Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TURRONES Company is now considering producing and selling a new product (for ever): A light 'Turron (Spanish Almond Candy or Nougat, traditional Christmas treat

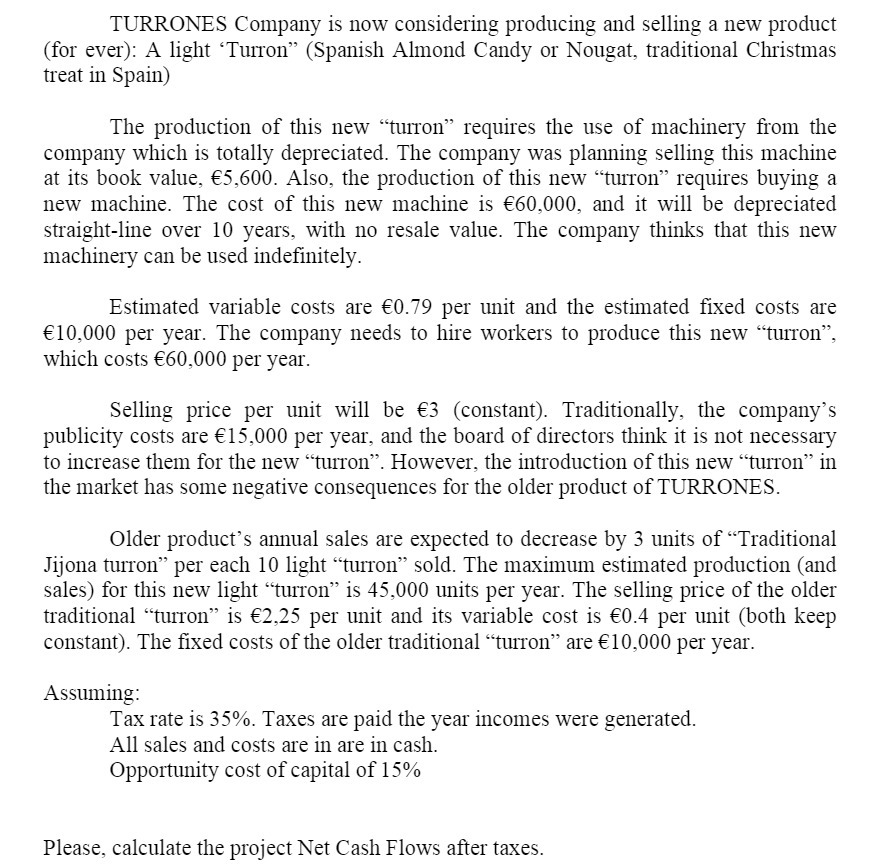

TURRONES Company is now considering producing and selling a new product (for ever): A light 'Turron (Spanish Almond Candy or Nougat, traditional Christmas treat in Spain) The production of this new "turron" requires the use of machinery from the company which is totally depreciated. The company was planning selling this machine at its book value, 5,600. Also, the production of this new "turron" requires buying a new machine. The cost of this new machine is 60,000, and it will be depreciated straight-line over 10 years, with no resale value. The company thinks that this new machinery can be used indefinitely. Estimated variable costs are 0.79 per unit and the estimated fixed costs are 10,000 per year. The company needs to hire workers to produce this new turron, which costs 60,000 per year. Selling price per unit will be 3 (constant). Traditionally, the company's publicity costs are 15,000 per year, and the board of directors think it is not necessary to increase them for the new "turron". However, the introduction of this new "turron" the market has some negative consequences for the older product of TURRONES. Older product's annual sales are expected to decrease by 3 units of Traditional Jijona turron" per each 10 light "turron" sold. The maximum estimated production (and sales) for this new light turron" is 45,000 units per year. The selling price of the older traditional turron is 2,25 per unit and its variable cost is 0.4 per unit (both keep constant). The fixed costs of the older traditional turron" are 10,000 per year. Assuming: Tax rate is 35%. Taxes are paid the year incomes were generated. All sales and costs are in are in cash. Opportunity cost of capital of 15% Please, calculate the project Net Cash Flows after taxes.

Step by Step Solution

★★★★★

3.28 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net cash flows after taxes for the project we need to consider the revenues costs depreciation and tax implications Heres how we can ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started