Answered step by step

Verified Expert Solution

Question

1 Approved Answer

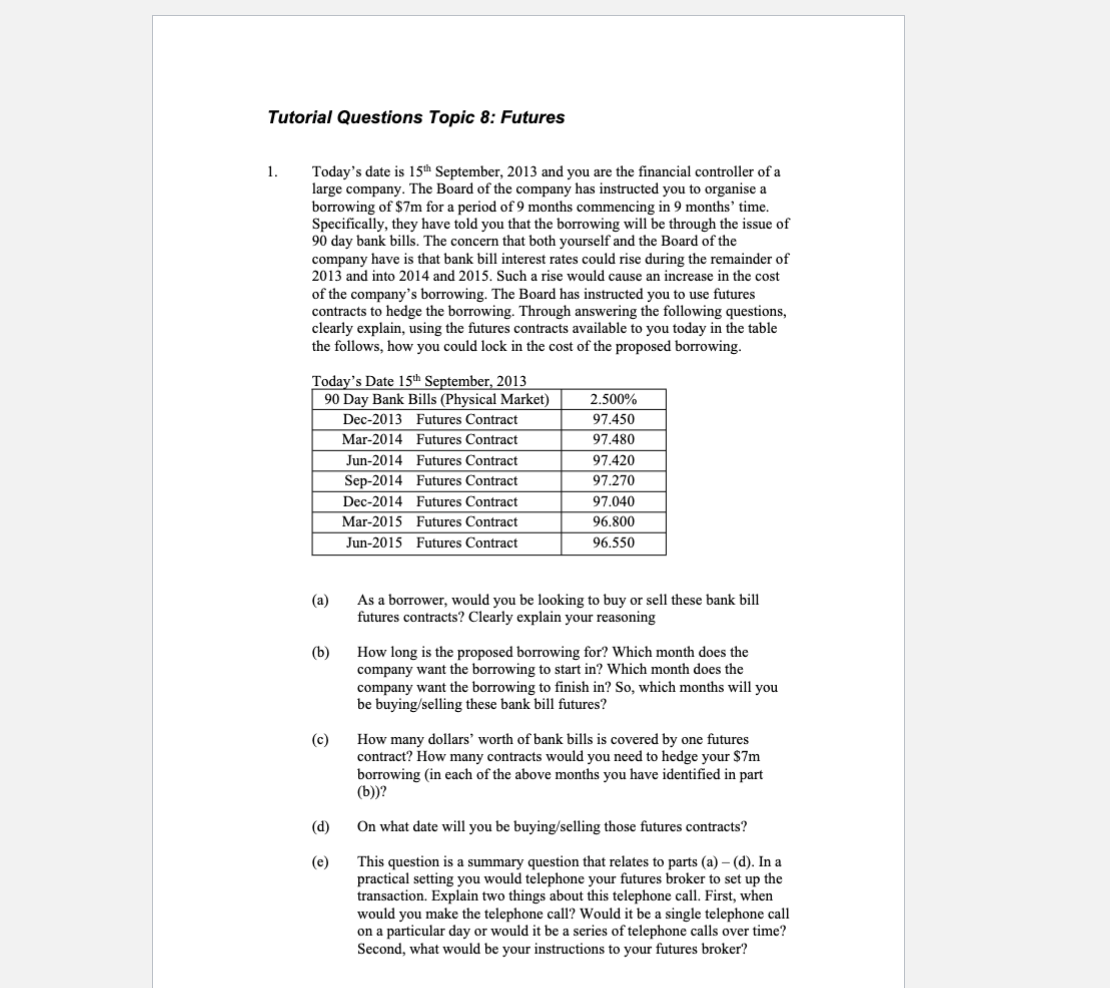

Tutorial Questions Topic 8 : Futures Today's date is 1 5 t h September, 2 0 1 3 and you are the financial controller of

Tutorial Questions Topic : Futures

Today's date is September, and you are the financial controller of a

large company. The Board of the company has instructed you to organise a

borrowing of $ for a period of months commencing in months' time.

Specifically, they have told you that the borrowing will be through the issue of

day bank bills. The concern that both yourself and the Board of the

company have is that bank bill interest rates could rise during the remainder of

and into and Such a rise would cause an increase in the cost

of the company's borrowing. The Board has instructed you to use futures

contracts to hedge the borrowing. Through answering the following questions,

clearly explain, using the futures contracts available to you today in the table

the follows, how you could lock in the cost of the proposed borrowing.

Today's Date September,

a As a borrower, would you be looking to buy or sell these bank bill

futures contracts? Clearly explain your reasoning

b How long is the proposed borrowing for? Which month does the

company want the borrowing to start in Which month does the

company want the borrowing to finish in So which months will you

be buyingselling these bank bill futures?

c How many dollars' worth of bank bills is covered by one futures

contract? How many contracts would you need to hedge your $

borrowing in each of the above months you have identified in part

b

d On what date will you be buyingselling those futures contracts?

e This question is a summary question that relates to parts ad In a

practical setting you would telephone your futures broker to set up the

transaction. Explain two things about this telephone call. First, when

would you make the telephone call? Would it be a single telephone call

on a particular day or would it be a series of telephone calls over time?

Second, what would be your instructions to your futures broker? Tutorial Questions Topic : Futures

Today's date is September, and you are the financial controller of a

large company. The Board of the company has instructed you to organise a

borrowing of $ for a period of months commencing in months' time.

Specifically, they have told you that the borrowing will be through the issue of

day bank bills. The concern that both yourself and the Board of the

company have is that bank bill interest rates could rise during the remainder of

and into and Such a rise would cause an increase in the cost

of the company's borrowing. The Board has instructed you to use futures

contracts to hedge the borrowing. Through answering the following questions,

clearly explain, using the futures contracts available to you today in the table

the follows, how you could lock in the cost of the proposed borrowing.

Today's Date September,

a As a borrower, would you be looking to buy or sell these bank bill

futures contracts? Clearly explain your reasoning

b How long is the proposed borrowing for? Which month does the

company want the borrowing to start in Which month does the

company want the borrowing to finish in So which months will you

be buyingselling these bank bill futures?

c How many dollars' worth of bank bills is covered by one futures

contract? How many contracts would you need to hedge your $

borrowing in each of the above months you have identified in part

b

d On what date will you be buyingselling those futures contracts?

e This question is a summary question that relates to parts ad In a

practical setting you would telephone your futures broker to set up the

transaction. Explain two things about this telephone call. First, when

would you make the telephone call? Would it be a single telephone call

on a particular day or would it be a series of telephone calls over time?

Second, what would be your instructions to your futures broker?

fWhat are the yields implicit in the quoted prices for the bank bill

futures contracts above?

g If you sold $m face value of bank bills at the June futures rate of

how much money would the company receive on th June

ANSWER: $ How much would it have to pay back

days later? ANSWER: $ Complete a similar calculation

for the other bank bill issues that the company will undertake.

h Use an IRR calculation to determine your overall pa cost of

borrowing from using futures to hedge your exposure? ANSWER:

pp pa

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started