Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) On the basis of the information provided, PREPARE a schedule of the total budgeted overheads for each of the four departments, clearly showing

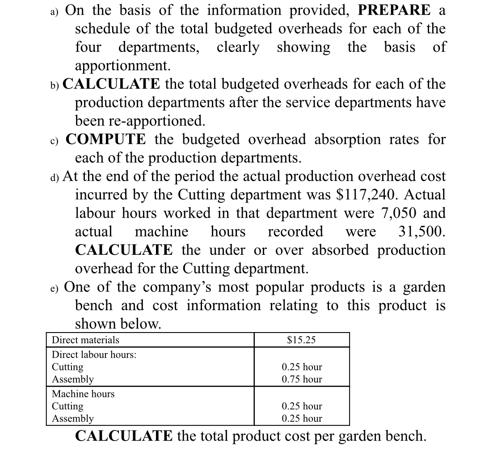

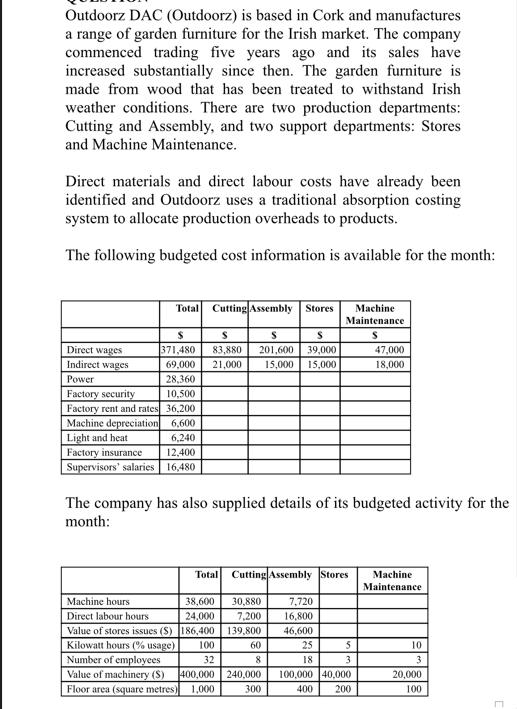

a) On the basis of the information provided, PREPARE a schedule of the total budgeted overheads for each of the four departments, clearly showing the basis of apportionment. b) CALCULATE the total budgeted overheads for each of the production departments after the service departments have been re-apportioned. c) COMPUTE the budgeted overhead absorption rates for each of the production departments. d) At the end of the period the actual production overhead cost incurred by the Cutting department was $117,240. Actual labour hours worked in that department were 7,050 and actual machine hours recorded were 31,500. CALCULATE the under or over absorbed production overhead for the Cutting department. e) One of the company's most popular products is a garden bench and cost information relating to this product is shown below. Direct materials Direct labour hours: $15.25 Cutting Assembly Machine hours Cutting Assembly 0.25 hour 0.75 hour 0.25 hour 0.25 hour CALCULATE the total product cost per garden bench. Outdoorz DAC (Outdoorz) is based in Cork and manufactures a range of garden furniture for the Irish market. The company commenced trading five years ago and its sales have increased substantially since then. The garden furniture is made from wood that has been treated to withstand Irish weather conditions. There are two production departments: Cutting and Assembly, and two support departments: Stores and Machine Maintenance. Direct materials and direct labour costs have already been identified and Outdoorz uses a traditional absorption costing system to allocate production overheads to products. The following budgeted cost information is available for the month: Total Cutting Assembly Stores Machine Maintenance Direct wages Indirect wages $ 371,480 83,880 S S 201,600 39,000 69,000 21,000 15,000 15,000 S S 47,000 18,000 Power 28,360 Factory security 10,500 Factory rent and rates 36,200. Machine depreciation 6,600 Light and heat Factory insurance 6,240 12,400 Supervisors' salaries 16,480 The company has also supplied details of its budgeted activity for the month: Total Cutting Assembly Stores Machine Maintenance Machine hours 38,600 30,880 7,720 Direct labour hours. 24,000 7,200 16,800 Value of stores issues (S) 186,400 139,800 46,600 Kilowatt hours (% usage) | 100 60 25 5 10 Number of employees 32 8 18 3 3 Value of machinery (S) 400,000 Floor area (square metres) 240,000 100,000 40,000 20,000. 1,000 300 400 200 100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started