Two companies Fatty and Skinny trade in the same market. Their financial statements for the year ended 31 October 2022 are summarised below: Statements

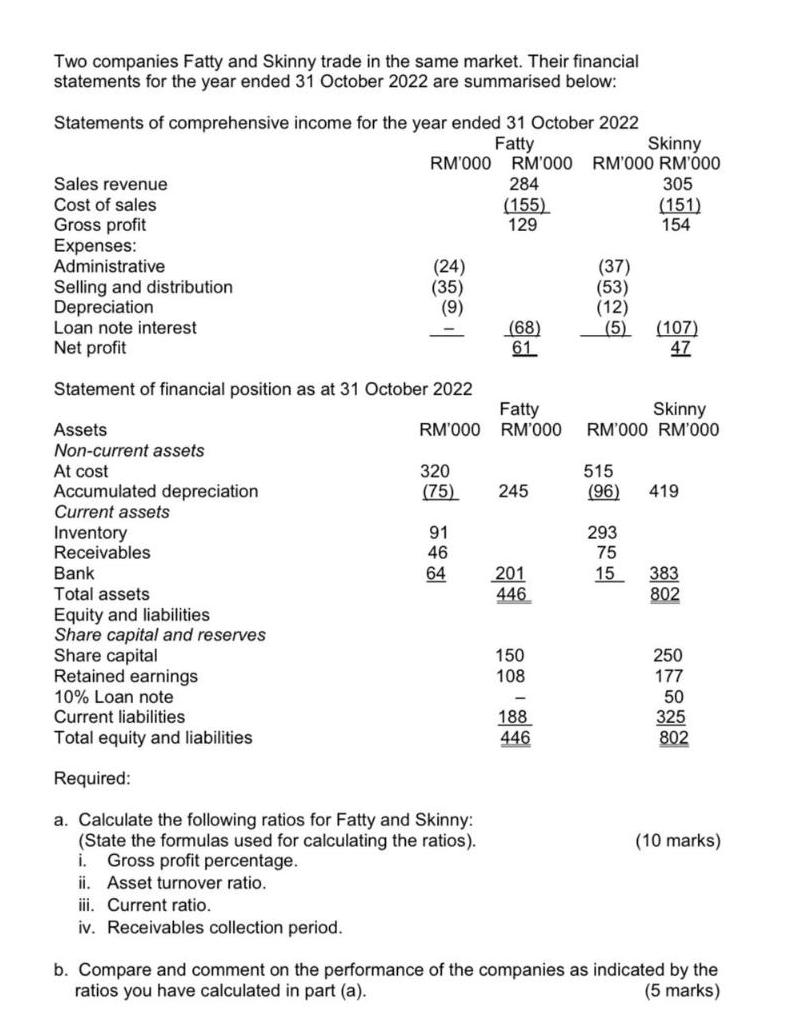

Two companies Fatty and Skinny trade in the same market. Their financial statements for the year ended 31 October 2022 are summarised below: Statements of comprehensive income for the year ended 31 October 2022 Fatty RM'000 Sales revenue Cost of sales Gross profit Expenses: Administrative Selling and distribution Depreciation Loan note interest Net profit Statement of financial position as at 31 October 2022 RM'000 Assets Non-current assets At cost Accumulated depreciation Current assets Inventory Receivables Bank Total assets Equity and liabilities Share capital and reserves Share capital (24) (35) (9) ii. Asset turnover ratio. iii. Current ratio. iv. Receivables collection period. 320 (75) 91 46 64 Retained earnings 10% Loan note Current liabilities Total equity and liabilities Required: a. Calculate the following ratios for Fatty and Skinny: (State the formulas used for calculating the ratios). 1. Gross profit percentage. Skinny RM'000 RM'000 RM'000 284 (155) 129 (68) 61 Fatty RM'000 245 201 446 150 108 188 446 (37) (53) (12) (5) 515 Skinny RM'000 RM'000 (96) 305 (151) 154 293 75 15 (107) 47 419 383 802 250 177 50 325 802 (10 marks) b. Compare and comment on the performance of the companies as indicated by the ratios you have calculated in part (a). (5 marks)

Step by Step Solution

3.29 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Fatty Gross Profit Percentage Gross Profit Sales Revenue x 100 129320 x 100 4031 Asset Turnover Ra...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started