Question

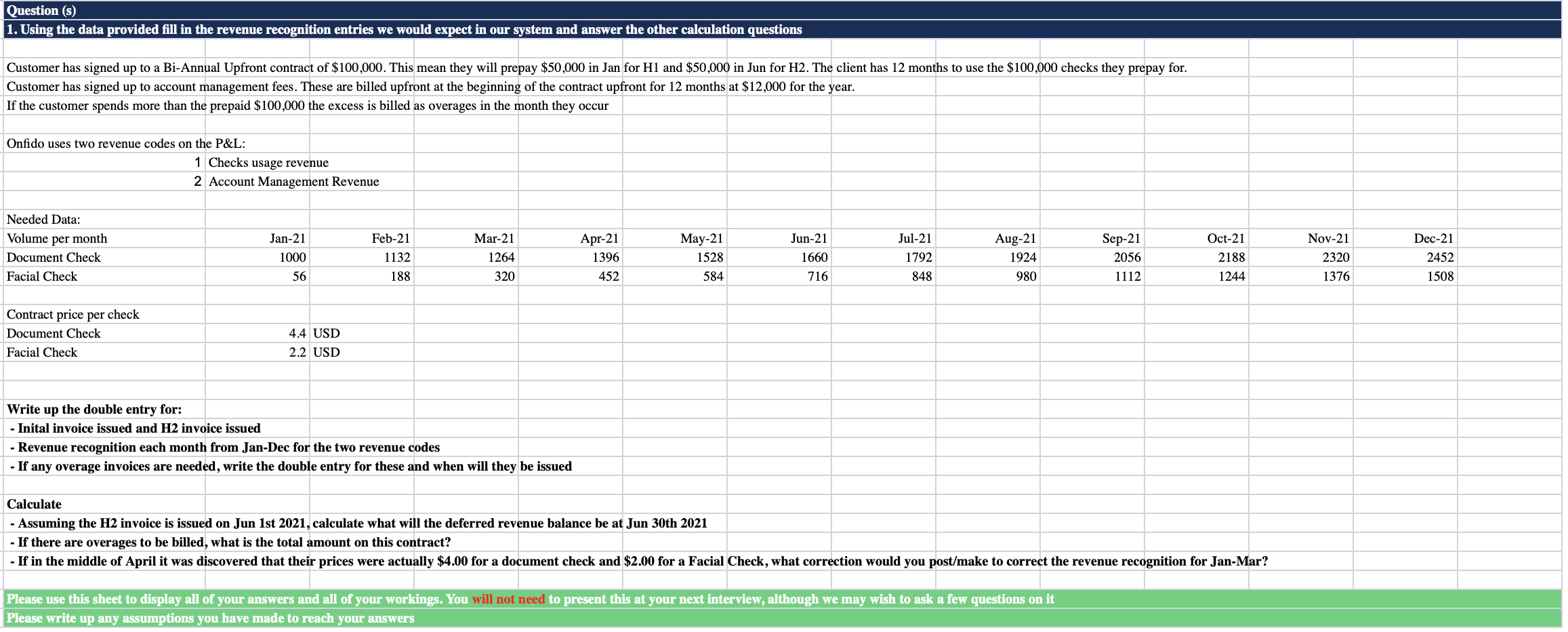

Two parts to this problem! Please help. There is no other parts to this problem Write up the double entry for: - Inital invoice issued

Two parts to this problem! Please help. There is no other parts to this problem

Write up the double entry for:

- Inital invoice issued and H2 invoice issued

- Revenue recognition each month from Jan-Dec for the two revenue codes

- If any overage invoices are needed, write the double entry for these and when will they be issued

Calculate

- Assuming the H2 invoice is issued on Jun 1st 2021, calculate what will the deferred revenue balance be at Jun 30th 2021

- If there are overages to be billed, what is the total amount on this contract?

- If in the middle of April it was discovered that their prices were actually $4.00 for a document check and $2.00 for a Facial Check, what correction would you post/make to correct the revenue recognition for Jan-Mar?

Question (s) 1. Using the data provided fill in the revenue recognition entries we would expect in our system and answer the other calculation questions Customer has signed up to account management fees. These are billed upfront at the beginning of the contract upfront for 12 months at $12,000 for the year. If the customer spends more than the prepaid $100,000 the excess is billed as overages in the month they occur Onfido uses two revenue codes on the P\&L: 1 Checks usage revenue 2 Account Management Revenue Needed Data: Volume per month Document Check Facial Check Contract price per check Document Check 4.4 USD Facial Check 2.2 USD Write up the double entry for: - Inital invoice issued and H2 invoice issued - Revenue recognition each month from Jan-Dec for the two revenue codes - If any overage invoices are needed, write the double entry for these and when will they be issued Calculate - Assuming the H2 invoice is issued on Jun 1st 2021, calculate what will the deferred revenue balance be at Jun 30 th 2021 - If there are overages to be billed, what is the total amount on this contract? Please use this sheet to display all of your answers and all of your workings. You will not need to present this at your next interview, although we may wish to ask a few questions on it Please write up any assumptions you have made to reach your answers Question (s) 1. Using the data provided fill in the revenue recognition entries we would expect in our system and answer the other calculation questions Customer has signed up to account management fees. These are billed upfront at the beginning of the contract upfront for 12 months at $12,000 for the year. If the customer spends more than the prepaid $100,000 the excess is billed as overages in the month they occur Onfido uses two revenue codes on the P\&L: 1 Checks usage revenue 2 Account Management Revenue Needed Data: Volume per month Document Check Facial Check Contract price per check Document Check 4.4 USD Facial Check 2.2 USD Write up the double entry for: - Inital invoice issued and H2 invoice issued - Revenue recognition each month from Jan-Dec for the two revenue codes - If any overage invoices are needed, write the double entry for these and when will they be issued Calculate - Assuming the H2 invoice is issued on Jun 1st 2021, calculate what will the deferred revenue balance be at Jun 30 th 2021 - If there are overages to be billed, what is the total amount on this contract? Please use this sheet to display all of your answers and all of your workings. You will not need to present this at your next interview, although we may wish to ask a few questions on it Please write up any assumptions you have made to reach your answersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started