Answered step by step

Verified Expert Solution

Question

1 Approved Answer

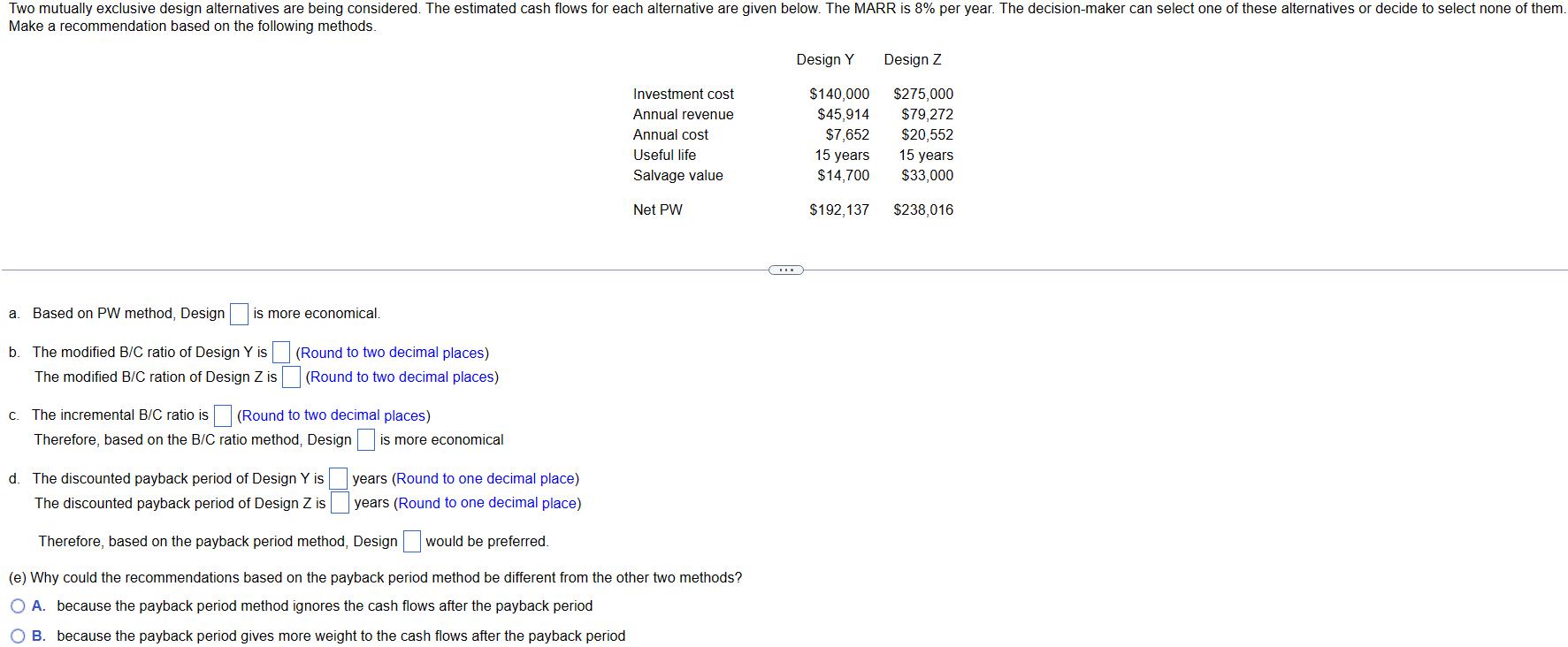

Two mutually exclusive design alternatives are being considered. The estimated cash flows for each alternative are given below. The MARR is 8% per year.

Two mutually exclusive design alternatives are being considered. The estimated cash flows for each alternative are given below. The MARR is 8% per year. The decision-maker can select one of these alternatives or decide to select none of them. Make a recommendation based on the following methods. a. Based on PW method, Design is more economical. b. The modified B/C ratio of Design Y is The modified B/C ration of Design Z is (Round to two decimal places) (Round to two decimal places) c. The incremental B/C ratio is (Round to two decimal places) Therefore, based on the B/C ratio method, Design is more economical Investment cost Annual revenue Annual cost Useful life Salvage value Net PW d. The discounted payback period of Design Y is The discounted payback period of Design Z is years (Round to one decimal place) years (Round to one decimal place) Therefore, based on the payback period method, Design would be preferred. (e) Why could the recommendations based on the payback period method be different from the other two methods? O A. because the payback period method ignores the cash flows after the payback period O B. because the payback period gives more weight to the cash flows after the payback period www Design Y $140,000 $45,914 $7,652 15 years $14,700 Design Z $275,000 $79,272 $20,552 15 years $33,000 $192,137 $238,016

Step by Step Solution

★★★★★

3.56 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a Based on the PW Present Worth method Design Y is more economical because it has a higher ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started