Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two individuals, A and B, and Corporation C formed Partnership P (P) on July 1, 2019. On that date A contributed $20,000 cash in

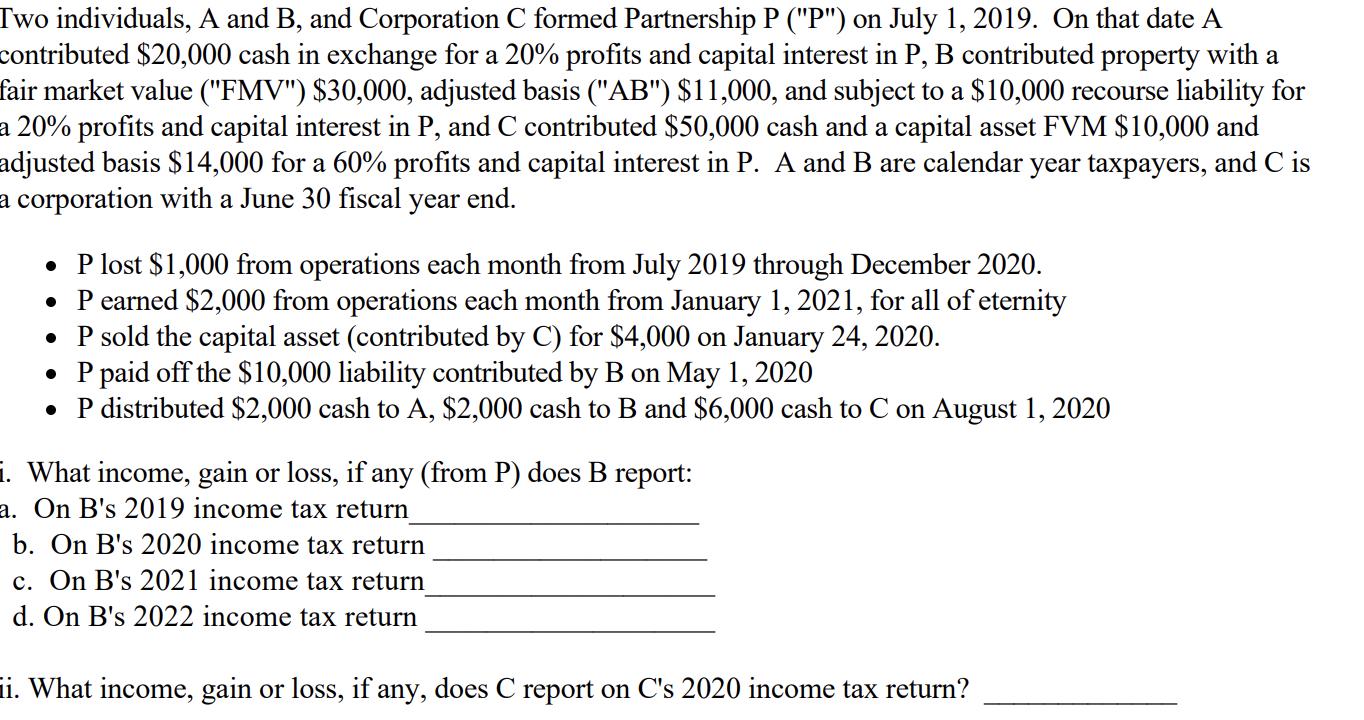

Two individuals, A and B, and Corporation C formed Partnership P ("P") on July 1, 2019. On that date A contributed $20,000 cash in exchange for a 20% profits and capital interest in P, B contributed property with a fair market value ("FMV") $30,000, adjusted basis ("AB") $11,000, and subject to a $10,000 recourse liability for a 20% profits and capital interest in P, and C contributed $50,000 cash and a capital asset FVM $10,000 and adjusted basis $14,000 for a 60% profits and capital interest in P. A and B are calendar year taxpayers, and C is a corporation with a June 30 fiscal year end. P lost $1,000 from operations each month from July 2019 through December 2020. P earned $2,000 from operations each month from January 1, 2021, for all of eternity P sold the capital asset (contributed by C) for $4,000 on January 24, 2020. P paid off the $10,000 liability contributed by B on May 1, 2020 P distributed $2,000 cash to A, $2,000 cash to B and $6,000 cash to C on August 1, 2020 i. What income, gain or loss, if any (from P) does B report: a. On B's 2019 income tax return b. On B's 2020 income tax return c. On B's 2021 income tax return d. On B's 2022 income tax return ii. What income, gain or loss, if any, does C report on C's 2020 income tax return?

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Answer Assuming the AB and e profili lormes as per their capital Profib contibu tiom n P as follo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started