Question

Two Assets P and Q have the following statistical properties: , , , and . The risk-free rate of interest (on bills) is 5%, and

Two Assets P and Q have the following statistical properties:  ,

,  ,

,  , and

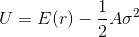

, and  . The risk-free rate of interest (on bills) is 5%, and borrowing is not possible. An investor with preferences given by

. The risk-free rate of interest (on bills) is 5%, and borrowing is not possible. An investor with preferences given by

can combine bills with either P or Q but not both.

a) Explain why this investor would never combine bills with Q unless the weight in Q were greater than one-half. Use the standard deviation-expected return diagram.

b) Consider a risk-neutral investor (A = 0). Which portfolio would he prefer? Within that portfolio, what would be the share of the risk-free asset? Show your solution on the standard deviation-expected return diagram.

c) Consider a risk-averse investor (A > 0). For what values of A would the investor combine bills with Q?

Erp) = 10% Op = 10% Elro) = 15% 0g = 25% V = E(r) - 40Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started