Answered step by step

Verified Expert Solution

Question

1 Approved Answer

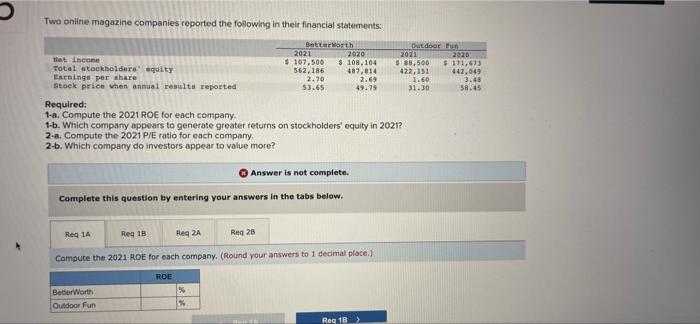

Two online magazine companies reported the following in their financial statements: BetterWorth Outdoor Fun 2021 2020 2021 2020 Net income $ 107,500 $ 108,104 $

Two online magazine companies reported the following in their financial statements:

| BetterWorth | Outdoor Fun | |||

|---|---|---|---|---|

| 2021 | 2020 | 2021 | 2020 | |

| Net income | $ 107,500 | $ 108,104 | $ 88,500 | $ 171,673 |

| Total stockholders' equity | 562,186 | 487,814 | 422,151 | 442,049 |

| Earnings per share | 2.70 | 2.69 | 1.60 | 3.48 |

| Stock price when annual results reported | 53.65 | 49.79 | 31.30 | 58.45 |

Required:

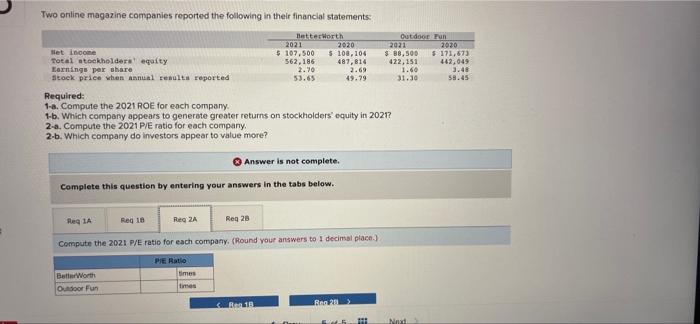

1-a. Compute the 2021 ROE for each company.

1-b. Which company appears to generate greater returns on stockholders equity in 2021?

2-a. Compute the 2021 P/E ratio for each company.

2-b. Which company do investors appear to value more?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started