Answered step by step

Verified Expert Solution

Question

1 Approved Answer

T-Toys Ltd has engaged Mr Cheung as a marketing manager since 2016. T-Toys Ltd is a Hong Kong-based firm that specializes in toy trading. Mr.

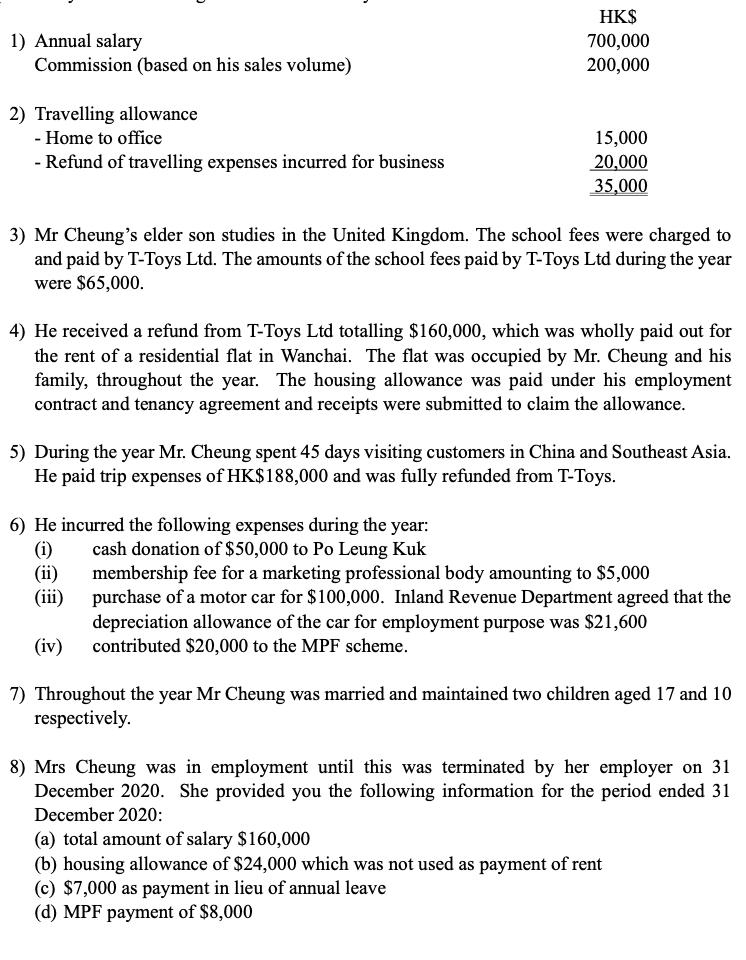

T-Toys Ltd has engaged Mr Cheung as a marketing manager since 2016. T-Toys Ltd is a Hong Kong-based firm that specializes in toy trading. Mr. Cheung was compelled to go regularly to China because T-Toys Ltd's primary clients are based there. For the fiscal year ending March 31, 2021, he presents the following data:

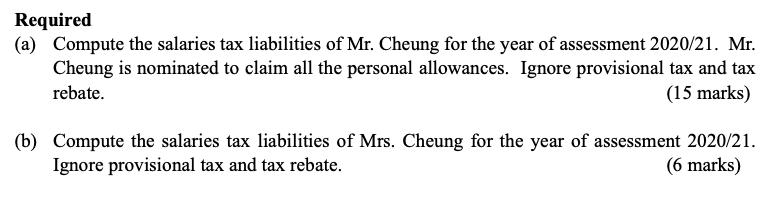

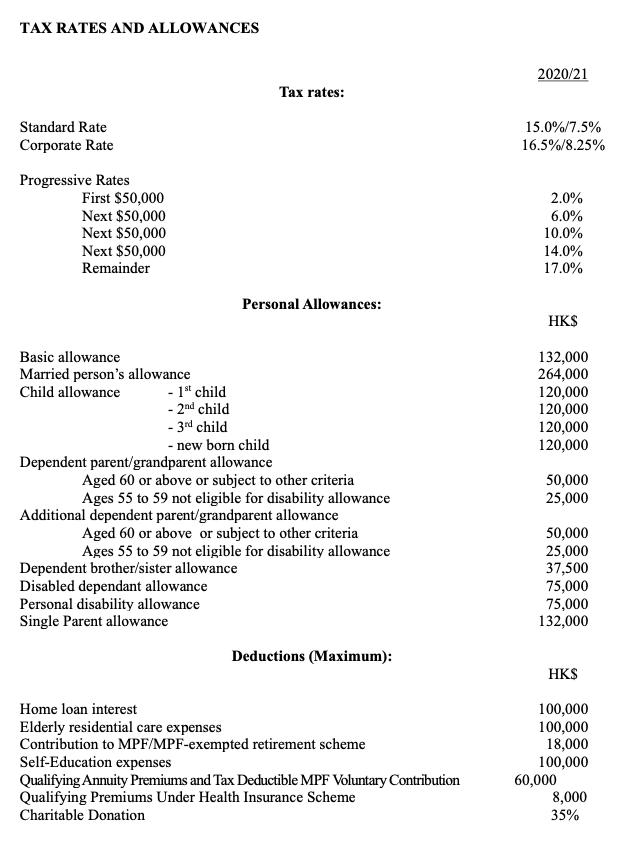

Information maybe needed:

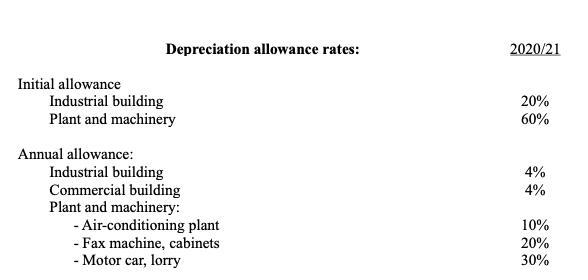

HK$ 1) Annual salary Commission (based on his sales volume) 700,000 200,000 2) Travelling allowance - Home to office 15,000 20,000 35,000 - Refund of travelling expenses incurred for business 3) Mr Cheung's elder son studies in the United Kingdom. The school fees were charged to and paid by T-Toys Ltd. The amounts of the school fees paid by T-Toys Ltd during the year were $65,000. 4) He received a refund from T-Toys Ltd totalling $160,000, which was wholly paid out for the rent of a residential flat in Wanchai. The flat was occupied by Mr. Cheung and his family, throughout the year. The housing allowance was paid under his employment contract and tenancy agreement and receipts were submitted to claim the allowance. 5) During the year Mr. Cheung spent 45 days visiting customers in China and Southeast Asia. He paid trip expenses of HK$188,000 and was fully refunded from T-Toys. 6) He incurred the following expenses during the year: (i) (ii) (iii) cash donation of $50,000 to Po Leung Kuk membership fee for a marketing professional body amounting to $5,000 purchase of a motor car for $100,000. Inland Revenue Department agreed that the depreciation allowance of the car for employment purpose was $21,600 contributed $20,000 to the MPF scheme. (iv) 7) Throughout the year Mr Cheung was married and maintained two children aged 17 and 10 respectively. 8) Mrs Cheung was in employment until this was terminated by her employer on 31 December 2020. She provided you the following information for the period ended 31 December 2020: (a) total amount of salary $160,000 (b) housing allowance of $24,000 which was not used as payment of rent (c) $7,000 as payment in lieu of annual leave (d) MPF payment of $8,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a MrChung Salary Tax Liability HK 1 Annual Salary 700000 x 17 1190...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started