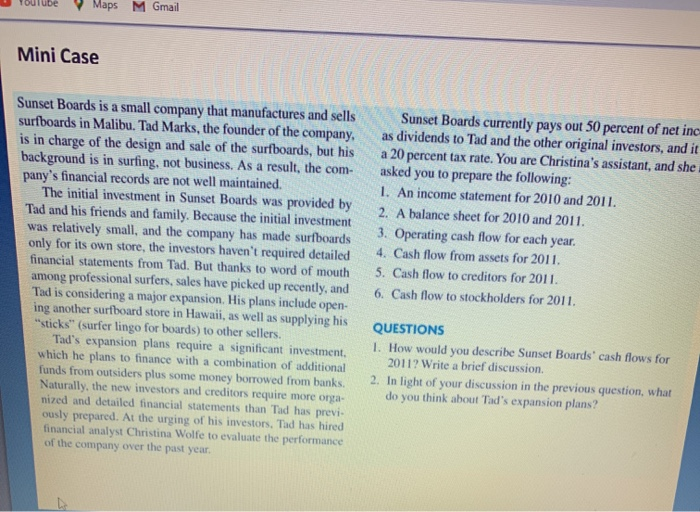

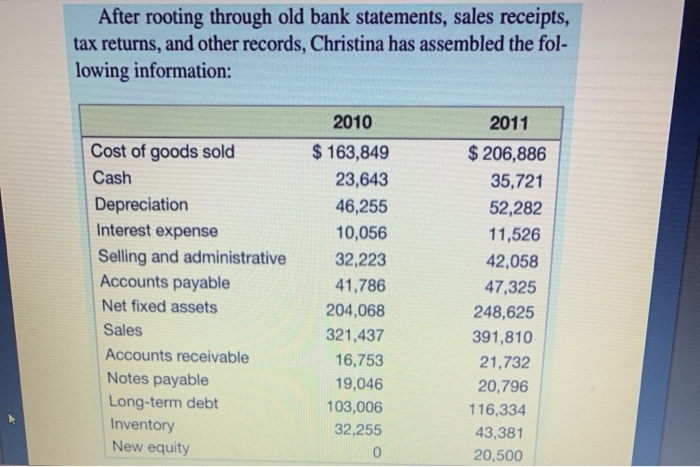

Tule Maps M Gmail Mini Case Sunset Boards is a small company that manufactures and sells surfboards in Malibu. Tad Marks, the founder of the company, is in charge of the design and sale of the surfboards, but his background is in surfing, not business. As a result, the com pany's financial records are not well maintained. The initial investment in Sunset Boards was provided by Tad and his friends and family. Because the initial investment was relatively small, and the company has made surfboards only for its own store, the investors haven't required detailed financial statements from Tad. But thanks to word of mouth among professional surfers, sales have picked up recently, and Tad is considering a major expansion. His plans include open- ing another surfboard store in Hawaii, as well as supplying his "sticks" (surferlingo for boards) to other sellers. Tad's expansion plans require a significant investment which he plans to finance with a combination of additional funds from outsiders plus some money borrowed from banks. Naturally, the new investors and creditors require more orta- nized and detailed financial statements than Tad has previ ously prepared. At the urging of his investors. Tad has hired financial analyst Christina Wolfe to evaluate the performance of the company over the past year. Sunset Boards currently pays out 50 percent of net inc as dividends to Tad and the other original investors, and it a 20 percent tax rate. You are Christina's assistant, and she asked you to prepare the following: 1. An income statement for 2010 and 2011. 2. A balance sheet for 2010 and 2011. 3. Operating cash flow for each year. 4. Cash flow from assets for 2011 5. Cash flow to creditors for 2011 6. Cash flow to stockholders for 2011. QUESTIONS 1. How would you describe Sunset Boards' cash flows for 2011? Write a brief discussion. 2. In light of your discussion in the previous question, what do you think about Tad's expansion plans? After rooting through old bank statements, sales receipts, tax returns, and other records, Christina has assembled the fol- lowing information: Cost of goods sold Cash Depreciation Interest expense Selling and administrative Accounts payable Net fixed assets Sales Accounts receivable Notes payable Long-term debt Inventory New equity 2010 $ 163,849 23,643 46,255 10,056 32,223 41,786 204,068 321,437 16,753 19,046 103,006 32,255 2011 $ 206,886 35,721 52,282 11,526 42,058 47,325 248,625 391,810 21,732 20,796 116,334 43,381 20,500