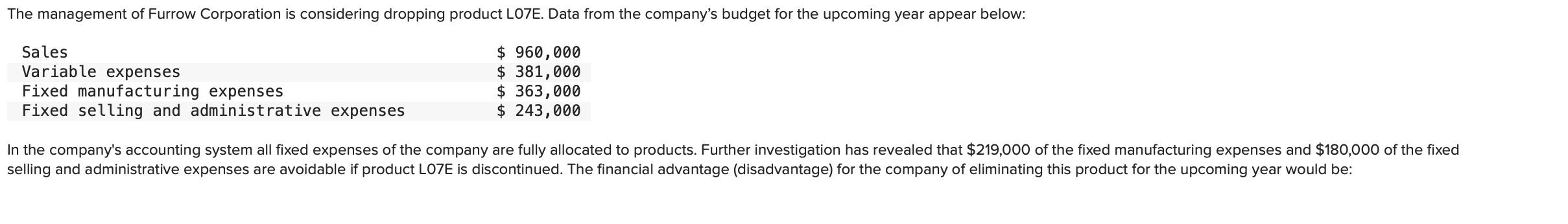

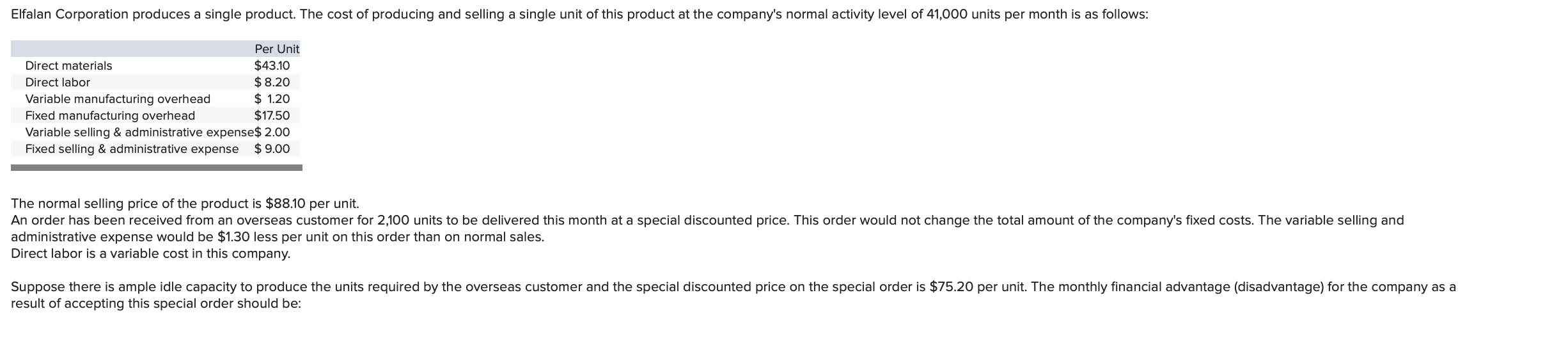

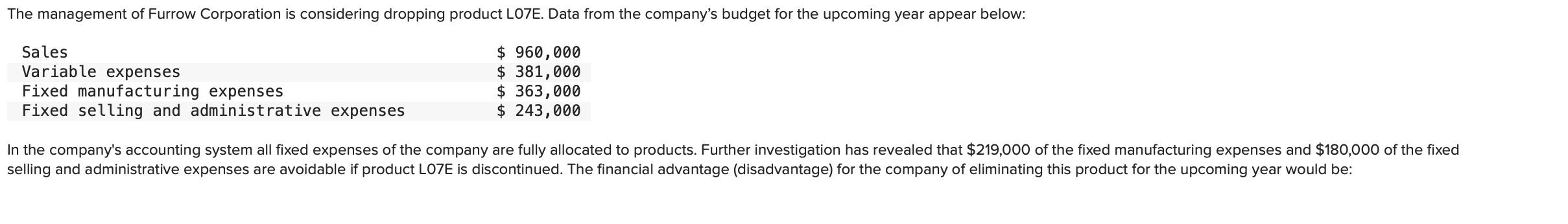

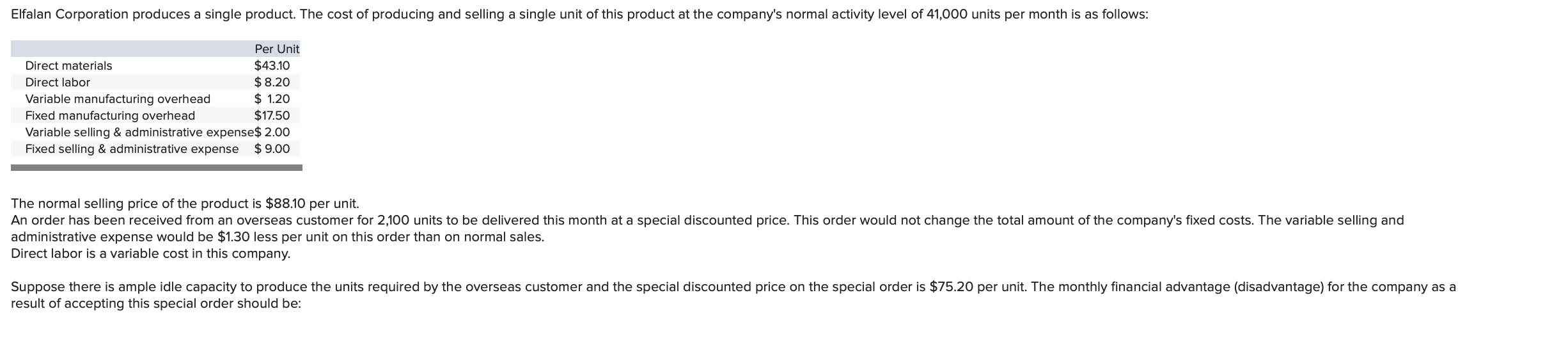

Two products, QI and VH, emerge from a joint process. Product Ql has been allocated $13,300 of the total joint costs of $34,000. A total of 2,000 units of product QI are produced from the joint process. Product QI can be sold at the split- off point for $12 per unit, or it can be processed further for an additional total cost of $10,000 and then sold for $15 per unit. If product QI is processed further and sold, what would be the financial advantage (disadvantage) for the company compared with sale in its unprocessed form directly after the split-off point? The management of Furrow Corporation is considering dropping product LOVE. Data from the company's budget for the upcoming year appear below: Sales Variable expenses Fixed manufacturing expenses Fixed selling and administrative expenses $ 960,000 $ 381,000 $ 363,000 $ 243,000 In the company's accounting system all fixed expenses of the company are fully allocated to products. Further investigation has revealed that $219,000 of the fixed manufacturing expenses and $180,000 of the fixed selling and administrative expenses are avoidable if product LOVE is discontinued. The financial advantage (disadvantage) for the company of eliminating this product for the upcoming year would be: Elfalan Corporation produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 41,000 units per month is as follows: Per Unit Direct materials $43.10 Direct labor $ 8.20 Variable manufacturing overhead $ 1.20 Fixed manufacturing overhead $17.50 Variable selling & administrative expense$ 2.00 Fixed selling & administrative expense $ 9.00 The normal selling price of the product is $88.10 per unit. An order has been received from an overseas customer for 2,100 units to be delivered this month at a special discounted price. This order would not change the total amount of the company's fixed costs. The variable selling and administrative expense would be $1.30 less per unit on this order than on normal sales. Direct labor is a variable cost in this company. Suppose there is ample idle capacity to produce the units required by the overseas customer and the special discounted price on the special order is $75.20 per unit. The monthly financial advantage (disadvantage) for the company as a result of accepting this special order should be