Question

Turn the trial balance into properly formatted financial statements -- statement of financial position (balance sheet) and statement of income. Do not try to prepare

Turn the trial balance into properly formatted financial statements -- statement of financial position (balance sheet) and statement of income. Do not try to prepare a cash flow statement or statement of stockholders' equity, you don't have enough information. Refer to early chapters in the textbook for help, the financial statements you submit must be something you'd be proud to show an investor, or a banker, or anyone else. Keep in mind that most companies summarize financial information. Rarely would a company include every account on its financial statements, rather, companies routinely combine similar and related accounts, sometimes with a different title. Again, rely on the earlier chapters in the textbook for guidance. Use your judgment . All of the asset accounts would be too much, but a single item "Total Assets" would provide far too little information, right?

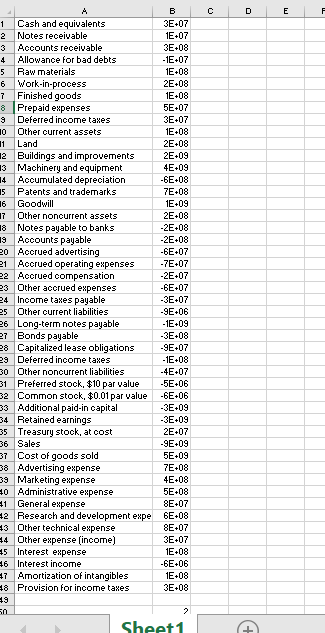

thats how the trial balance looks like. i didn't have any option to attack the link.

C D E F B 1 Cash and equivalents 3E+07 2 Notes receivable 1E+07 3 Accounts receivable 3E+08 4 Allowance for bad debts -1E+07 5 Raw materials 1E+08 6 Work-in-process 2E+08 7 Finished goods 1E+08 8 Prepaid expenses 5E+07 9 Deferred income taxes 3E+07 10 Other Ourrent assets 1E+08 11 Land 2E+08 12 Buildings and improvements 2E+09 13 Machinery and equipment 4E+09 14 Accumulated depreciation -6E+08 15 Patents and trademarks 7E+08 16 Goodwill 1E+09 17 Other noncurrent assets 2E+08 18 Notes payable to banks -2E+08 19 Accounts payable -2E+08 20 Accrued advertising -6E+07 21 Accrued operating expenses -7E+07 22 Accrued compensation -2E+07 23 Other accrued expenses -6E+07 24 Income taxes payable -3E+07 25 Other current liabilities 9E+06 26 Long-term notes payable - 1E-09 21 Bonds payable 3E+08 28 Capitalized lease obligations 9E+07 29 Deferred income taxes -1E+08 30 Other noncurrent liabilities -4E+07 31 Preferred stock, $10 par value -5E+06 32 Common stock, $0.01 par value -6E+06 33 Additional paid-in capital -3E+09 34 Retained earnings 3E+09 35 Treasury stock, at cost 2E+07 36 Sales -9E+09 37 Cost of goods sold 5E+09 38 Advertising expense 7E+08 39 Marketing expense 4E+08 20 Administrative expense 5E+08 21 General expense 8E+07 42 Research and development expe 6E+08 23 Other technical expense 8E+07 24 Other expense (income) 3E+07 45 Interest expense 1E+08 26 Interest income -6E+06 7 Amortization of intangibles 1E+08 #8 Provision for income taxes 3E+08 Sheet1 C D E F B 1 Cash and equivalents 3E+07 2 Notes receivable 1E+07 3 Accounts receivable 3E+08 4 Allowance for bad debts -1E+07 5 Raw materials 1E+08 6 Work-in-process 2E+08 7 Finished goods 1E+08 8 Prepaid expenses 5E+07 9 Deferred income taxes 3E+07 10 Other Ourrent assets 1E+08 11 Land 2E+08 12 Buildings and improvements 2E+09 13 Machinery and equipment 4E+09 14 Accumulated depreciation -6E+08 15 Patents and trademarks 7E+08 16 Goodwill 1E+09 17 Other noncurrent assets 2E+08 18 Notes payable to banks -2E+08 19 Accounts payable -2E+08 20 Accrued advertising -6E+07 21 Accrued operating expenses -7E+07 22 Accrued compensation -2E+07 23 Other accrued expenses -6E+07 24 Income taxes payable -3E+07 25 Other current liabilities 9E+06 26 Long-term notes payable - 1E-09 21 Bonds payable 3E+08 28 Capitalized lease obligations 9E+07 29 Deferred income taxes -1E+08 30 Other noncurrent liabilities -4E+07 31 Preferred stock, $10 par value -5E+06 32 Common stock, $0.01 par value -6E+06 33 Additional paid-in capital -3E+09 34 Retained earnings 3E+09 35 Treasury stock, at cost 2E+07 36 Sales -9E+09 37 Cost of goods sold 5E+09 38 Advertising expense 7E+08 39 Marketing expense 4E+08 20 Administrative expense 5E+08 21 General expense 8E+07 42 Research and development expe 6E+08 23 Other technical expense 8E+07 24 Other expense (income) 3E+07 45 Interest expense 1E+08 26 Interest income -6E+06 7 Amortization of intangibles 1E+08 #8 Provision for income taxes 3E+08 Sheet1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started