Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tutorial: BASIC EPS & DILUTED EPS CASE A ABC Berhad has the following at the end of 31 December 2023: - Profit after tax

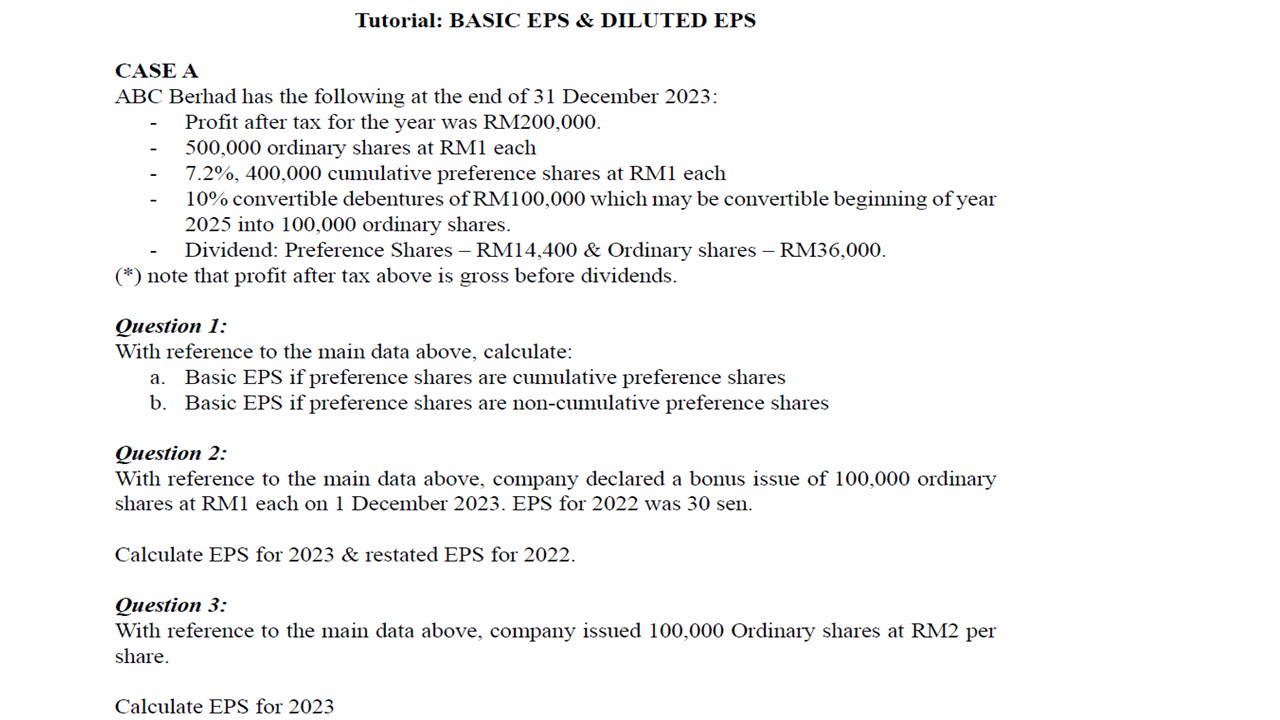

Tutorial: BASIC EPS & DILUTED EPS CASE A ABC Berhad has the following at the end of 31 December 2023: - Profit after tax for the year was RM200,000. 500,000 ordinary shares at RMI each - 7.2%, 400,000 cumulative preference shares at RMI each 10% convertible debentures of RM100,000 which may be convertible beginning of year 2025 into 100,000 ordinary shares. Dividend: Preference Shares - RM14,400 & Ordinary shares - RM36,000. (*) note that profit after tax above is gross before dividends. Question 1: With reference to the main data above, calculate: a. Basic EPS if preference shares are cumulative preference shares b. Basic EPS if preference shares are non-cumulative preference shares Question 2: With reference to the main data above, company declared a bonus issue of 100,000 ordinary shares at RM1 each on 1 December 2023. EPS for 2022 was 30 sen. Calculate EPS for 2023 & restated EPS for 2022. Question 3: With reference to the main data above, company issued 100,000 Ordinary shares at RM2 per share. Calculate EPS for 2023

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

CASE A Question 1 a Basic EPS if preference shares are cumulative preference shares Profit after tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started