Question

Two men, Arman and Fazli, are exposed to the motor accident risk. Assume that the probability of motor accident happening is 20% with a loss

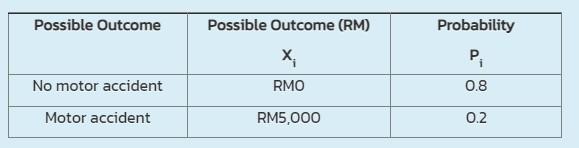

Two men, Arman and Fazli, are exposed to the motor accident risk. Assume that the probability of motor accident happening is 20% with a loss of RM5,000, and that the probability of no motor accident happening is 80%. The chances of losses for these two men are uncorrelated. Under normal situations whereby they each bear the effects of their own loss, the expected losses are independent of each other and have the following distribution:

a) Compute the expected loss, variance and standard deviation of Arman and Fazli independently before risk pooling.

b) Prepare a probability distribution table of Arman and Fazli after risk pooling. Calculate the expected loss, variance and standard deviation after the risk pooling arrangement.

c) Explain briefly FOUR (4) inferences which can be made from this pooling arrangement.

Possible Outcome Possible Outcome (RM) X RMO Probability P. 0.8 No motor accident Motor accident RM5,000 0.2 Possible Outcome Possible Outcome (RM) X RMO Probability P. 0.8 No motor accident Motor accident RM5,000 0.2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started