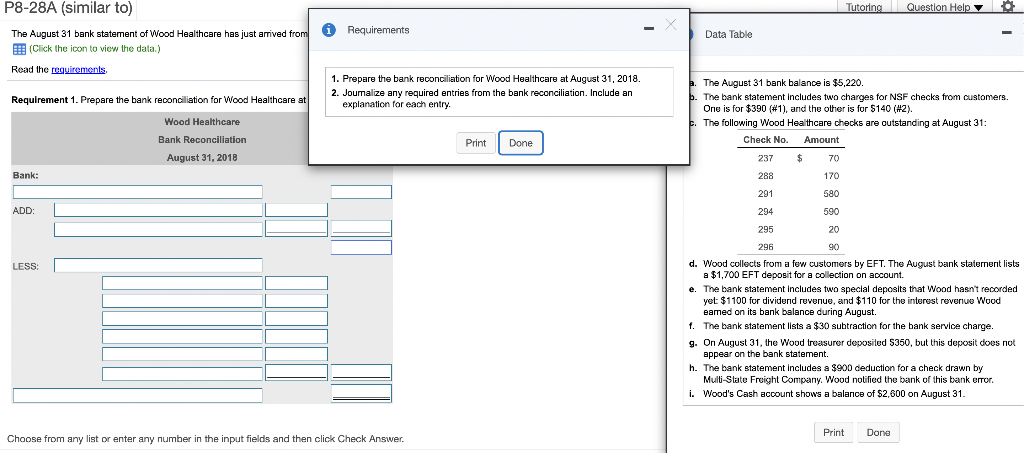

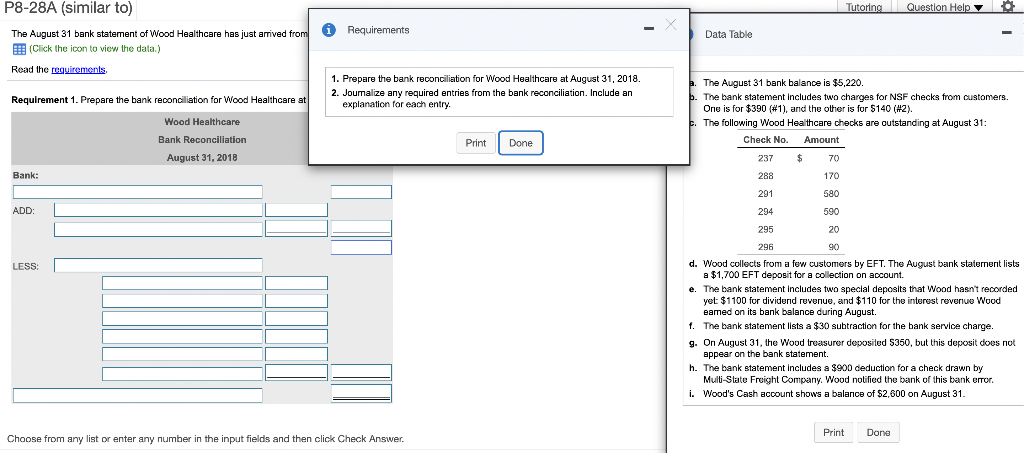

Tutoring Question Help P8-28A (similar to) The August 31 bank statement of Wood Healthcare has just arrived from (Click the icon to view the data.) Requirements Data Table Read the requirements 1. Prepare the bank reconciliation for Wood Healthcare at August 31, 2018. 2. Joumalize any required entries from the bank reconciliation. Include an explanation for each entry. Requirement 1. Prepare the bank reconciliation for Wood Healthcare at Wood Healthcare Bank Reconciliation August 31, 2018 Bank: 2. The August 31 bank balance is $5,220. b. The bank statement includes two charges for NSF checks from customers. One is for $390 (#1), and the other is for $140 (#2). The following Wood Healthcare checks are outstanding at August 31 Check No. Amount 237 $ 70 Print Done 288 170 291 580 ADD: 294 590 20 295 296 90 LESS d. Wood collects from a few customers by EFT. The August bank statement lists a $1,700 EFT deposit for a collection on account e. The bank statement includes two special deposits that Wood hasn't recorded yet: $1100 for dividend revenue, and $110 for the interest revenue Wood eamed on its bank balance during August. f. The bank statement lists a $30 subtraction for the bank service charge. 9. On August 31, the Wood treasurer deposited 5350, but this deposit does not appear on the bank statement. h. The bank statement includes a $900 deduction for a check drawn by Multi-Slate Freight Company. Wood notified the bank of this bank error. i. Wood's Cash account shows a balance of $2,600 on August 31. Print Done Choose from any list or enter any number in the input fields and then click Check Answer. Tutoring Question Help P8-28A (similar to) The August 31 bank statement of Wood Healthcare has just arrived from (Click the icon to view the data.) Requirements Data Table Read the requirements 1. Prepare the bank reconciliation for Wood Healthcare at August 31, 2018. 2. Joumalize any required entries from the bank reconciliation. Include an explanation for each entry. Requirement 1. Prepare the bank reconciliation for Wood Healthcare at Wood Healthcare Bank Reconciliation August 31, 2018 Bank: 2. The August 31 bank balance is $5,220. b. The bank statement includes two charges for NSF checks from customers. One is for $390 (#1), and the other is for $140 (#2). The following Wood Healthcare checks are outstanding at August 31 Check No. Amount 237 $ 70 Print Done 288 170 291 580 ADD: 294 590 20 295 296 90 LESS d. Wood collects from a few customers by EFT. The August bank statement lists a $1,700 EFT deposit for a collection on account e. The bank statement includes two special deposits that Wood hasn't recorded yet: $1100 for dividend revenue, and $110 for the interest revenue Wood eamed on its bank balance during August. f. The bank statement lists a $30 subtraction for the bank service charge. 9. On August 31, the Wood treasurer deposited 5350, but this deposit does not appear on the bank statement. h. The bank statement includes a $900 deduction for a check drawn by Multi-Slate Freight Company. Wood notified the bank of this bank error. i. Wood's Cash account shows a balance of $2,600 on August 31. Print Done Choose from any list or enter any number in the input fields and then click Check