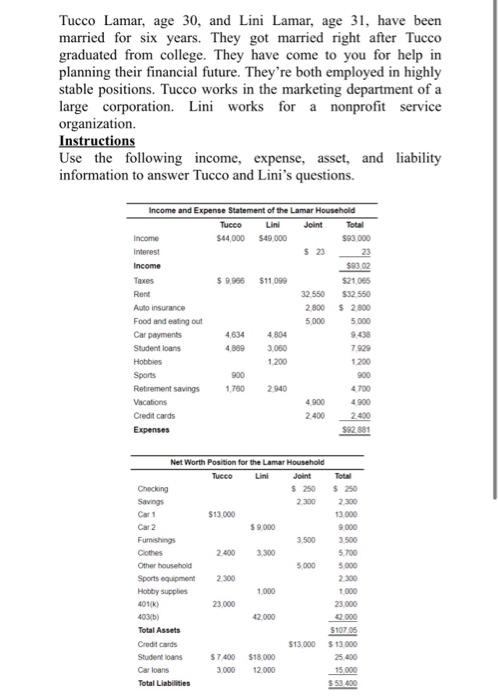

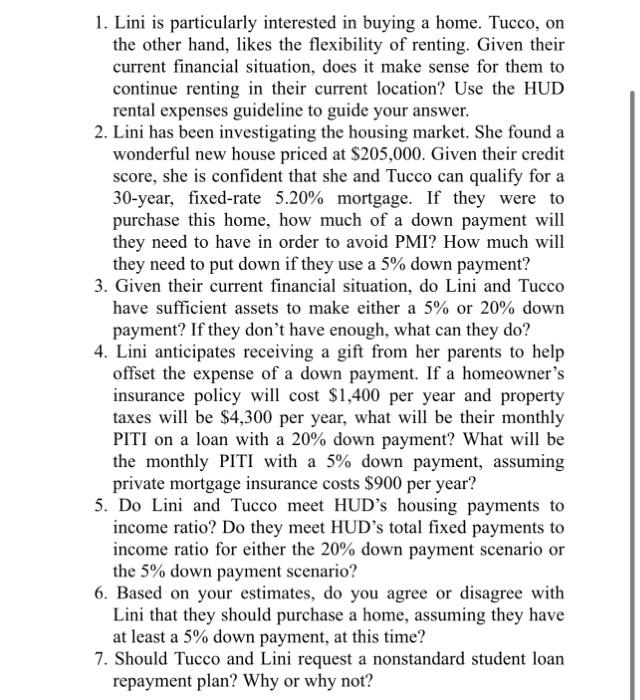

Tucco Lamar, age 30 , and Lini Lamar, age 31 , have been married for six years. They got married right after Tucco graduated from college. They have come to you for help in planning their financial future. They're both employed in highly stable positions. Tucco works in the marketing department of a large corporation. Lini works for a nonprofit service organization. Instructions Use the following income, expense, asset, and liability information to answer Tucco and Lini's questions. 1. Lini is particularly interested in buying a home. Tucco, on the other hand, likes the flexibility of renting. Given their current financial situation, does it make sense for them to continue renting in their current location? Use the HUD rental expenses guideline to guide your answer. 2. Lini has been investigating the housing market. She found a wonderful new house priced at $205,000. Given their credit score, she is confident that she and Tucco can qualify for a 30-year, fixed-rate 5.20% mortgage. If they were to purchase this home, how much of a down payment will they need to have in order to avoid PMI? How much will they need to put down if they use a 5% down payment? 3. Given their current financial situation, do Lini and Tucco have sufficient assets to make either a 5% or 20% down payment? If they don't have enough, what can they do? 4. Lini anticipates receiving a gift from her parents to help offset the expense of a down payment. If a homeowner's insurance policy will cost $1,400 per year and property taxes will be $4,300 per year, what will be their monthly PITI on a loan with a 20% down payment? What will be the monthly PITI with a 5% down payment, assuming private mortgage insurance costs $900 per year? 5. Do Lini and Tucco meet HUD's housing payments to income ratio? Do they meet HUD's total fixed payments to income ratio for either the 20% down payment scenario or the 5% down payment scenario? 6. Based on your estimates, do you agree or disagree with Lini that they should purchase a home, assuming they have at least a 5% down payment, at this time? 7. Should Tucco and Lini request a nonstandard student loan repayment plan? Why or why not