Question

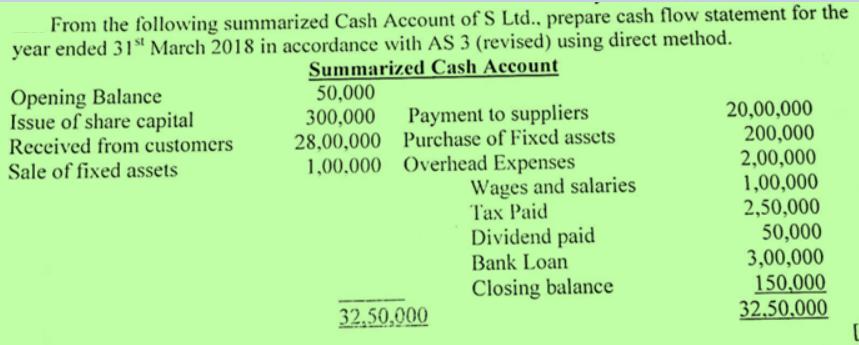

From the following summarized Cash Account of S Ltd., prepare cash flow statement for the year ended 31st March 2018 in accordance with AS

From the following summarized Cash Account of S Ltd., prepare cash flow statement for the year ended 31st March 2018 in accordance with AS 3 (revised) using direct method. Summarized Cash Account Opening Balance Issue of share capital Received from customers Sale of fixed assets 50,000 300,000 28,00,000 1,00.000 Overhead Expenses Payment to suppliers Purchase of Fixed assets 32.50.000 Wages and salaries Tax Paid Dividend paid Bank Loan Closing balance 20,00,000 200,000 2,00,000 1,00,000 2,50,000 50,000 3,00,000 150,000 32.50.000 C

Step by Step Solution

3.61 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Statement of cash flows for the year ended march 31 2018 1 Cash flow fro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Auditing and Assurance Services

Authors: Timothy Louwers, Robert Ramsay, David Sinason, Jerry Straws

6th edition

978-1259197109, 77632281, 77862341, 1259197107, 9780077632281, 978-0077862343

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App