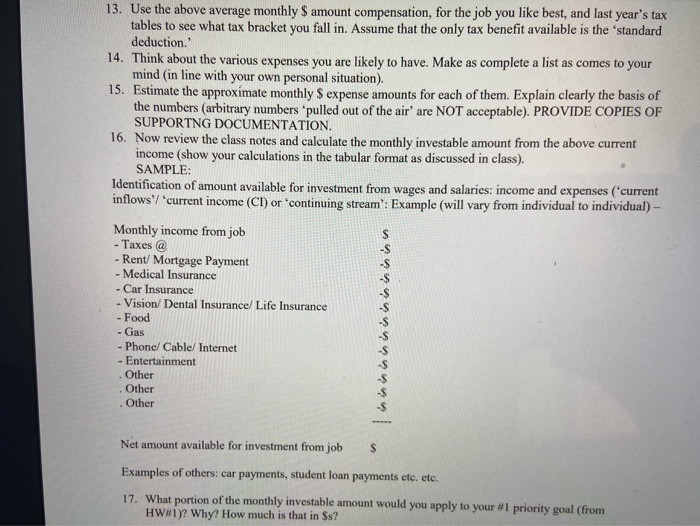

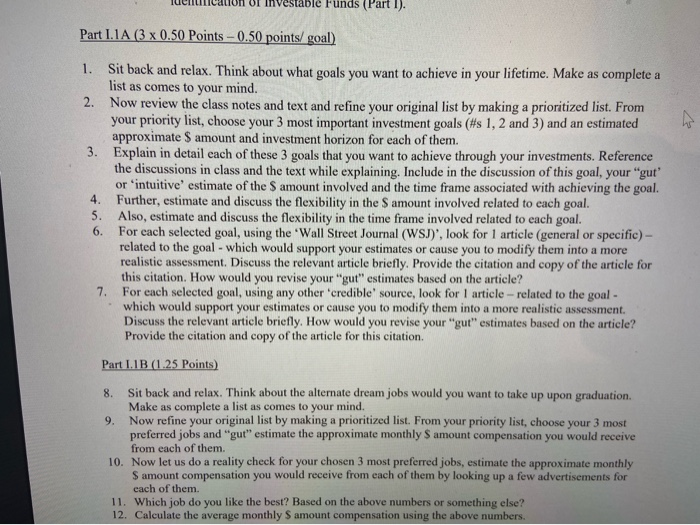

TUCIRILICALION or investable runds (Part I). Part LIA (3 x 0.50 Points - 0.50 points/ goal) 1. Sit back and relax. Think about what goals you want to achieve in your lifetime. Make as complete a list as comes to your mind. 2. Now review the class notes and text and refine your original list by making a prioritized list. From your priority list, choose your 3 most important investment goals (#s 1, 2 and 3) and an estimated approximate $ amount and investment horizon for each of them. 3. Explain in detail each of these 3 goals that you want to achieve through your investments. Reference the discussions in class and the text while explaining. Include in the discussion of this goal, your "gut or 'intuitive' estimate of the amount involved and the time frame associated with achieving the goal. 4. Further, estimate and discuss the flexibility in the S amount involved related to cach goal. 5. Also, estimate and discuss the flexibility in the time frame involved related to each goal. 6. For each selected goal, using the 'Wall Street Journal (WSJ)', look for 1 article (general or specific) - related to the goal - which would support your estimates or cause you to modify them into a more realistic assessment. Discuss the relevant article briefly. Provide the citation and copy of the article for this citation. How would you revise your "gut" estimates based on the article? 7. For each selected goal, using any other credible source, look for 1 article-related to the goal- which would support your estimates or cause you to modify them into a more realistic assessment. Discuss the relevant article briefly. How would you revise your "gut" estimates based on the article? Provide the citation and copy of the article for this citation Part II B (1.25 Points) 8. Sit back and relax. Think about the alternate dream jobs would you want to take up upon graduation Make as complete a list as comes to your mind. 9. Now refine your original list by making a prioritized list. From your priority list, choose your 3 most preferred jobs and "gut" estimate the approximate monthly S amount compensation you would receive from each of them. 10. Now let us do a reality check for your chosen 3 most preferred jobs, estimate the approximate monthly Samount compensation you would receive from each of them by looking up a few advertisements for each of them. 11. Which job do you like the best? Based on the above numbers or something else? 12. Calculate the average monthly S amount compensation using the above numbers 13. Use the above average monthly $ amount compensation, for the job you like best, and last year's tax tables to see what tax bracket you fall in. Assume that the only tax benefit available is the standard deduction." 14. Think about the various expenses you are likely to have. Make as complete a list as comes to your mind in line with your own personal situation). 15. Estimate the approximate monthly S expense amounts for each of them. Explain clearly the basis of the numbers (arbitrary numbers pulled out of the air' are NOT acceptable). PROVIDE COPIES OF SUPPORTNG DOCUMENTATION. 16. Now review the class notes and calculate the monthly investable amount from the above current income (show your calculations in the tabular format as discussed in class). SAMPLE: Identification of amount available for investment from wages and salaries: income and expenses ("current inflows' 'current income (CI) or 'continuing stream': Example (will vary from individual to individual) - Monthly income from job - Taxes @ - Rent/ Mortgage Payment - Medical Insurance - Car Insurance - Vision Dental Insurance Life Insurance - Food - Gas - Phone/Cable/ Internet - Entertainment Other . Other . Other Net amount available for investment from job s Examples of others: car payments, student loan payments ete, etc. 17. What portion of the monthly investable amount would you apply to your HW#1)? Why? How much is that in $s? priority goal (from Part I. 1C (0.25 Points) 18. Are you happy/ surprised at the results? Based on your #1 goal,' would this part of the monthly investable amount be adequate (using 'gut feelings) to achieve that goal? 19. Now review the above calculations and re-calculate the investable amount from the above current income (show your revised calculations in the tabular format as discussed in class) after adjusting the 'gut' estimates of expenses based upon your revised thoughts on how much you can afford to spend. 20. Make sure you explain in detail how you go about adjusting your income and each of the expenses on a more realistic basis). 21. What S monthly amount would be available now to put towards achieving your #1 goals? 22. Based on your #1 goal,' would this revised monthly investable amount be adequate (using 'gut feelings) to achieve those goals? General guidelines (NOT following the guidelines will cause you to loose points) The homework should be typed, single-spaced, Times New Roman, 12 point with exceptions acceptable for headers. Y-FOR EVERY 0.5 POINTS YOUR ANSWERS SHOUD BE ABOUT TO 1 PAGE. You should feel free to use more pages AS NEEDED. This does NOT include the pages for the "cutting and pasting of the instructions! SOME PARTS REQUIRE DETAILED DISCUSSIONS!! 3. Provide citations and COPIES OF DOCUMENTATION to support your numbers! Not doing so will result in loss of points!! PLEASE SEE NOTES BELOW!!! Do not forget to write your name, Investments and Portfolio Analysis FINA 3210, your section, TP Part # Spring 2020 at the top of the page. Example for Format for the write-up: Term Project Part 1 Part LIA 1. Sit back and relax. Think about what goals you want to achieve in your lifetime. Make as complete a list as comes to your mind. Your answer here. 2. Now review the class notes and text and refine your original list by making a prioritized list. From your priority list, choose your 3 most important investment goals ( 1, 2 and 3) and an estimated approximate $ amount and investment horizon for each of them. Your answer here. And so on Part LIB Sit back and relax. Think about the alternate dream jobs would you want to take up upon graduation. Make as complete a list as comes to your mind. Your answer here. 9. Now refine your original list by making a prioritized list. From your priority list, choose your 3 most preferred jobs and "gutestimate the approximate monthly S amount compensation you would receive from each of them. Your answer here. And so on Similarly, for Part L.IC TUCILICALION or investade runds (Part I). Part LIA (3 x 0.50 Points - 0.50 points/ goal) 1. Sit back and relax. Think about what goals you want to achieve in your lifetime. Make as complete a list as comes to your mind. 2. Now review the class notes and text and refine your original list by making a prioritized list. From your priority list, choose your 3 most important investment goals (#s 1, 2 and 3) and an estimated approximate $ amount and investment horizon for each of them. 3. Explain in detail each of these 3 goals that you want to achieve through your investments. Reference the discussions in class and the text while explaining. Include in the discussion of this goal, your "gut or 'intuitive' estimate of the amount involved and the time frame associated with achieving the goal. 4. Further, estimate and discuss the flexibility in the amount involved related to cach goal. 5. Also, estimate and discuss the flexibility in the time frame involved related to each goal. 6. For each selected goal, using the "Wall Street Journal (WSJ)', look for 1 article (general or specific) - related to the goal - which would support your estimates or cause you to modify them into a more realistic assessment. Discuss the relevant article briefly. Provide the citation and copy of the article for this citation. How would you revise your "gut" estimates based on the article? 7. For each selected goal, using any other credible source, look for 1 article-related to the goal - which would support your estimates or cause you to modify them into a more realistic assessment. Discuss the relevant article briefly. How would you revise your "gut" estimates based on the article? Provide the citation and copy of the article for this citation Part IIB (1.25 Points) 8. Sit back and relax. Think about the alternate dream jobs would you want to take up upon graduation. Make as complete a listas comes to your mind. 9. Now refine your original list by making a prioritized list. From your priority list, choose your 3 most preferred jobs and "gut" estimate the approximate monthly S amount compensation you would receive from each of them. 10. Now let us do a reality check for your chosen 3 most preferred jobs, estimate the approximate monthly Samount compensation you would receive from each of them by looking up a few advertisements for cach of them. 11. Which job do you like the best? Based on the above numbers or something else? 12. Calculate the average monthly S amount compensation using the above numbers TUCIRILICALION or investable runds (Part I). Part LIA (3 x 0.50 Points - 0.50 points/ goal) 1. Sit back and relax. Think about what goals you want to achieve in your lifetime. Make as complete a list as comes to your mind. 2. Now review the class notes and text and refine your original list by making a prioritized list. From your priority list, choose your 3 most important investment goals (#s 1, 2 and 3) and an estimated approximate $ amount and investment horizon for each of them. 3. Explain in detail each of these 3 goals that you want to achieve through your investments. Reference the discussions in class and the text while explaining. Include in the discussion of this goal, your "gut or 'intuitive' estimate of the amount involved and the time frame associated with achieving the goal. 4. Further, estimate and discuss the flexibility in the S amount involved related to cach goal. 5. Also, estimate and discuss the flexibility in the time frame involved related to each goal. 6. For each selected goal, using the 'Wall Street Journal (WSJ)', look for 1 article (general or specific) - related to the goal - which would support your estimates or cause you to modify them into a more realistic assessment. Discuss the relevant article briefly. Provide the citation and copy of the article for this citation. How would you revise your "gut" estimates based on the article? 7. For each selected goal, using any other credible source, look for 1 article-related to the goal- which would support your estimates or cause you to modify them into a more realistic assessment. Discuss the relevant article briefly. How would you revise your "gut" estimates based on the article? Provide the citation and copy of the article for this citation Part II B (1.25 Points) 8. Sit back and relax. Think about the alternate dream jobs would you want to take up upon graduation Make as complete a list as comes to your mind. 9. Now refine your original list by making a prioritized list. From your priority list, choose your 3 most preferred jobs and "gut" estimate the approximate monthly S amount compensation you would receive from each of them. 10. Now let us do a reality check for your chosen 3 most preferred jobs, estimate the approximate monthly Samount compensation you would receive from each of them by looking up a few advertisements for each of them. 11. Which job do you like the best? Based on the above numbers or something else? 12. Calculate the average monthly S amount compensation using the above numbers 13. Use the above average monthly $ amount compensation, for the job you like best, and last year's tax tables to see what tax bracket you fall in. Assume that the only tax benefit available is the standard deduction." 14. Think about the various expenses you are likely to have. Make as complete a list as comes to your mind in line with your own personal situation). 15. Estimate the approximate monthly S expense amounts for each of them. Explain clearly the basis of the numbers (arbitrary numbers pulled out of the air' are NOT acceptable). PROVIDE COPIES OF SUPPORTNG DOCUMENTATION. 16. Now review the class notes and calculate the monthly investable amount from the above current income (show your calculations in the tabular format as discussed in class). SAMPLE: Identification of amount available for investment from wages and salaries: income and expenses ("current inflows' 'current income (CI) or 'continuing stream': Example (will vary from individual to individual) - Monthly income from job - Taxes @ - Rent/ Mortgage Payment - Medical Insurance - Car Insurance - Vision Dental Insurance Life Insurance - Food - Gas - Phone/Cable/ Internet - Entertainment Other . Other . Other Net amount available for investment from job s Examples of others: car payments, student loan payments ete, etc. 17. What portion of the monthly investable amount would you apply to your HW#1)? Why? How much is that in $s? priority goal (from Part I. 1C (0.25 Points) 18. Are you happy/ surprised at the results? Based on your #1 goal,' would this part of the monthly investable amount be adequate (using 'gut feelings) to achieve that goal? 19. Now review the above calculations and re-calculate the investable amount from the above current income (show your revised calculations in the tabular format as discussed in class) after adjusting the 'gut' estimates of expenses based upon your revised thoughts on how much you can afford to spend. 20. Make sure you explain in detail how you go about adjusting your income and each of the expenses on a more realistic basis). 21. What S monthly amount would be available now to put towards achieving your #1 goals? 22. Based on your #1 goal,' would this revised monthly investable amount be adequate (using 'gut feelings) to achieve those goals? General guidelines (NOT following the guidelines will cause you to loose points) The homework should be typed, single-spaced, Times New Roman, 12 point with exceptions acceptable for headers. Y-FOR EVERY 0.5 POINTS YOUR ANSWERS SHOUD BE ABOUT TO 1 PAGE. You should feel free to use more pages AS NEEDED. This does NOT include the pages for the "cutting and pasting of the instructions! SOME PARTS REQUIRE DETAILED DISCUSSIONS!! 3. Provide citations and COPIES OF DOCUMENTATION to support your numbers! Not doing so will result in loss of points!! PLEASE SEE NOTES BELOW!!! Do not forget to write your name, Investments and Portfolio Analysis FINA 3210, your section, TP Part # Spring 2020 at the top of the page. Example for Format for the write-up: Term Project Part 1 Part LIA 1. Sit back and relax. Think about what goals you want to achieve in your lifetime. Make as complete a list as comes to your mind. Your answer here. 2. Now review the class notes and text and refine your original list by making a prioritized list. From your priority list, choose your 3 most important investment goals ( 1, 2 and 3) and an estimated approximate $ amount and investment horizon for each of them. Your answer here. And so on Part LIB Sit back and relax. Think about the alternate dream jobs would you want to take up upon graduation. Make as complete a list as comes to your mind. Your answer here. 9. Now refine your original list by making a prioritized list. From your priority list, choose your 3 most preferred jobs and "gutestimate the approximate monthly S amount compensation you would receive from each of them. Your answer here. And so on Similarly, for Part L.IC TUCILICALION or investade runds (Part I). Part LIA (3 x 0.50 Points - 0.50 points/ goal) 1. Sit back and relax. Think about what goals you want to achieve in your lifetime. Make as complete a list as comes to your mind. 2. Now review the class notes and text and refine your original list by making a prioritized list. From your priority list, choose your 3 most important investment goals (#s 1, 2 and 3) and an estimated approximate $ amount and investment horizon for each of them. 3. Explain in detail each of these 3 goals that you want to achieve through your investments. Reference the discussions in class and the text while explaining. Include in the discussion of this goal, your "gut or 'intuitive' estimate of the amount involved and the time frame associated with achieving the goal. 4. Further, estimate and discuss the flexibility in the amount involved related to cach goal. 5. Also, estimate and discuss the flexibility in the time frame involved related to each goal. 6. For each selected goal, using the "Wall Street Journal (WSJ)', look for 1 article (general or specific) - related to the goal - which would support your estimates or cause you to modify them into a more realistic assessment. Discuss the relevant article briefly. Provide the citation and copy of the article for this citation. How would you revise your "gut" estimates based on the article? 7. For each selected goal, using any other credible source, look for 1 article-related to the goal - which would support your estimates or cause you to modify them into a more realistic assessment. Discuss the relevant article briefly. How would you revise your "gut" estimates based on the article? Provide the citation and copy of the article for this citation Part IIB (1.25 Points) 8. Sit back and relax. Think about the alternate dream jobs would you want to take up upon graduation. Make as complete a listas comes to your mind. 9. Now refine your original list by making a prioritized list. From your priority list, choose your 3 most preferred jobs and "gut" estimate the approximate monthly S amount compensation you would receive from each of them. 10. Now let us do a reality check for your chosen 3 most preferred jobs, estimate the approximate monthly Samount compensation you would receive from each of them by looking up a few advertisements for cach of them. 11. Which job do you like the best? Based on the above numbers or something else? 12. Calculate the average monthly S amount compensation using the above numbers