Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two real estate companies set up a separate vehicle for the purpose of acquiring and operating condominium units. One of the companies, SS Company

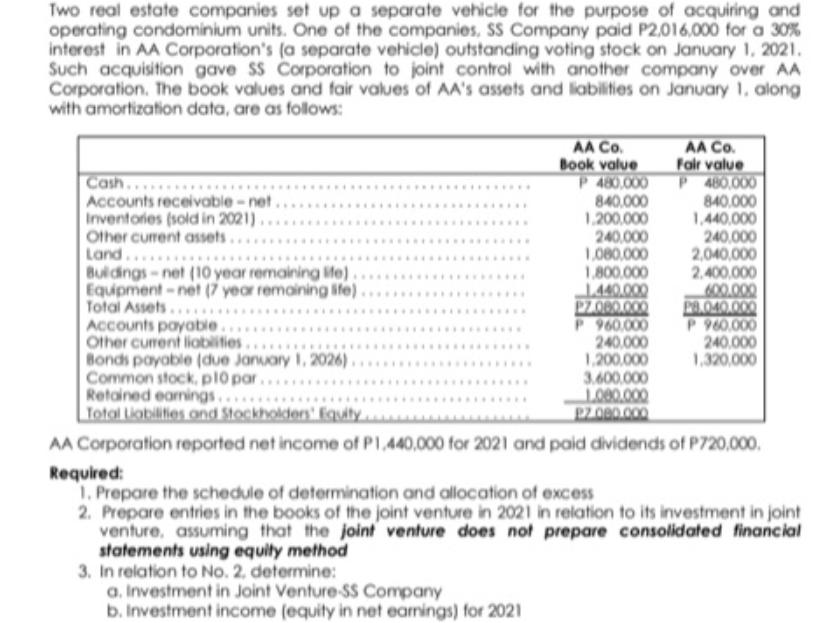

Two real estate companies set up a separate vehicle for the purpose of acquiring and operating condominium units. One of the companies, SS Company paid P2,016,000 for a 30% interest in AA Corporation's (a separate vehicle) outstanding voting stock on January 1, 2021. Such acquisition gave SS Corporation to joint control with another company over AA Corporation. The book values and fair values of AA's assets and liabilities on January 1, along with amortization data, are as follows: Cash.. Accounts receivable-net. Inventories (sold in 2021). Other current assets.. Land Buldings-net (10 year remaining life) Equipment-net (7 year remaining life) Total Assets..... AA Co. Book value P 480.000 840,000 1,200,000 240,000 1,080,000 1.800.000 1.440.000 PZ.080.000 P 960.000 240,000 1,200,000 AA Co. Fair value P 480.000 840,000 1,440,000 240,000 2,040,000 2,400,000 600.000 PB.040.000 P 960.000 240,000 1,320,000 Accounts payable... Other current liabilities. Bonds payable (due January 1, 2026). Common stock, p10 par. 3.600,000 Retained earings........ 1.000.000 Total Liabilities and Stockholders' Equity PZ.080.000 AA Corporation reported net income of P1.440,000 for 2021 and paid dividends of P720,000. Required: 1. Prepare the schedule of determination and allocation of excess 2. Prepare entries in the books of the joint venture in 2021 in relation to its investment in joint venture, assuming that the joint venture does not prepare consolidated financial statements using equity method 3. In relation to No. 2. determine: a. Investment in Joint Venture-SS Company b. Investment income (equity in net earnings) for 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started