Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two parts are required, see instructions. Directions Part 1 Read the following information. You are requested to fly to Mexico City to do a due

Two parts are required, see instructions.

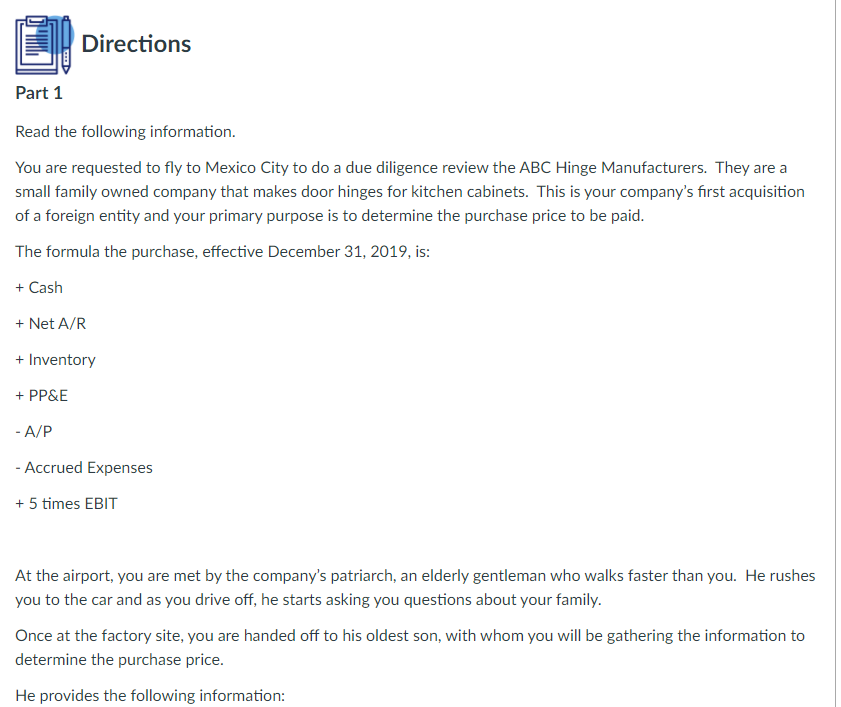

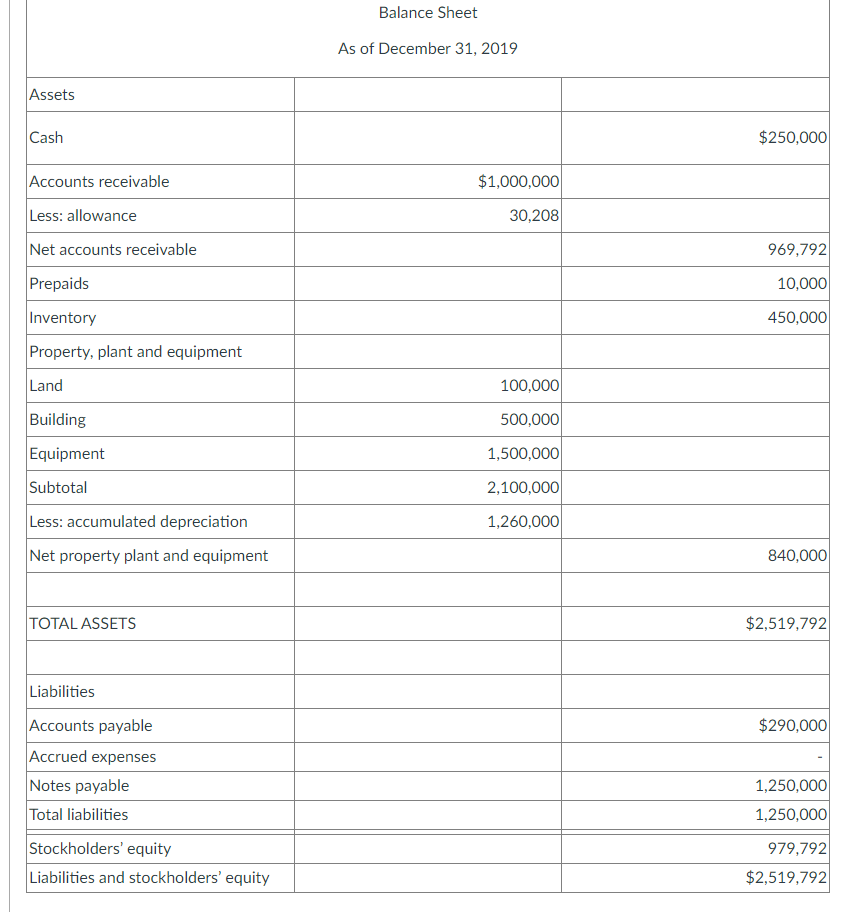

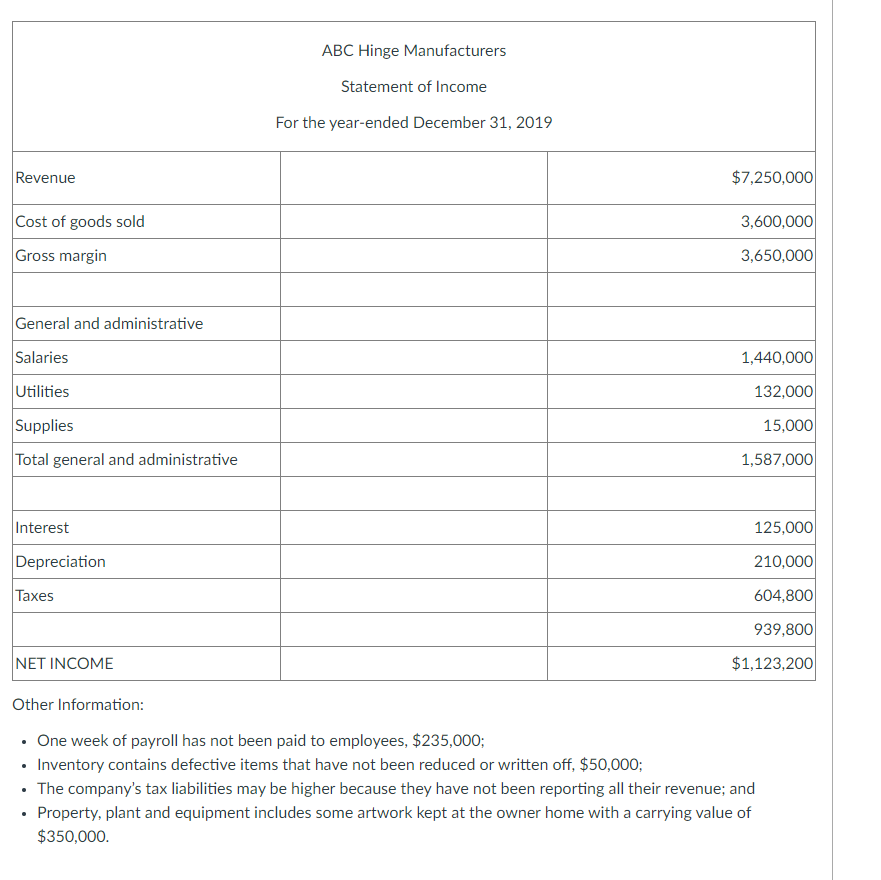

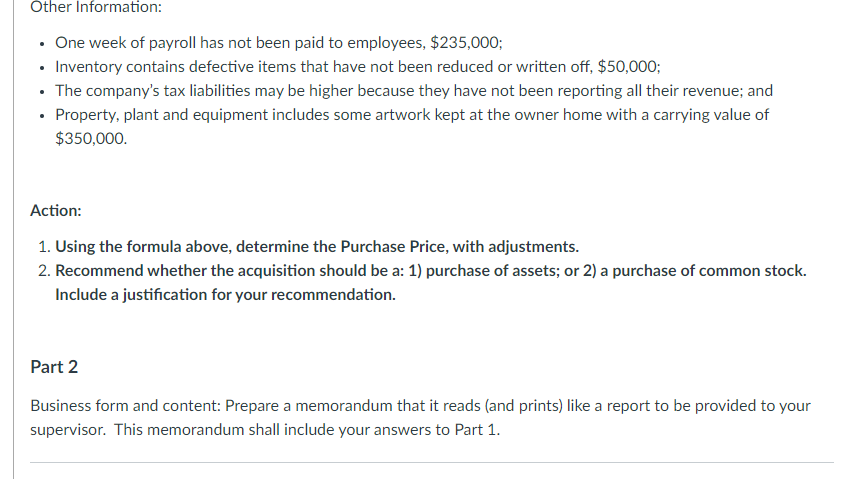

Directions Part 1 Read the following information. You are requested to fly to Mexico City to do a due diligence review the ABC Hinge Manufacturers. They are a small family owned company that makes door hinges for kitchen cabinets. This is your company's first acquisition of a foreign entity and your primary purpose is to determine the purchase price to be paid. The formula the purchase, effective December 31, 2019, is: + Cash + Net A/R + Inventory + PP&E -A/P - Accrued Expenses +5 times EBIT At the airport, you are met by the company's patriarch, an elderly gentleman who walks faster than you. He rushes you to the car and as you drive off, he starts asking you questions about your family. Once at the factory site, you are handed off to his oldest son, with whom you will be gathering the information to determine the purchase price. He provides the following information: Balance Sheet As of December 31, 2019 Assets Cash $250,000 Accounts receivable $1,000,000 Less: allowance 30,208 969,792 Net accounts receivable Prepaids 10,000 450,000 Inventory Property, plant and equipment Land 100,000 Building 500,000 Equipment 1,500,000 2,100,000 Subtotal Less: accumulated depreciation Net property plant and equipment 1,260,000 840,000 TOTAL ASSETS $2,519,792 Liabilities $290,000 1,250,000 Accounts payable Accrued expenses Notes payable Total liabilities Stockholders' equity Liabilities and stockholders' equity 1,250,000 979,792 $2,519,792 ABC Hinge Manufacturers Statement of Income For the year-ended December 31, 2019 Revenue $7,250,000 Cost of goods sold 3,600,000 Gross margin 3,650,000 General and administrative 1,440,000 Salaries Utilities 132,000 15,000 Supplies Total general and administrative 1,587,000 Interest 125,000 Depreciation 210,000 Taxes 604,800 939,800 NET INCOME $1,123,200 Other Information: One week of payroll has not been paid to employees, $235,000; Inventory contains defective items that have not been reduced or written off $50,000; The company's tax liabilities may be higher because they have not been reporting all their revenue; and Property, plant and equipment includes some artwork kept at the owner home with a carrying value of $350,000. Other Information: One week of payroll has not been paid to employees, $235,000; Inventory contains defective items that have not been reduced or written off, $50,000; The company's tax liabilities may be higher because they have not been reporting all their revenue; and Property, plant and equipment includes some artwork kept at the owner home with a carrying value of $350,000. Action: 1. Using the formula above, determine the Purchase Price, with adjustments. 2. Recommend whether the acquisition should be a: 1) purchase of assets; or 2) a purchase of common stock. Include a justification for your recommendation. Part 2 Business form and content: Prepare a memorandum that it reads and prints) like a report to be provided to your supervisor. This memorandum shall include your answers toStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started