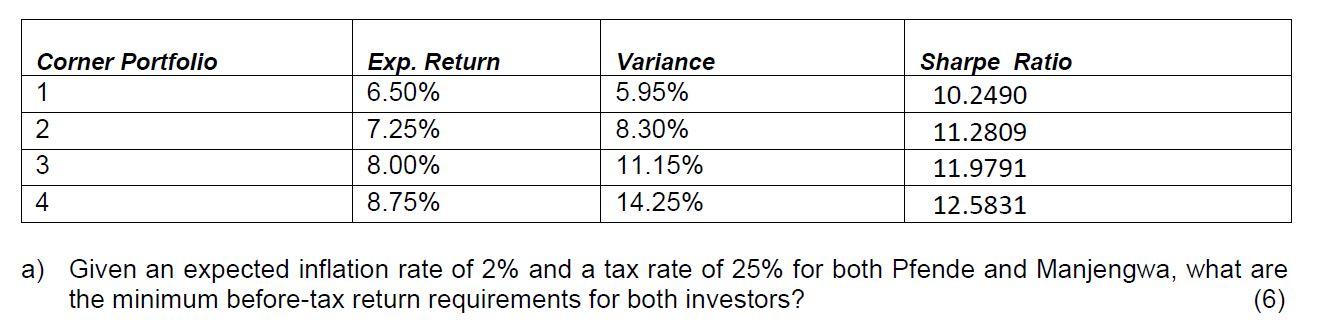

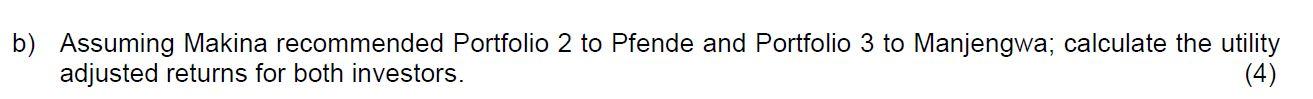

Tsaurai Makina, CFA, a senior analyst at JOSIE Investments, is reviewing the investment policy statements (IPS) of two new JOSIE clients. The first client, Kelvin Pfende, is a 45-year-old seasoned investor who prefers to take a strategic approach to allocating his assets. The second client, Benjie Manjengwa, is a 22- year-old recent college graduate who believes in monitoring his portfolio on a daily basis and capitalizing on perceived mispricings. Pfende has just moved his account from Aggressive Investments (AI) to JOSIE because he was uncomfortable with the 12% return Al was promising their clients. Pfende knew that this return was only achievable with an increased level of risk-taking. Makina interviews Pfende over the phone and inquires about his spending rate and his risk aversion score on a scale of 1 to 10, with 10 indicating the lowest tolerance for risk. Pfende thinks that 3% should about cover his spending needs on an annual basis and believes that his risk aversion score would be 6 out of 10. Manjengwa has just opened his first investments account through JOSIE. JOSIE services were recommended to him by one of his University finance professors. Although he would like to manage his own investments, Manjengwa's new job requires him to work 60 hours a week leaving him little time to day trade for his own account. For this reason, Manjengwa has handed investing responsibilities to JOSIE and consequently, Makina. Makina asks Manjengwa the same two questions that he asked Pfende. Manjengwa believes 5% is enough to cover his spending needs and rates his risk aversion score at 3 out of 10. Makina begins to select a static asset allocation for each investor given the information he gathered from both interviews. His first step entails specifying asset classes. Makina then creates four portfolios and calculates their expected returns, standard deviations, and Sharpe ratios. The portfolios are as follows: Corner Portfolio 1 2 3 4 Exp. Return 6.50% 7.25% 8.00% 8.75% Variance 5.95% 8.30% 11.15% 14.25% Sharpe Ratio 10.2490 11.2809 11.9791 12.5831 a) Given an expected inflation rate of 2% and a tax rate of 25% for both Pfende and Manjengwa, what are the minimum before-tax return requirements for both investors? (6) b) Assuming Makina recommended Portfolio 2 to Pfende and Portfolio 3 to Manjengwa; calculate the utility adjusted returns for both investors. (4) Given the four corner portfolios that Makina developed, calculate the standard deviation of a portfolio that is capable of achieving an expected return of 6.7%. (5) d) Assuming no constraint against leverage, determine the weights that should be invested in the risk-free asset and the tangency portfolio to achieve an expected return of 7.5%. (4) e) Discuss the effects of gearing on a portfolio return and the risk

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a The minimum beforetax return requirements for Pfende and Manjengwa can be calculated using the for...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started