Question

TWO On 1 July 2019,John acquired 60% of the equity share capital of Kamata for Komillion in cash.Kamata already owned 60% of the equity share

TWO On 1 July 2019,John acquired 60% of the equity share capital of Kamata for Komillion in cash.Kamata already owned 60% of the equity share capital of Caleb at this date, having paid K4 million in cash.

On 1 April 2020, John acquired 10% of the equity share capital of Caleb for K1million in cash.

The following information is relevant:

1. On 1 July 2019, the balances on the retained earnings of Kamata and Caleb were K550,000 and K570,000 respectively.

2. As at 1 July 2019, a tangible non-current asset in the books of Kamata, with a remaining life of five years, was deemed to have a fair value of K250,000 in excess of its book value. The fair value of all other net assets were equal to their carrying values.

3. During the year ended 30 June 2020, Kamata sold goods to both John and Caleb at a mark-up of 20% on cost. The value of the goods held in inventory at the year-end were as follows: John K240,000 Caleb K120,000

4. The fair value of the non-controlling interest in Kamata was K800,000 on 1 July 2019. The fair value of the non-controlling interest in Caleb, taking into account effective ownership, was K1.3m on the same date.

5. Goodwill has not been impaired.

Required:

Prepare the consolidated statement of financial position of the Jon group as at 30 June 2020. It is group policy to value NCI at fair value.

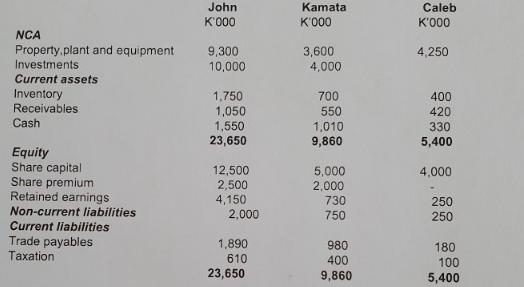

NCA Property.plant and equipment Investments Current assets Inventory Receivables Cash Equity Share capital Share premium Retained earnings Non-current liabilities Current liabilities Trade payables Taxation John K'000 9,300 10,000 1,750 1,050 1,550 23,650 12,500 2,500 4,150 2,000 1,890 610 23,650 Kamata K'000 3,600 4,000 700 550 1,010 9,860 5,000 2,000 730 750 980 400 9,860 Caleb K'000 4,250 400 420 330 5,400 4,000 250 250 180 100 5,400

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

John Group Consolidated Statement of Financial Position As at 30 June 2020 Assets No...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started