Answered step by step

Verified Expert Solution

Question

1 Approved Answer

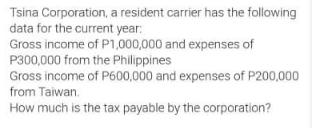

Tsina Corporation, a resident carrier has the following data for the current year: Gross income of P1,000,000 and expenses of P300,000 from the Philippines

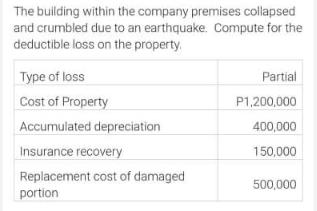

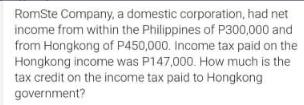

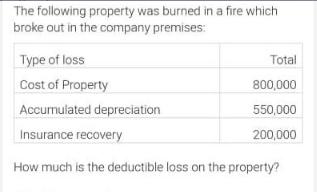

Tsina Corporation, a resident carrier has the following data for the current year: Gross income of P1,000,000 and expenses of P300,000 from the Philippines Gross income of P600,000 and expenses of P200,000 from Taiwan. How much is the tax payable by the corporation? The building within the company premises collapsed and crumbled due to an earthquake. Compute for the deductible loss on the property. Type of loss Cost of Property Accumulated depreciation Insurance recovery Replacement cost of damaged portion Partial P1,200,000 400,000 150,000 500,000 RomSte Company, a domestic corporation, had net income from within the Philippines of P300,000 and from Hongkong of P450,000. Income tax paid on the Hongkong income was P147,000. How much is the tax credit on the income tax paid to Hongkong government? The following property was burned in a fire which broke out in the company premises: Type of loss Cost of Property Accumulated depreciation Insurance recovery How much is the deductible loss on the property? Total 800,000 550,000 200,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the tax payable by Tsina Corporation we need to determine its taxable income from both the Philippines and Taiwan The taxable income is cal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started