Answered step by step

Verified Expert Solution

Question

1 Approved Answer

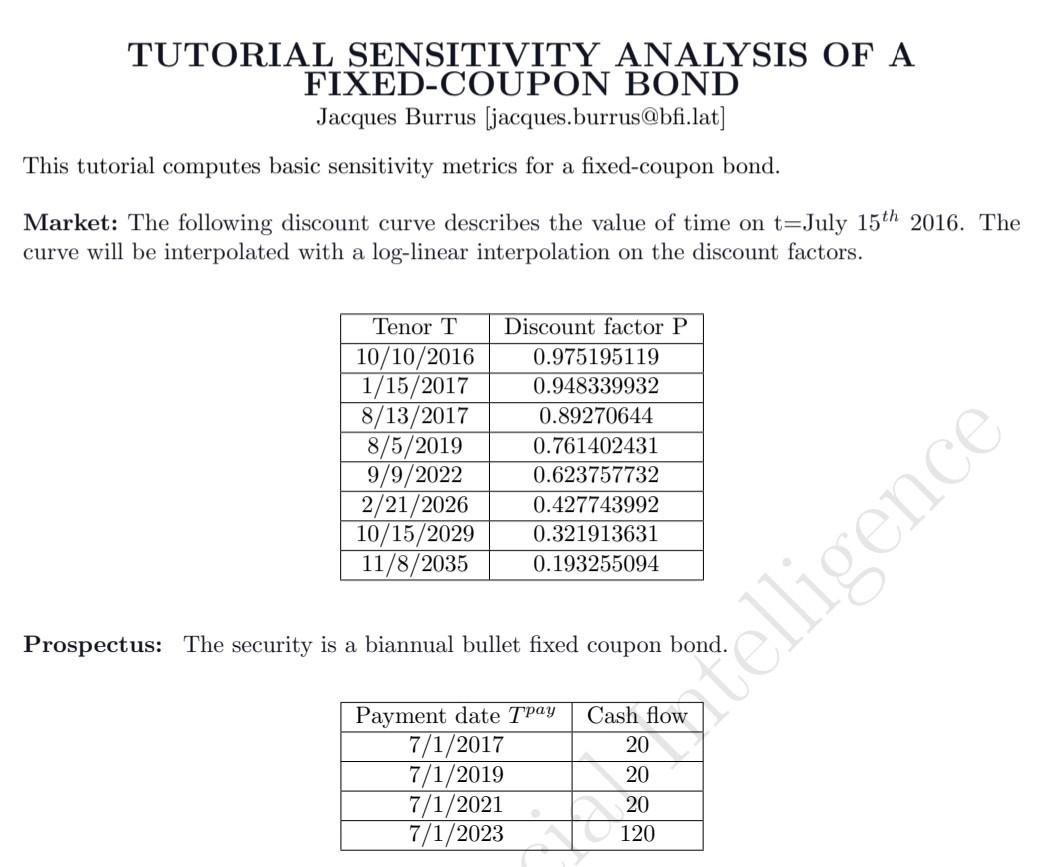

TUTORIAL SENSITIVITY ANALYSIS OF A FIXED-COUPON BOND Jacques Burrus (jacques.burrus@bfi.lat] This tutorial computes basic sensitivity metrics for a fixed-coupon bond. Market: The following discount curve

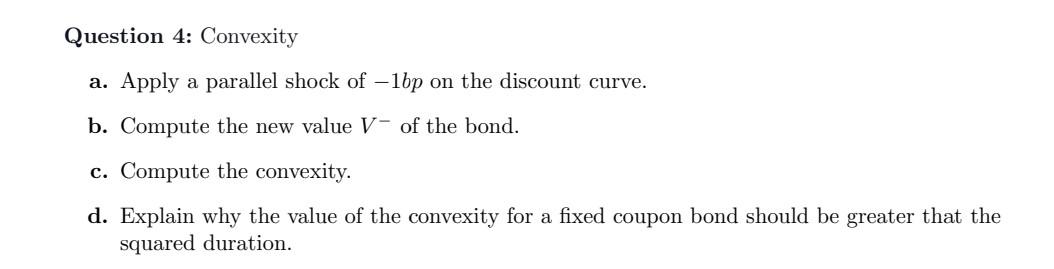

TUTORIAL SENSITIVITY ANALYSIS OF A FIXED-COUPON BOND Jacques Burrus (jacques.burrus@bfi.lat] This tutorial computes basic sensitivity metrics for a fixed-coupon bond. Market: The following discount curve describes the value of time on t=July 15th 2016. The curve will be interpolated with a log-linear interpolation on the discount factors. Tenor T 10/10/2016 1/15/2017 8/13/2017 8/5/2019 9/9/2022 2/21/2026 10/15/2029 11/8/2035 Discount factor P 0.975195119 0.948339932 0.89270644 0.761402431 0.623757732 0.427743992 0.321913631 0.193255094 Prospectus: The security is a biannual bullet fixed coupon bond. telligence Payment date Tpay 7/1/2017 7/1/2019 7/1/2021 7/1/2023 20 20 20 120 Question 4: Convexity a. Apply a parallel shock of -1bp on the discount curve. b. Compute the new value V- of the bond. c. Compute the convexity. d. Explain why the value of the convexity for a fixed coupon bond should be greater that the squared duration. TUTORIAL SENSITIVITY ANALYSIS OF A FIXED-COUPON BOND Jacques Burrus (jacques.burrus@bfi.lat] This tutorial computes basic sensitivity metrics for a fixed-coupon bond. Market: The following discount curve describes the value of time on t=July 15th 2016. The curve will be interpolated with a log-linear interpolation on the discount factors. Tenor T 10/10/2016 1/15/2017 8/13/2017 8/5/2019 9/9/2022 2/21/2026 10/15/2029 11/8/2035 Discount factor P 0.975195119 0.948339932 0.89270644 0.761402431 0.623757732 0.427743992 0.321913631 0.193255094 Prospectus: The security is a biannual bullet fixed coupon bond. telligence Payment date Tpay 7/1/2017 7/1/2019 7/1/2021 7/1/2023 20 20 20 120 Question 4: Convexity a. Apply a parallel shock of -1bp on the discount curve. b. Compute the new value V- of the bond. c. Compute the convexity. d. Explain why the value of the convexity for a fixed coupon bond should be greater that the squared duration

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started