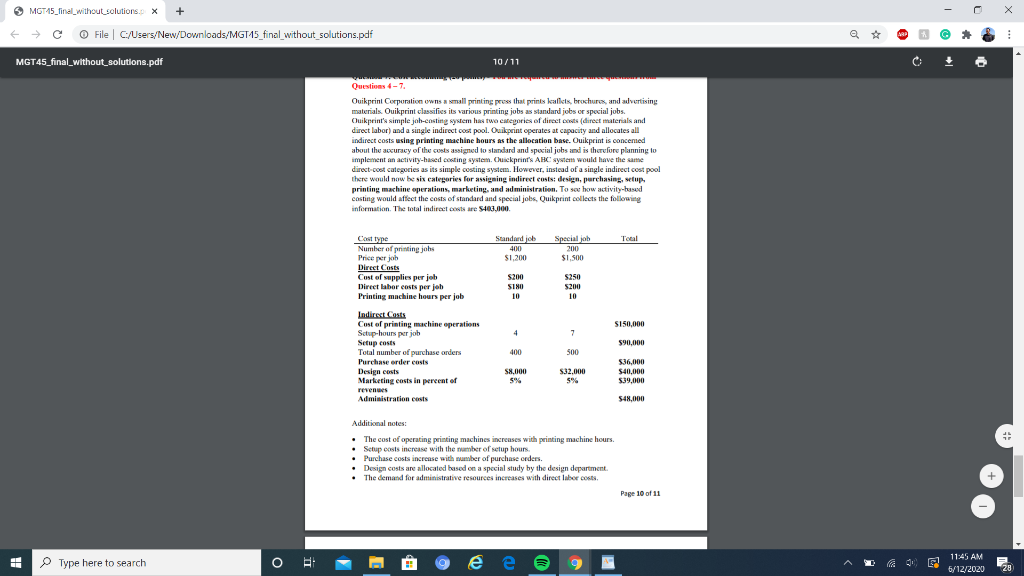

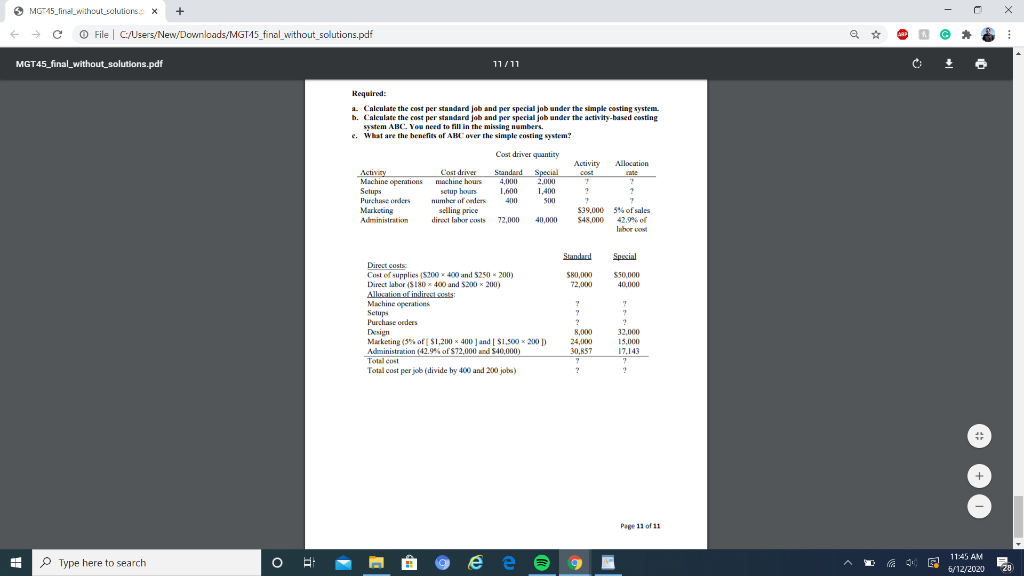

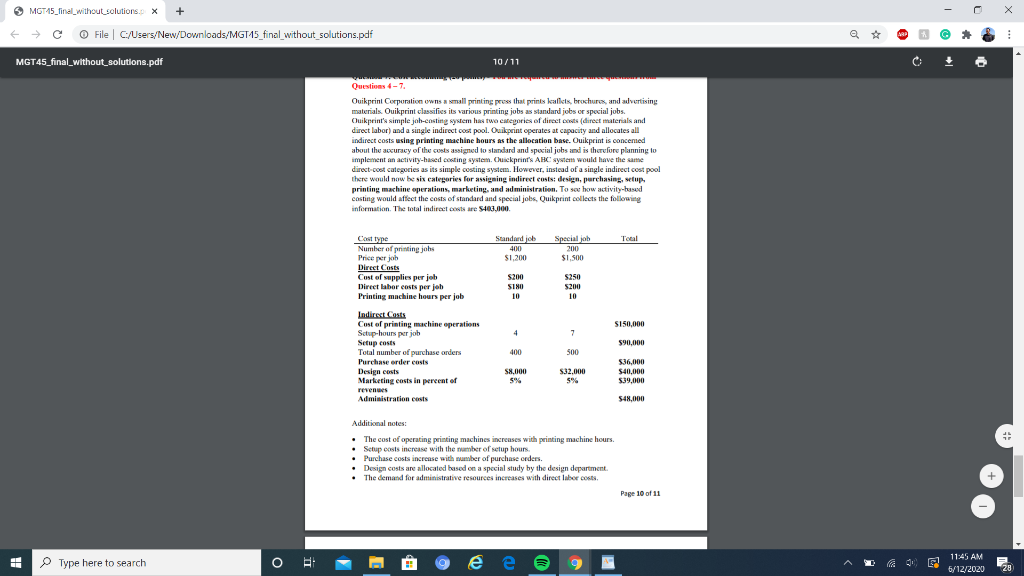

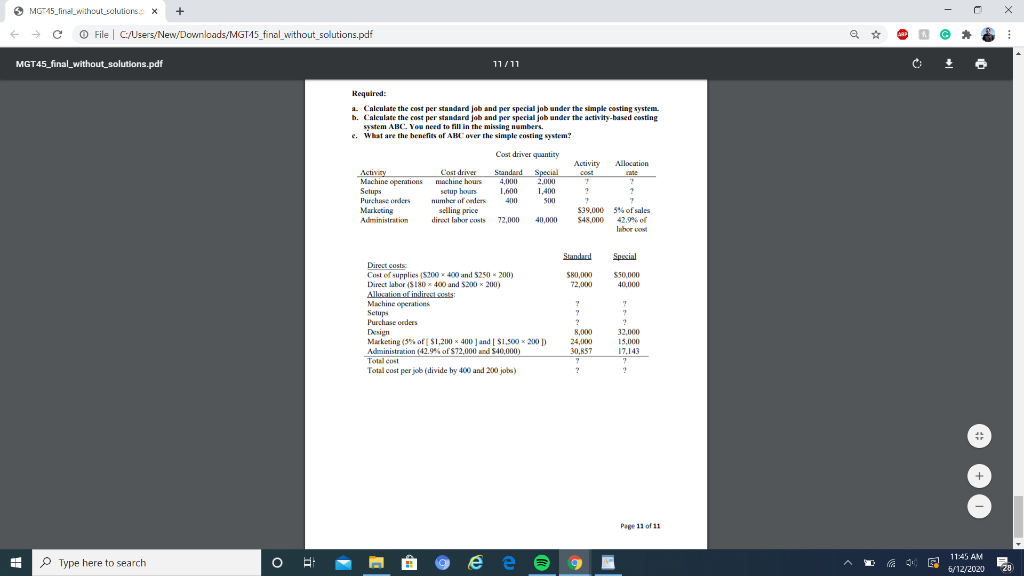

tum MGT15_final_without_solutions. X + c File C:/Users/New/Downloads/MGT15_final without solutions.pdf * MGT45_final_without_solutions.pdf 10/11 C Questions 4-7 Ouikprint Corporation owns a small printing press that prints kallcts, brochures, and advertising materials. Ouikprint classifies its various printing jobs as standard jobs or special jobs. Ouikpeint's simple job-casting system has two categories of direct costs (direct materials and direct labor) and a single indirect cost pool. Ouikprint operates at capacity and allocates all indirect costs using printing machine hours as the allocation base. Ouikprint is concented about the accuracy of the costs assigned to standard and special jobs and is therefore planning to implement an activity-hased costing system. Ouickprint's ABC system would have the same direct-cost categories as its simple costing system. However, instead of a single indirect cost pool there would now be sis categories for assigning indirect costs: design, purchasing, setup printing machine operations, marketing and administration. To see how activity-based casting would affect the costs of standard and special jobs. Quikprint collects the following information. The total indirect costs are 540.000 Tocal Standard job 400 $1,200 Special job 200 $1,500 S200 SINU 10 10 S250 5200 10 Casttype Number of printing jobs Price per job Direct Costs Cost of supplies per job Direet labor costs per job Printing machine hours per job Indirect Costs Cost of printing machine operations Setup hours per job Setup costs Total number of purchase orders Purchase order costs Design costs Marketing costs in percent of revenues Administration costs $150,000 4 7 $90,000 400 500 $8.000 S'% $32.000 5% 536,000 540,000 539,000 548.000 Additional notes: Purchase costs increase with number of purchase orders. Design costs are allocated based on a special study by the design department The demand for administrative resources increases with direct labor costs Page 10 of 11 1 Type here to search O E 11:45 AM 6/12/2020 28 MGT15_final_without_solutions. X + File C:/Users/New/Downloads/MGT45_final_without_solutions.pdf * MGT45_final_without_solutions.pdf 11/11 c: Required: 1. Calculate the cost per standard job and per special job under the simple casting system. b. Calculate the cost per standard job and per special job under the activity-based costing system ABC. You need to fill in the missing numbers. What are the benefits of ABC over the simple costing system? Activity Cost drives Allocation rate 2 Cost driver quantity Standard Special 4,000 2.000 1,600 1.400 400 500 Activity Machine operations Setups Purchase orders Marketing Administration ? machine hours setup hours number of onders selling price direct labore 72,000 40,000 $39.000 5% of sales S48.000 labor cost Standard Direct costs $80,000 72,000 Special $50,000 40,000 Cost of supplies (5200 x 400 and $250 x 200) Direct labor (S180 x 400 and $200 x 200) Allocation of indirect costs Machine operations Setups Purchase orders Design Marketing (5% of [ $1,200 400 and $1,500 200 Administration (42.9% of $72,000 and $40,000) Total cost Total cost per job (divide by 400 and 200 jobs) ? 8.000 24, 30.057 32.000 15,000 17.143 3 2 Page 11 of 11 1 Type here to search O BE 11:45 AM 6/12/2020 28 tum MGT15_final_without_solutions. X + c File C:/Users/New/Downloads/MGT15_final without solutions.pdf * MGT45_final_without_solutions.pdf 10/11 C Questions 4-7 Ouikprint Corporation owns a small printing press that prints kallcts, brochures, and advertising materials. Ouikprint classifies its various printing jobs as standard jobs or special jobs. Ouikpeint's simple job-casting system has two categories of direct costs (direct materials and direct labor) and a single indirect cost pool. Ouikprint operates at capacity and allocates all indirect costs using printing machine hours as the allocation base. Ouikprint is concented about the accuracy of the costs assigned to standard and special jobs and is therefore planning to implement an activity-hased costing system. Ouickprint's ABC system would have the same direct-cost categories as its simple costing system. However, instead of a single indirect cost pool there would now be sis categories for assigning indirect costs: design, purchasing, setup printing machine operations, marketing and administration. To see how activity-based casting would affect the costs of standard and special jobs. Quikprint collects the following information. The total indirect costs are 540.000 Tocal Standard job 400 $1,200 Special job 200 $1,500 S200 SINU 10 10 S250 5200 10 Casttype Number of printing jobs Price per job Direct Costs Cost of supplies per job Direet labor costs per job Printing machine hours per job Indirect Costs Cost of printing machine operations Setup hours per job Setup costs Total number of purchase orders Purchase order costs Design costs Marketing costs in percent of revenues Administration costs $150,000 4 7 $90,000 400 500 $8.000 S'% $32.000 5% 536,000 540,000 539,000 548.000 Additional notes: Purchase costs increase with number of purchase orders. Design costs are allocated based on a special study by the design department The demand for administrative resources increases with direct labor costs Page 10 of 11 1 Type here to search O E 11:45 AM 6/12/2020 28 MGT15_final_without_solutions. X + File C:/Users/New/Downloads/MGT45_final_without_solutions.pdf * MGT45_final_without_solutions.pdf 11/11 c: Required: 1. Calculate the cost per standard job and per special job under the simple casting system. b. Calculate the cost per standard job and per special job under the activity-based costing system ABC. You need to fill in the missing numbers. What are the benefits of ABC over the simple costing system? Activity Cost drives Allocation rate 2 Cost driver quantity Standard Special 4,000 2.000 1,600 1.400 400 500 Activity Machine operations Setups Purchase orders Marketing Administration ? machine hours setup hours number of onders selling price direct labore 72,000 40,000 $39.000 5% of sales S48.000 labor cost Standard Direct costs $80,000 72,000 Special $50,000 40,000 Cost of supplies (5200 x 400 and $250 x 200) Direct labor (S180 x 400 and $200 x 200) Allocation of indirect costs Machine operations Setups Purchase orders Design Marketing (5% of [ $1,200 400 and $1,500 200 Administration (42.9% of $72,000 and $40,000) Total cost Total cost per job (divide by 400 and 200 jobs) ? 8.000 24, 30.057 32.000 15,000 17.143 3 2 Page 11 of 11 1 Type here to search O BE 11:45 AM 6/12/2020 28