Answered step by step

Verified Expert Solution

Question

1 Approved Answer

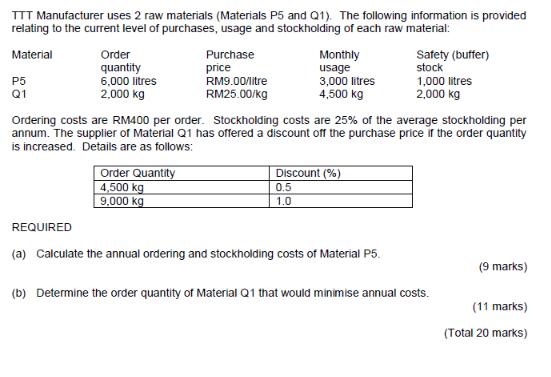

TTT Manufacturer uses 2 raw materials (Materials P5 and Q1). The following information is provided relating to the current level of purchases, usage and

TTT Manufacturer uses 2 raw materials (Materials P5 and Q1). The following information is provided relating to the current level of purchases, usage and stockholding of each raw material: Material Purchase Monthly Order quantity Safety (buffer) stock usage price RM9.00/litre P5 6,000 litres 3,000 litres 1,000 litres Q1 2,000 kg RM25.00/kg 4,500 kg 2,000 kg Ordering costs are RM400 per order. Stockholding costs are 25% of the average stockholding per annum. The supplier of Material Q1 has offered a discount off the purchase price if the order quantity is increased. Details are as follows: Order Quantity Discount (%) 0.5 4,500 kg 9,000 kg 1.0 REQUIRED (a) Calculate the annual ordering and stockholding costs of Material P5. (9 marks) (b) Determine the order quantity of Material Q1 that would minimise annual costs. (11 marks) (Total 20 marks) TTT Manufacturer uses 2 raw materials (Materials P5 and Q1). The following information is provided relating to the current level of purchases, usage and stockholding of each raw material: Material Purchase Monthly Order quantity Safety (buffer) stock usage price RM9.00/litre P5 6,000 litres 3,000 litres 1,000 litres Q1 2,000 kg RM25.00/kg 4,500 kg 2,000 kg Ordering costs are RM400 per order. Stockholding costs are 25% of the average stockholding per annum. The supplier of Material Q1 has offered a discount off the purchase price if the order quantity is increased. Details are as follows: Order Quantity Discount (%) 0.5 4,500 kg 9,000 kg 1.0 REQUIRED (a) Calculate the annual ordering and stockholding costs of Material P5. (9 marks) (b) Determine the order quantity of Material Q1 that would minimise annual costs. (11 marks) (Total 20 marks)

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

2 above table clearly shows that order qty should be set at ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started