Question: Two mutually exclusive alternatives are being considered. Alternative A has an initial cost of $100 and uniform annual benefit of $19.93. The useful life is

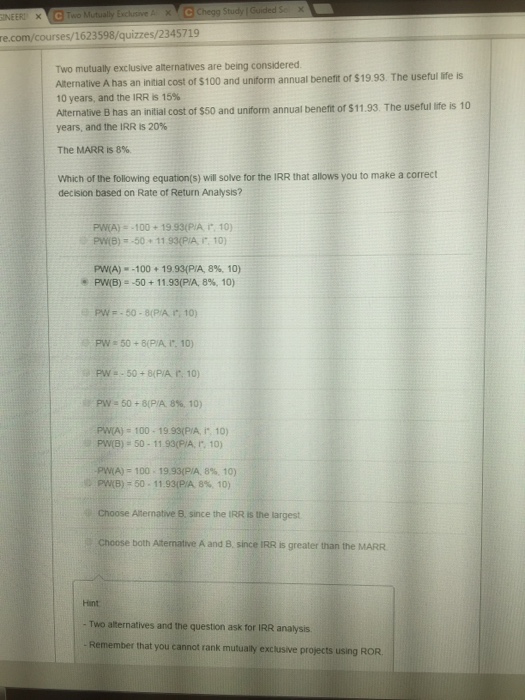

Two mutually exclusive alternatives are being considered. Alternative A has an initial cost of $100 and uniform annual benefit of $19.93. The useful life is 10 years, and the IRR is 15% Alternative B has an initial cost of $50 and uniform annual benefit of $11.93. The useful life is 10 years, and the IRR is 20% The MARR is 8% Which of the following equation(s) will solve for the IRR that allows you to make a correct decision based on rate of return analysis? PW(A) = -100 + 19.93(P/A, i*, 10) PW(theta) = -50 + 11.93(P/A, i*, 10) PW(A) = -100 + 19.93(P/A, 8%, 10) PW(B) = -50 + 19.93(P/A, 8%, 10) PW = -50-8(P/A, i*, 10) PW = 50 + 8(P/A, i*, 10) PW = -50 + 8(P/A, i*, 10) PW = 50 + 8(P/A, 8%, 10) PW(A) = 100 - 19.93(P/A, i*, 10) PW(A) = 50 - 11.93(P/A, i*, 10) PW(A) = 100 - 19.93(P/A, 8%, 10) PW(A) = 50 - 11.93(P/A, 8%, 10) Choose Alternative B, since the IRR is the largest. Choose both Alternative A and B, since IRR is greater than the MARR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts