Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two accountants for the firm of Elwes and Wright are arguing about the merits of presenting an income statement in a multiple- step versus a

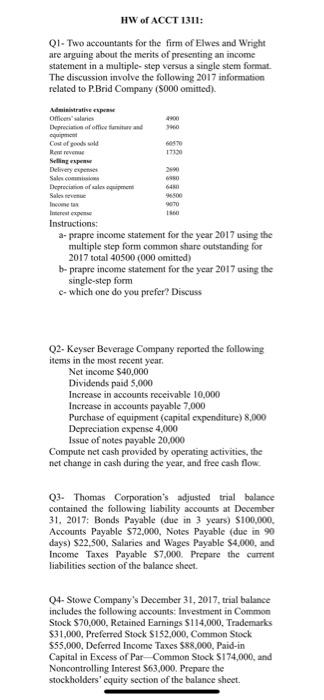

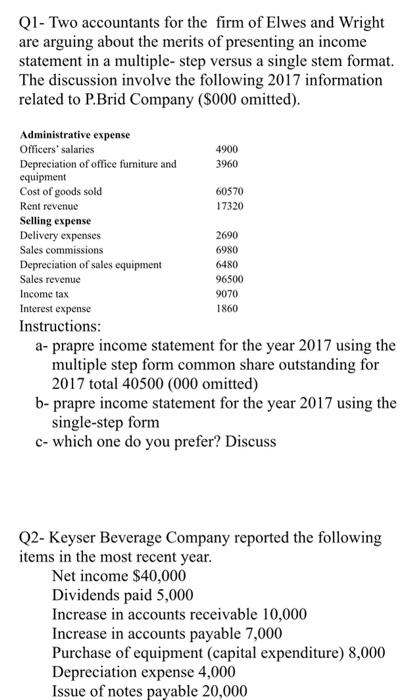

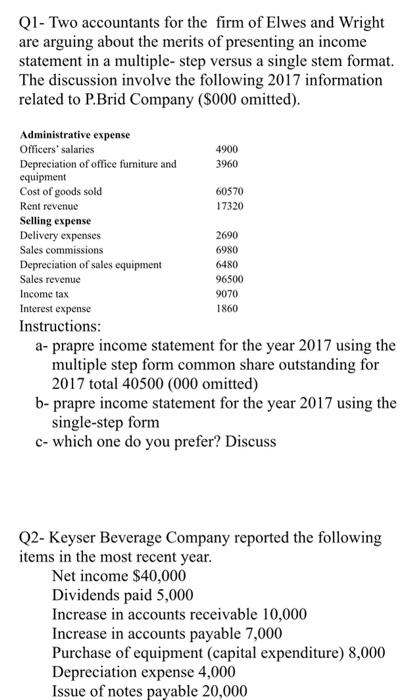

Two accountants for the firm of Elwes and Wright are arguing about the merits of presenting an income statement in a multiple- step versus a single stem format. The discussion involve the following 2017 information related to P.Brid Company ($000 omitted)

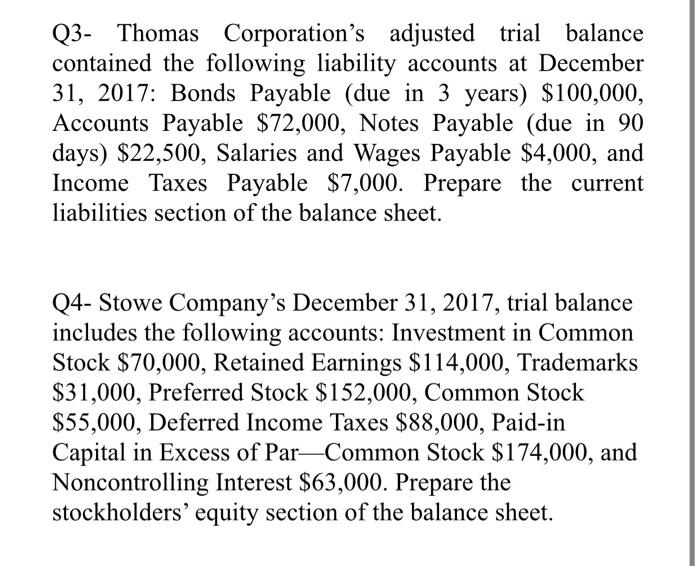

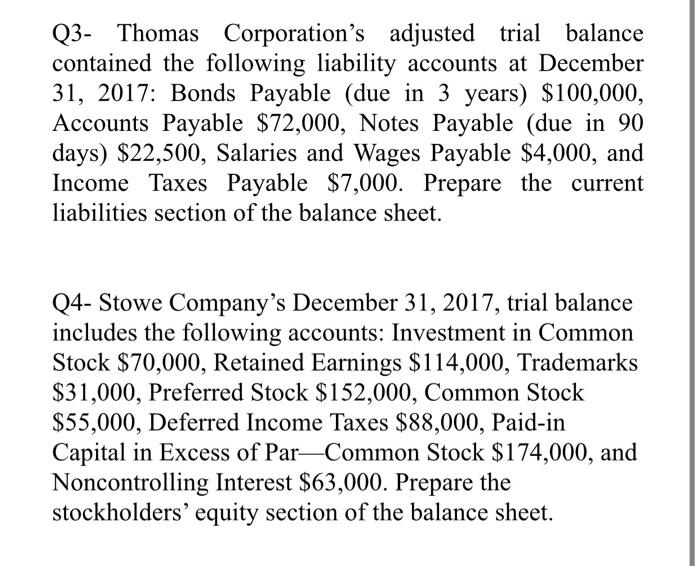

HW of ACCT 1311: QI-Two accountants for the firm of Elwes and Wright are arguing about the merits of presenting an income statement in a multiple-step versus a single stem format. The discussion involve the following 2017 information related to P.Brid Company (S000 omitted). Admiratione pe Officer salaries Deprecate food Cost of all 00 Rent 17130 Seling Delivery Sale.com Depreciation of elect Sales 9070 Instructions: a-prapre income statement for the year 2017 using the multiple step form common share outstanding for 2017 total 40500 (000 omitted) b-prapre income statement for the year 2017 using the single-step form c. which one do you prefer? Discuss Q2-Keyser Beverage Company reported the following items in the most recent year Net income $40,000 Dividends paid 5.000 Increase in accounts receivable 10,000 Increase in accounts payable 7,000 Purchase of equipment (capital expenditure) 8,000 Depreciation expense 4.000 Issue of notes payable 20,000 Compute net cash provided by operating activities, the net change in cash during the year, and free cash flow Q3. Thomas Corporation's adjusted trial balance contained the following liability accounts at December 31. 2017: Bonds Payable (due in 3 years) $100,000 Accounts Payable 72,000, Notes Payable (due in 90 days) $22,500. Salaries and Wages Payable $4.000, and Income Taxes Payable $7,000. Prepare the current liabilities section of the balance sheet. 04- Stowe Company's December 31, 2017 trial balance includes the following accounts: Investment in Common Stock S70,000, Retained Earnings $114,000. Trademarks $31,000. Preferred Stock S152,000, Common Stock $55,000, Deferred Income Taxes $88,000, Paid-in Capital in Excess of Par Common Stock S174,000, and Noncontrolling Interest S63,000. Prepare the stockholders' equity section of the balance sheet. Q3- Thomas Corporation's adjusted trial balance contained the following liability accounts at December 31, 2017: Bonds Payable (due in 3 years) $100,000, Accounts Payable $72,000, Notes Payable (due in 90 days) $22,500, Salaries and Wages Payable $4,000, and Income Taxes Payable $7,000. Prepare the current liabilities section of the balance sheet. Q4- Stowe Company's December 31, 2017, trial balance includes the following accounts: Investment in Common Stock $70,000, Retained Earnings $114,000, Trademarks $31,000, Preferred Stock $152,000, Common Stock $55,000, Deferred Income Taxes $88,000, Paid-in Capital in Excess of ParCommon Stock $174,000, and Noncontrolling Interest $63,000. Prepare the stockholders' equity section of the balance sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started