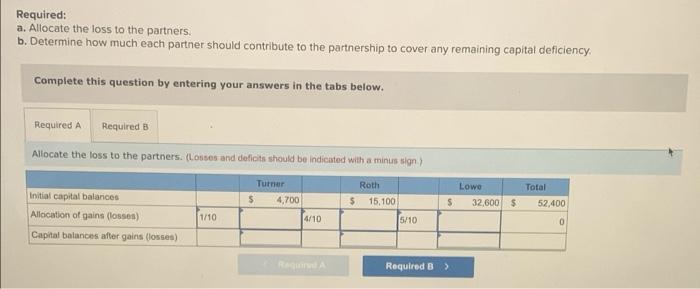

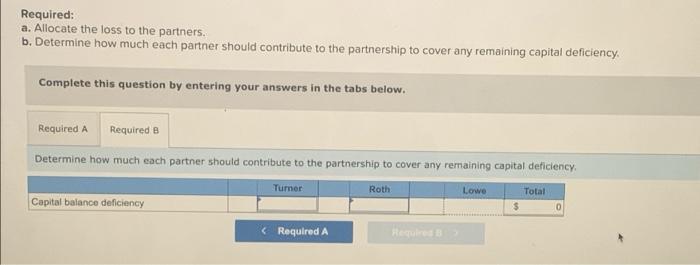

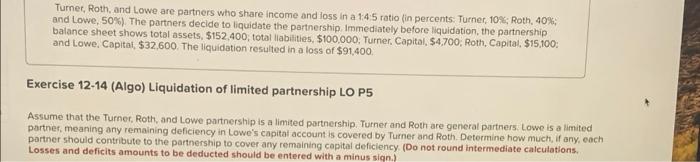

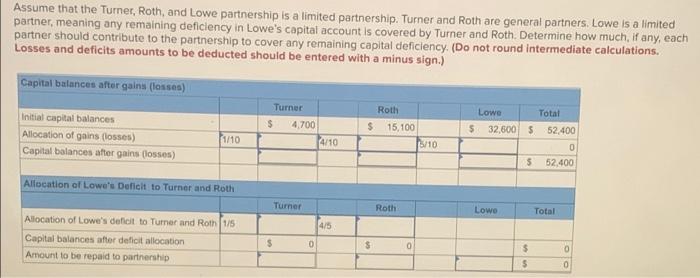

Turner, Roth, and Lowe are partners who share income and loss in a 1:4:5 ratio (in percents: Turner, 10%; Roth, 40% and Lowe, 50%). The partners decide to liquidate the partnership. Immediately before liquidation, the partnership balance sheet shows total assets, $152,400, total liabilities, $100,000: Turner, Capital, $4,700; Roth, Capital, $15,100, and Lowe, Capital, $32,600. The liquidation resulted in a loss of $91,400, Exercise 12-13 (Algo) Liquidation of partnership LO P5 Required: a. Allocate the loss to the partners. b. Determine how much each partner should contribute to the partnership to cover any remaining capital deficiency, Complete this question by entering your answers in the tabs below. Required: a. Allocate the loss to the partners. b. Determine how much each partner should contribute to the partnership to cover any remaining capital deficiency. Complete this question by entering your answers in the tabs below. Required A Required B Allocate the loss to the partners. (Lorses and deficits should be indicated with a minus sign) Turner $ 4,700 Roth 5 15,100 5/10 Lowo 32,600 Total 52,400 S Initial capital balances Allocation of gains (lossen) Capital balances after gains (losses) $ 1/10 4/10 0 Required B Required: a. Allocate the loss to the partners. b. Determine how much each partner should contribute to the partnership to cover any remaining capital deficiency Complete this question by entering your answers in the tabs below. Required A Required B Determine how much each partner should contribute to the partnership to cover any remaining capital deficiency Turner Roth Lowe Capital balance deficiency Total $ 0 Required A Recruit Turner, Roth, and Lowe are partners who share income and loss in a 1:45 ratio (in percents: Turner, 10% Roth, 40%. and Lowe, 50%). The partners decide to liquidate the partnership. Immediately before liquidation, the partnership balance sheet shows total assets $152.400, total liabilities, $100,000, Turner. Capital, $4,700, Roth, Capital $15.100: and Lowe. Capital $32,600. The liquidation resulted in a loss of $91,400 Exercise 12-14 (Algo) Liquidation of limited partnership LO P5 Assume that the Turner, Roth, and Lowe partnership is a limited partnership. Turner and Roth are general partners Lowe is a limited partner, meaning any remaining deficiency in Lowe's capital account is covered by Turner and Roth Determine how much, if any, each partner should contribute to the partnership to cover any remaining capital deficiency (Do not round intermediate calculations. Losses and deficits amounts to be deducted should be entered with a minus sian) Assume that the Turner, Roth, and Lowe partnership is a limited partnership. Turner and Roth are general partners. Lowe is a limited partner, meaning any remaining deficiency in Lowe's capital account is covered by Turner and Roth. Determine how much, if any, each partner should contribute to the partnership to cover any remaining capital deficiency. (Do not round intermediate calculations. Losses and deficits amounts to be deducted should be entered with a minus sign.) Capital balances after gains (losses) Lowe Initial capital balances $ 4.700 15,100 5 32,500 5 52,400 Allocation of gains (losses) 16/10 Capital balances after gains (lossen) Turner Total Roth $ 1/10 4/10 0 52.400 5 Allocation of Lowe's Deficit to Turner and Roth Turner Roth Lowo Total . 4/5 Allocation of Lowe's deflot to Turner and Roth (1) Capital balances after deficit allocation Amount to be repaid to partnership $ 0 0 0 $ 5 0