Question

Turner Video will invest $70,500 in a project. The firms cost of capital is 12 percent. The investment will provide the following inflows. Use Appendix

Turner Video will invest $70,500 in a project. The firms cost of capital is 12 percent. The investment will provide the following inflows. Use Appendix Afor an approximate answer but calculate your final answer using the formula and financial calculator methods.

| Year | Inflow | ||

| 1 | $ | 21,000 | |

| 2 | 23,000 | ||

| 3 | 27,000 | ||

| 4 | 31,000 | ||

| 5 | 35,000 | ||

|

| |||

The internal rate of return is 14 percent.

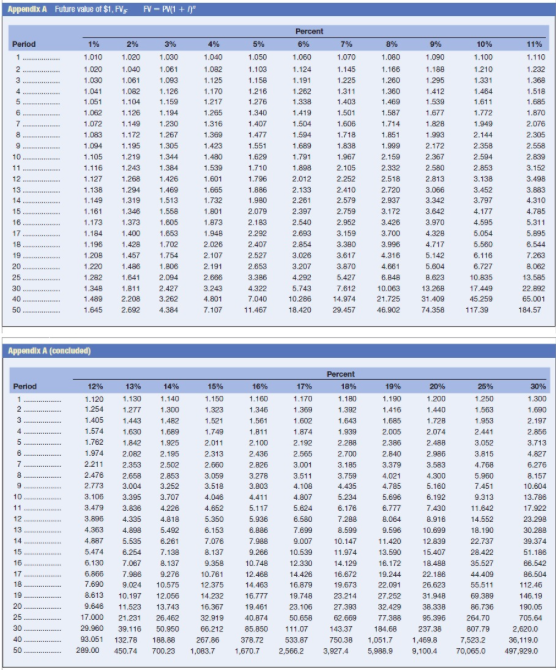

a. If the reinvestment assumption of the net present value method is used, what will be the total value of the inflows after five years? (Assume the inflows come at the end of each year.) (Do not round intermediate calculations and round your answer to 2 decimal places.)

b. If the reinvestment assumption of the internal rate of return method is used, what will be the total value of the inflows after five years? (Use the given internal rate of return. Do not round intermediate calculations and round your answer to 2 decimal places.)

c. Which investment assumption is better?

| Reinvestment assumption of IRR | |

| Reinvestment assumption of NPV |

Appendix A Future value of $1, FV FV-PV1 + n 40 9306113278 188.88 26786 378.72 533.87 750.38 1,051.7 1,469.8 289.00 450.74 700.23 1,08371670.72.566.2 3,874 5,988 9,1004 70,0650 497.829.0 202 360-ero ons 995 $50 150 003 210 195 011 995 002 ses 001 57 200 000 197 013210 IST 004 700 002 200 200 spa 198 // 46 19 05 64 250 980 ess 001 ose $15 750 980-St 013 190 750 400 11 999 750 70 79 2334579 11-18 22 35 44 55 69 86 004 007 $25 000 198 350 300 38 8 4 18 22 26 31 38 95 201 000 100 " 13 16 19 22 27 32 77 84 001 3 4 6 7 8 10 11 14 16 27 02 43 750 007 '' es 000 120 101 202 ssa Ana 004 004 999 700 000 012 193 201 997 55 6. 7 9. 10 12 14 16 9 40 85 000 125 170 201 005 $15 360 400 400 $30 een ess raz soi Bra see ces 102 198 000 001 197 12 14 16 32 000 001 000 120 ise 194 200 201 ses 104 400 400 sia-ess re 750 800 004 47 202 104 7. 9. 1 1 1 26 50 779 10. 11. 21, 30, 22, 50. 010 000 000 001 002 012 003 004 105 16 27 198 140 61 73 84 198 200 220 202 // ses 12345678g 10 1 2 3 4 5 6 7 18 19 20 25 30 40 50 123456789 10 11 12 13 14 15 16 17 18 19 20 25 30 40 50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started