Question

TWEPCO analyzed the wind investment using accepted discounted cashflow analysis. this includes the use of both ht internal rate of return and the net present

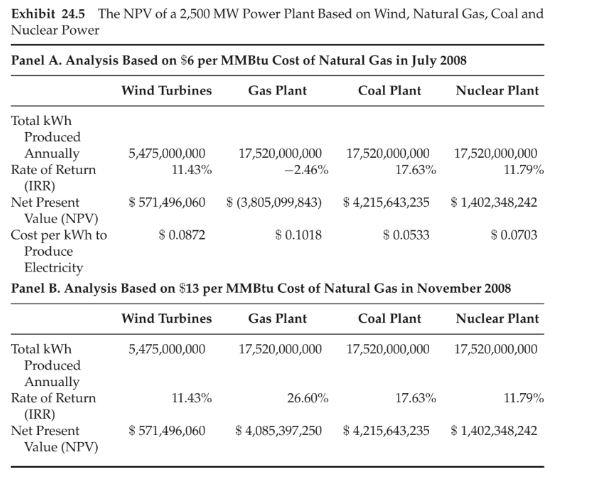

TWEPCO analyzed the wind investment using accepted discounted cashflow analysis. this includes the use of both ht internal rate of return and the net present value metrics. In the exhibit below, the estimated net present value (npv) for the proposed wind turbine is presented alongside a similar analysis of natural gas, coal, and nuclear power generation. once again, two panels in the exhibit correspond to July and October prices of natural gas. under the July higher prices for natural gas, the NVP of the gas-fired plant is very negative, which reflects the fact that the price per kWh received from the plant is $0.10 while the cost per KWh to produce power is $0.1018.

QUESTION

What are TWEPCOs options at this point? What would you recommend that the company do with regard to the wind generation project? Specifically, should TWEPCO proceed with the investment in wind power generation or not? Explain?

This question is from Chapter 24: Wind Energy Power Company, Inc: Analyzing a Wind Energy Investment

Exhibit 24.5 The NPV of a 2,500 MW Power Plant Based on Wind, Natural Gas, Coal and Nuclear Power Panel A. Analysis Based on $6 per MMBtu Cost of Natural Gas in July 2008 Wind Turbines Gas Plant Coal Plant Nuclear Plant Total kWh Produced Annually 5,475,000,000 17,520,000,000 17,520,000,000 17,520,000,000 Rate of Return 11.43% -2.46% 17.63% 11.79% (IRR) Net Present $ 571,496,060 $ (3,805,099,843) $ 4,215,643,235 $1,402,348,242 Value (NPV) Cost per kWh to $ 0.0872 $ 0.1018 $ 0.0533 $ 0.0703 Produce Electricity Panel B. Analysis Based on $13 per MMBtu Cost of Natural Gas in November 2008 Wind Turbines Gas Plant Coal Plant Nuclear Plant Total kWh 5,475,000,000 17,520,000,000 17,520,000,000 17,520,000,000 Produced Annually Rate of Return 11.43% 26.60% 17.63% 11.79% (IRR) Net Present $ 571,496,060 $ 4,085,397,250 $4,215,643,235 $1,402,348,242 Value (NPV) Exhibit 24.5 The NPV of a 2,500 MW Power Plant Based on Wind, Natural Gas, Coal and Nuclear Power Panel A. Analysis Based on $6 per MMBtu Cost of Natural Gas in July 2008 Wind Turbines Gas Plant Coal Plant Nuclear Plant Total kWh Produced Annually 5,475,000,000 17,520,000,000 17,520,000,000 17,520,000,000 Rate of Return 11.43% -2.46% 17.63% 11.79% (IRR) Net Present $ 571,496,060 $ (3,805,099,843) $ 4,215,643,235 $1,402,348,242 Value (NPV) Cost per kWh to $ 0.0872 $ 0.1018 $ 0.0533 $ 0.0703 Produce Electricity Panel B. Analysis Based on $13 per MMBtu Cost of Natural Gas in November 2008 Wind Turbines Gas Plant Coal Plant Nuclear Plant Total kWh 5,475,000,000 17,520,000,000 17,520,000,000 17,520,000,000 Produced Annually Rate of Return 11.43% 26.60% 17.63% 11.79% (IRR) Net Present $ 571,496,060 $ 4,085,397,250 $4,215,643,235 $1,402,348,242 Value (NPV)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started