Answered step by step

Verified Expert Solution

Question

1 Approved Answer

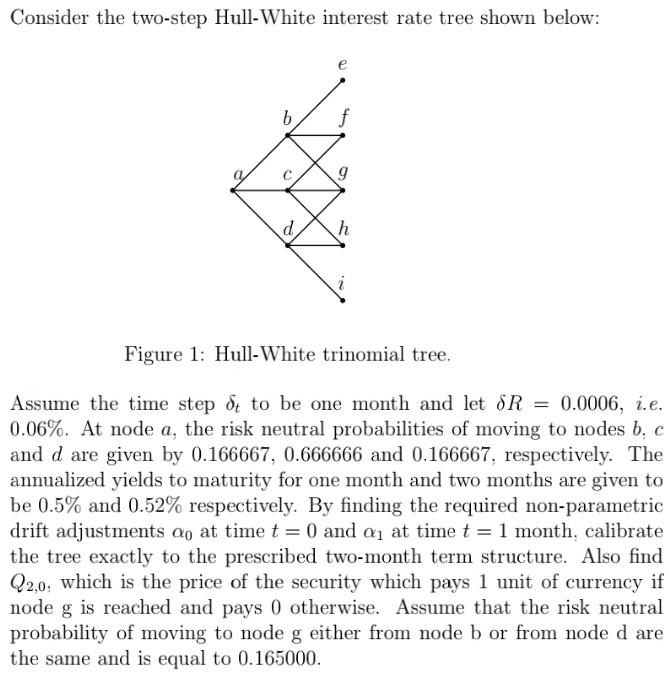

Two step Hull-White tree Consider the two-step Hull-White interest rate tree shown below: Figure 1: Hull-White trinomial tree. Assume the time step ( delta_{t} )

Two step Hull-White tree

Consider the two-step Hull-White interest rate tree shown below: Figure 1: Hull-White trinomial tree. Assume the time step \\( \\delta_{t} \\) to be one month and let \\( \\delta R=0.0006 \\), i.e. \0.06. At node \\( a \\), the risk neutral probabilities of moving to nodes \\( b, c \\) and \\( d \\) are given by \\( 0.166667,0.666666 \\) and 0.166667 , respectively. The annualized yields to maturity for one month and two months are given to be \0.5 and \0.52 respectively. By finding the required non-parametric drift adjustments \\( \\alpha_{0} \\) at time \\( t=0 \\) and \\( \\alpha_{1} \\) at time \\( t=1 \\) month, calibrate the tree exactly to the prescribed two-month term structure. Also find \\( Q_{2,0} \\), which is the price of the security which pays 1 unit of currency if node \\( g \\) is reached and pays 0 otherwise. Assume that the risk neutral probability of moving to node g either from node b or from node \\( d \\) are the same and is equal to 0.165000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started