Answered step by step

Verified Expert Solution

Question

1 Approved Answer

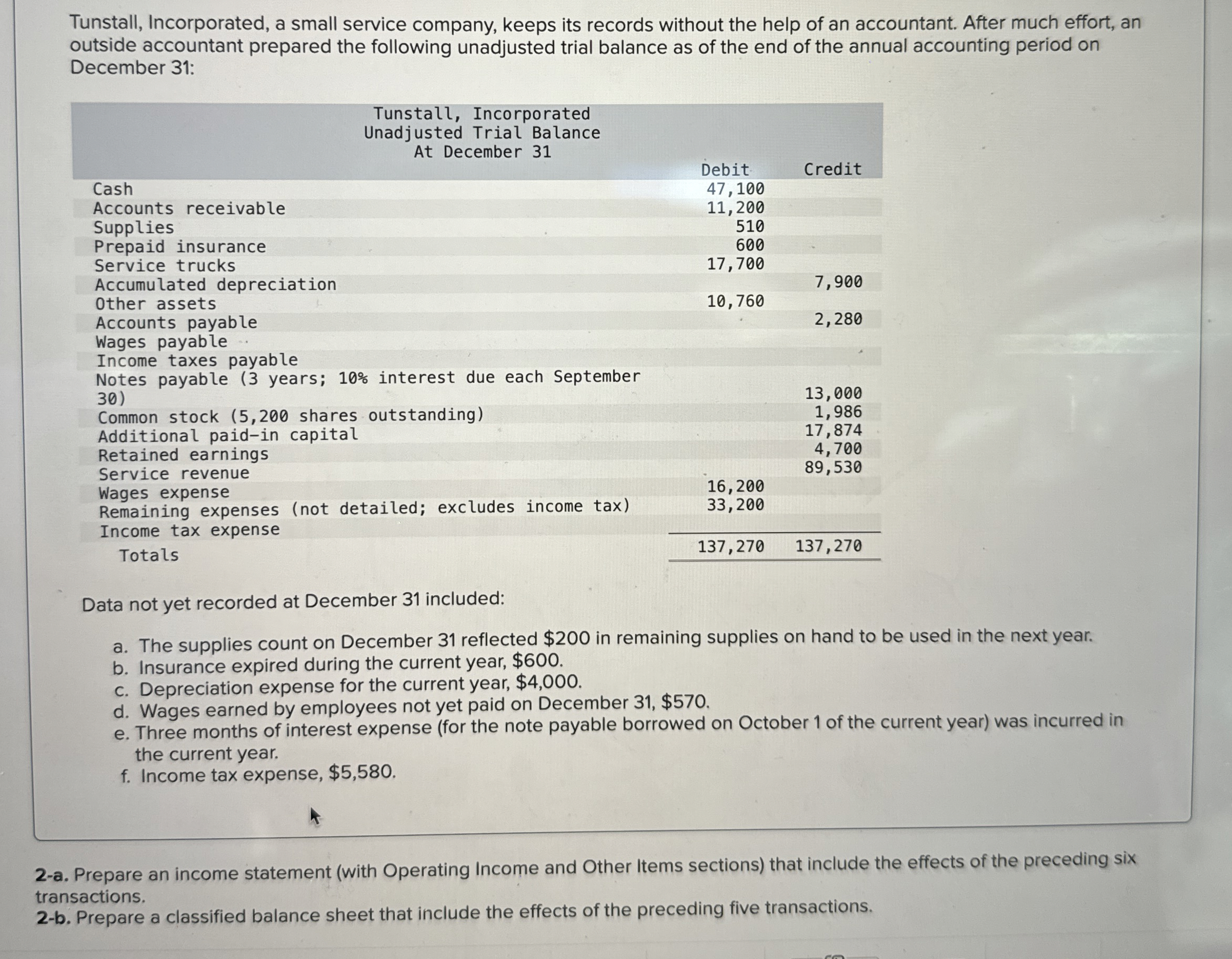

Tunstall, Incorporated, a small service company, keeps its records without the help of an accountant. After much effort, an outside accountant prepared the following unadjusted

Tunstall, Incorporated, a small service company, keeps its records without the help of an accountant. After much effort, an outside accountant prepared the following unadjusted trial balance as of the end of the annual accounting period on December :

tabletableTunstall IncorporatedUnadjusted Trial BalanceAt December Debit,CreditCashAccounts receivable,SuppliesPrepaid insurance,Service trucks,Accumulated depreciation,,Other assets,Accounts payable,,Wages payable,,Income taxes payable,,tableNotes payable years; interest due each SeptemberCommon stock shares outstandingAdditional paidin capital,,Retained earnings,,Service revenue,,Wages expense,Remaining expenses not detailed; excludes income taxIncome tax expense,,Totals

Data not yet recorded at December included:

a The supplies count on December reflected $ in remaining supplies on hand to be used in the next year.

b Insurance expired during the current year, $

c Depreciation expense for the current year, $

d Wages earned by employees not yet paid on December $

e Three months of interest expense for the note payable borrowed on October of the current year was incurred in the current year.

f Income tax expense, $

a Prepare an income statement with Operating Income and Other Items sections that include the effects of the preceding six transactions.

b Prepare a classified balance sheet that include the effects of the preceding five transactions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started