Answered step by step

Verified Expert Solution

Question

1 Approved Answer

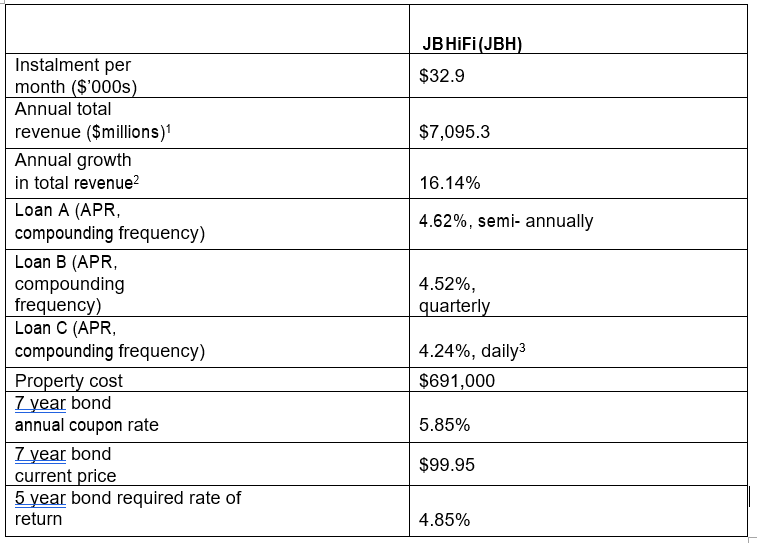

TVM and bond valuation questions (1 mark each): Your case company has just made a large sale on an instalment contract. The contract requires the

- TVM and bond valuation questions (1 mark each):

- Your case company has just made a large sale on an instalment contract. The contract requires the customer to pay your case company the amount shown in Table 1 (page 4 of this document) at the end of every month for 5 years. Your case company would like the cash now for an investment and so has asked its bank to discount the instalment contract and pay it the discounted value. The bank will discount the contract at 6% APR, compounded monthly. How much cash will your case company receive from the bank?

- Your company has annual operating revenue as shown in Table 1. Assume this revenue will grow continuously at the annual rate shown in Table 1. What is your prediction for annual operating revenue in 7 years?

- Your company needs to borrow funds and has several options available to it, Loans A, B and

C. The interest rates (APR) for these options are given in Table 1. What is the EAR of the loan option the company should choose?

- Your company is buying new property for the amount given in Table 1. To finance this, the companys bank has offered an amortised loan at 3.65% APR, quarterly compounding, with 11 years of quarterly payments. What quarterly payment will the company have to make on this loan? Assume that the entire property cost is financed and that payments are made at the end of each period.

Assessment 2: Business Case Studies I ACC00716 S3 2019

- Your company has an issue of $100 par value annual coupon bonds with 7 years remaining until maturity. The annual coupon rate is given in Table 1, along with the current price of the bonds. What is the yield to maturity on the bonds?

- Your company has an issue of $1,000 par value bonds that offer a 8% coupon rate paid semi- annually. The bonds have 5 years remaining until maturity. The markets required return on these bonds is given in Table 1. What is the amount of each coupon payment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started