Answered step by step

Verified Expert Solution

Question

1 Approved Answer

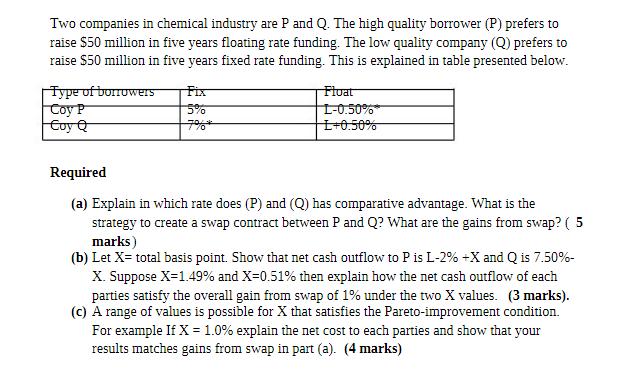

Two companies in chemical industry are P and Q. The high quality borrower (P) prefers to raise $50 million in five years floating rate

Two companies in chemical industry are P and Q. The high quality borrower (P) prefers to raise $50 million in five years floating rate funding. The low quality company (Q) prefers to raise $50 million in five years fixed rate funding. This is explained in table presented below. Type of borrowers Coy P CoyQ 5% Float L-0.50%* L+0.50% Required (a) Explain in which rate does (P) and (Q) has comparative advantage. What is the strategy to create a swap contract between P and Q? What are the gains from swap? ( 5 marks) (b) Let X= total basis point. Show that net cash outflow to P is L-2% +X and Q is 7.50%- X. Suppose X=1.49% and X-0.51% then explain how the net cash outflow of each parties satisfy the overall gain from swap of 1% under the two X values. (3 marks). (c) A range of values is possible for X that satisfies the Pareto-improvement condition. For example If X = 1.0% explain the net cost to each parties and show that your results matches gains from swap in part (a). (4 marks)

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a Company P has a comparative advantage in floating rate funding as its cost of floating rate funding L050 is lower than the cost of fixed rate funding 7 Company Q on the other hand has a com...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started