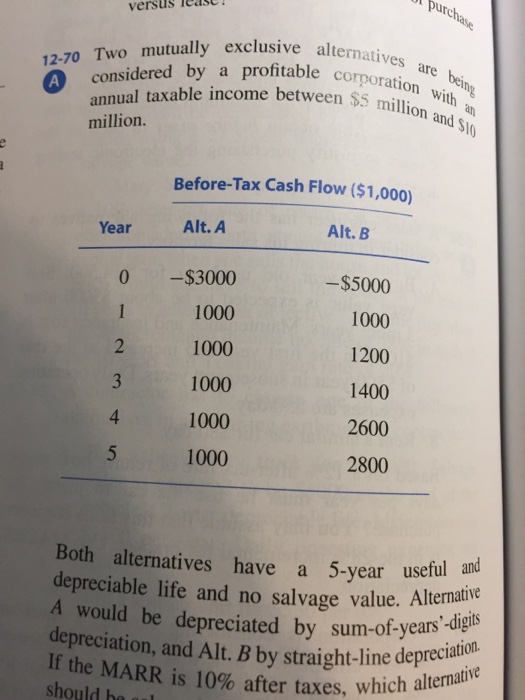

Question: Two mutually exclusive alternatives are being considered by a profitable corporation with an annual taxable income between $5 million and $10 million. Both alternatives have

versus least 12-70 Two mutually exclusiv alternatives annual by a profitable corporation with ng are taxable income between million and million. slo Before-Tax Cash Flow ($1,000) Year Alt. A Alt. B 0 $3000 $5000 1000 1000 1000 1200 1000 1400 1000 2600 1000 2800 Both alternatives have a 5-year useful and depreciable life and no salvage value. Alternative would be depreciated by sum-of-years digits depreciation, and ciation MARR is 10% after taxes, which a should be a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts