Answered step by step

Verified Expert Solution

Question

1 Approved Answer

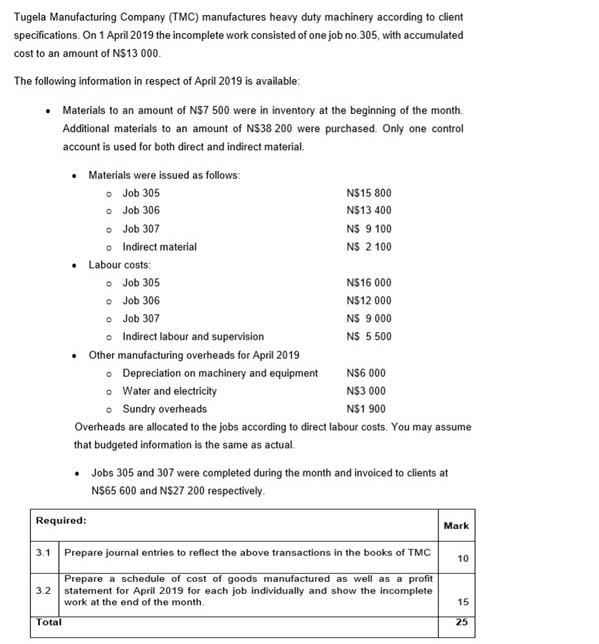

Tugela Manufacturing Company (TMC) manufactures heavy duty machinery according to client specifications. On 1 April 2019 the incomplete work consisted of one job no.305,

Tugela Manufacturing Company (TMC) manufactures heavy duty machinery according to client specifications. On 1 April 2019 the incomplete work consisted of one job no.305, with accumulated cost to an amount of N$13 000. The following information in respect of April 2019 is available: Materials to an amount of NS7 500 were in inventory at the beginning of the month. Additional materials to an amount of N$38 200 were purchased. Only one control account is used for both direct and indirect material. Materials were issued as follows: o Job 305 o Job 306 o Job 307 o Indirect material N$15 800 NS13 400 N$ 9 100 NS 2 100 Labour costs: Job 305 Job 306 Job 307 o Indirect labour and supervision NS16 000 NS12 000 NS 9 000 NS 5500 Other manufacturing overheads for April 2019 NS6 000 o Depreciation on machinery and equipment Water and electricity Sundry overheads NS3 000 N$1 900 Overheads are allocated to the jobs according to direct labour costs. You may assume that budgeted information is the same as actual. Jobs 305 and 307 were completed during the month and invoiced to clients at NS65 600 and NS27 200 respectively. Required: Mark 3.1 Prepare journal entries to reflect the above transactions in the books of TMC 10 Prepare a schedule of cost of goods manufactured as well as a profit statement for April 2019 for each job individually and show the incomplete work at the end of the month. 3.2 15 Total 25

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started