Question

TTT Company purchased a machine some years ago. At the end of the current year, the company revalued the machine to its fair value. The

TTT Company purchased a machine some years ago. At the end of the current year, the company revalued the machine to its fair value. The machine has the following characteristics at the end of the current year:

Original cost | $1,250,000 |

Residual value | $50,000 |

Estimated useful life (from acquisition date) | 10 years |

Years of use up to end of current year | 4 years |

Estimated useful life remaining (after current year-end) | 6 years |

Fair value at end of current year | $950,000 |

Depreciation method | Straight-line |

Requirements

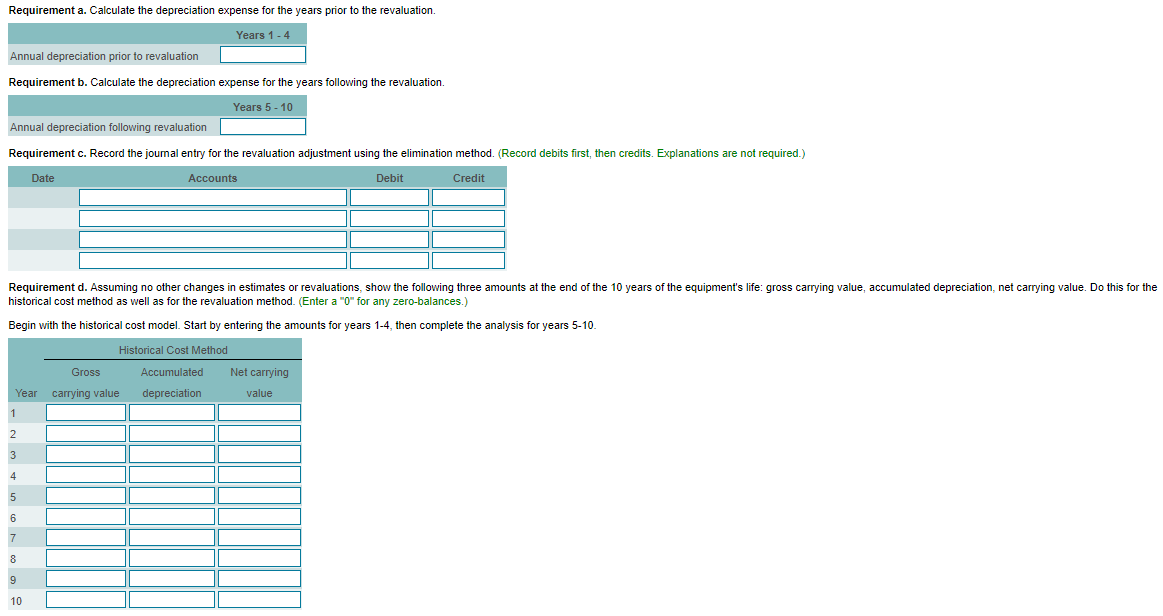

a. | Calculate the depreciation expense for the years prior to the revaluation. |

b. | Calculate the depreciation expense for the years following the revaluation. |

c. | Record the journal entry for the revaluation adjustment using the elimination method. |

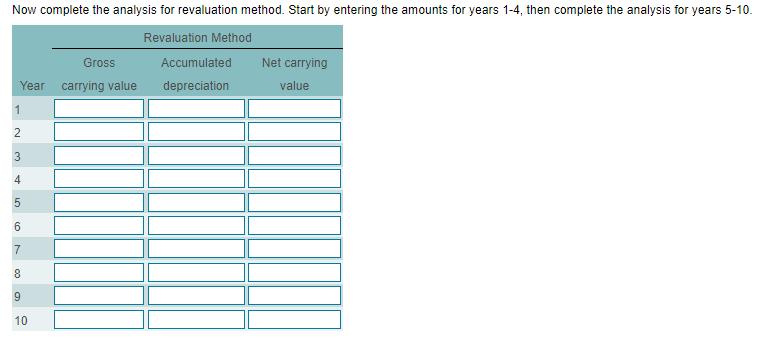

d. | Assuming no other changes in estimates or revaluations, show the following three amounts at the end of the 10 years of the equipment's life: gross carrying value, accumulated depreciation, net carrying value. Do this for the historical cost method as well as for the revaluation method. |

?

?

Requirement a. Calculate the depreciation expense for the years prior to the revaluation. Years 1-4 Annual depreciation prior to revaluation Requirement b. Calculate the depreciation expense for the years following the revaluation. Years 5- 10 Annual depreciation following revaluation Requirement c. Record the joumal entry for the revaluation adjustment using the elimination method. (Record debits first, then credits. Explanations are not required.) Date Accounts Debit Credit Requirement d. Assuming no other changes historical cost method as well as for the revaluation method. (Enter a "0" for any zero-balances.) estimates or revaluations, show the following three amounts at the end of the 10 years of the equipment's life: gross carrying value, accumulated depreciation, net carrying value. Do this for the Begin with the historical cost model. Start by entering the amounts for years 1-4, then complete the analysis for years 5-10. Historical Cost Method Gross Accumulated Net carrying Year carrying value depreciation value 1 3 4 6 9 10

Step by Step Solution

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

C Recording of Journal Entry for Revaluation Adjustment 1 Elimination of Accumulated Depreciation ag...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started