Answered step by step

Verified Expert Solution

Question

1 Approved Answer

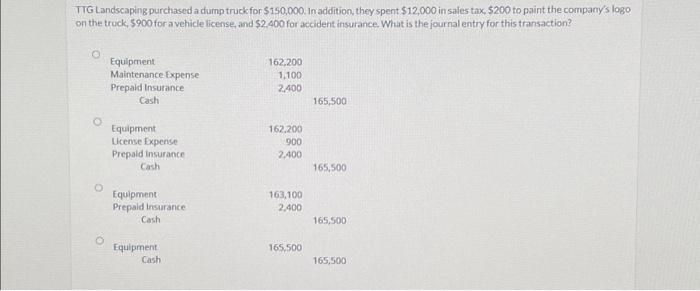

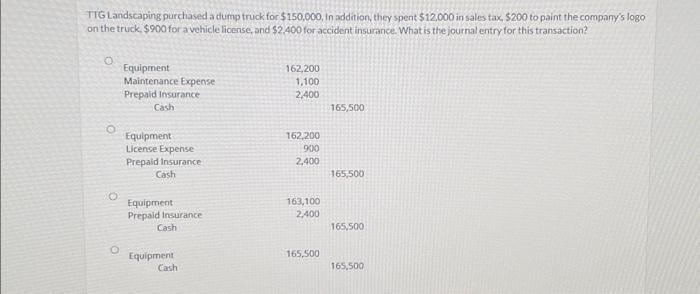

TTG Landscaping purchased a dump truck for $150,000. In addition, they spent $12,000 in sales tax, $200 to paint the company's logo on the truck,

TTG Landscaping purchased a dump truck for $150,000. In addition, they spent $12,000 in sales tax, $200 to paint the company's logo on the truck, $900 for a vehicle license, and $2,400 for accident insurance. What is the journal entry for this transaction? Equipment Maintenance Expense Prepaid Insurance Cash Equipment License Expense Prepaid Insurance Cash Equipment Prepaid Insurance Cash Equipment Cash 162,200 1,100 2,400 162,200 900 2,400 163,100 2,400 165,500 165,500 165,500 165,500 165,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started