Question

Two lives aged x and y take out a policy that will pay out 15,000 on the death of (x) provided that (y) has

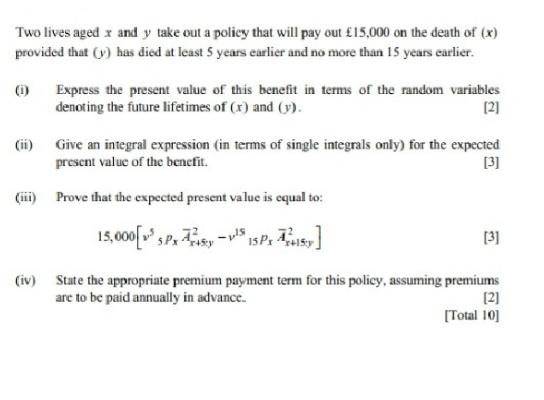

Two lives aged x and y take out a policy that will pay out 15,000 on the death of (x) provided that (y) has died at least 5 years earlier and no more than 15 years earlier. (1) Express the present value of this benefit in terms of the random variables denoting the future lifetimes of (x) and (y). [2] (ii) Give an integral expression (in terms of single integrals only) for the expected present value of the benefit. [3] (iii) Prove that the expected present value is equal to: 15,000 PX S 15PX Sy] v5 Px sy -pls [3] (iv) State the appropriate premium payment term for this policy, assuming premiums are to be paid annually in advance... [2] [Total 10]

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

i The present value of the benefit can be expressed in terms of the random variables denoting the fu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

10th edition

978-0077511388, 78034779, 9780077511340, 77511387, 9780078034770, 77511344, 978-0077861759

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App