Question

Two business owners, Owner A and Owner B, both take out revolver loans, meaning they have terms with the lender to require the debt service

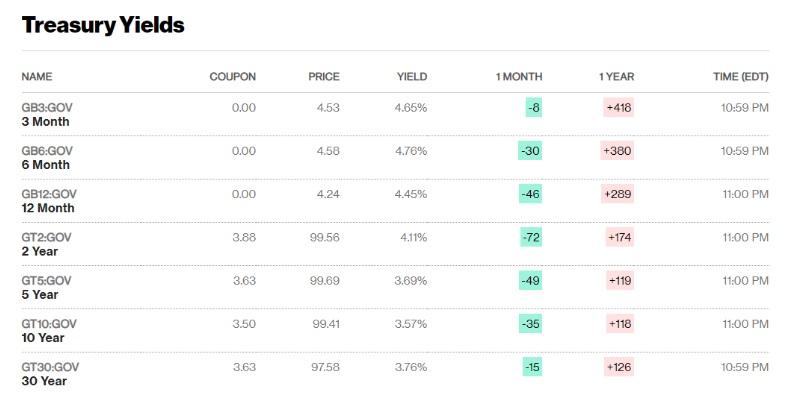

Two business owners, Owner A and Owner B, both take out revolver loans, meaning they have terms with the lender to require the debt service to be paid each period, without any reduction of principal debt amounts. For each business owner, the loans amount is $10,000,000. Owner A has agreed with their lender to pay a fixed interest rate of 7% with payments due at the end of each year. Owner B has agreed with their lender to pay a variable interest rate of 10-year Treasury Yield + 2% as of 3/29/2023. As of March 29, 2023, here are the Treasury rates:  6 The expectation for the 10-year Treasury rates at time = 2, time = 3, and time = 4 are as follows: TIME 10 Year Rate Spot Rate (used for discounting) 1 (known) 3.57% 4.65% 2 (predicted) 4.07% 4.07% 3 (predicted) 3.57% 3.07% 4 (predicted) 3.07% 2.32%

6 The expectation for the 10-year Treasury rates at time = 2, time = 3, and time = 4 are as follows: TIME 10 Year Rate Spot Rate (used for discounting) 1 (known) 3.57% 4.65% 2 (predicted) 4.07% 4.07% 3 (predicted) 3.57% 3.07% 4 (predicted) 3.07% 2.32%

[The relevant rate for discounting would be reflected by the 3-month Treasury rate, and this is the discount rate. The analyst would not need to apply CAPM. Rather, just discount using the known or predicted 3-month rate.] Lets assume there is no swap agreement between Owner A and Owner B. What is the annual cash flow of Owner A to their lender? 1. Year 1 2. Year 2 3. Year 3 4. Year 4 What is the annual cash flow of Owner B to their lender? 5. Year 1 6. Year 2 7. Year 3 8. Year 4

Now, lets assume Owner A and Owner B enter into an interest-rate swap agreement (a plain vanilla swap). OA wants variable risk exposure and OB wants to fix their rate. They agree to a notional amount of $10,000,000. OA agrees to pay OB the 10YT (10-year Treasury) + 1% while OB agrees to pay OA a fixed rate of 6%. Given this swap...

9. What is the annual net cash flow that Owner A has to pay in Year 1? 10. What is the annual net cash flow that Owner A has to pay in Year 2? 11. What is the annual net cash flow that Owner A has to pay in Year 3? 12. What is the annual net cash flow that Owner A has to pay in Year 4?

13. What is the annual net cash flow that Owner B has to pay in Year 1? 14. What is the annual net cash flow that Owner B has to pay in Year 2? 15. What is the annual net cash flow that Owner B has to pay in Year 3? 16. What is the annual net cash flow that Owner B has to pay in Year 4?

Now, lets assume Owner A and Owner B enter into a Different interest-rate swap agreement (a plain vanilla swap). OA wants variable risk exposure and OB wants to fix their rate. They agree to a notional amount of $10,000,000. OA agrees to pay OB the 10YT (10-year Treasury) + 3% while OB agrees to pay OA a fixed rate of 9%. 17. What is the annual net cash flow that Owner A has to pay in Year 3? 18. What is the annual net cash flow that Owner A has to pay in Year 4? 19. What is the annual net cash flow that Owner B has to pay in Year 3? 20. What is the annual net cash flow that Owner B has to pay in Year 4?

Valuation

To better understand which counterparty made out well, given a change in the direction of interest rates, the best way to approach the issue is to conduct a valuation. You will use the spot rates for all discounting and valuation (NPV) problems.

21. What is the spot rate used for discounting in Year 3? 22. What is the NPV of the cash outflows for Owner A in Years 1 through 4, for problems 1-4? 23. What is the NPV of the cash outflows for Owner A in Years 1 through 4, for problems 9-12? 24. What is the NPV of the cash outflows for Owner B in Years 1 through 4, for problems 5-8? 25. What is the NPV of the cash outflows for Owner B in Years 1 through 4, for problems 13-16?6

Treasury Yields Treasury YieldsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started