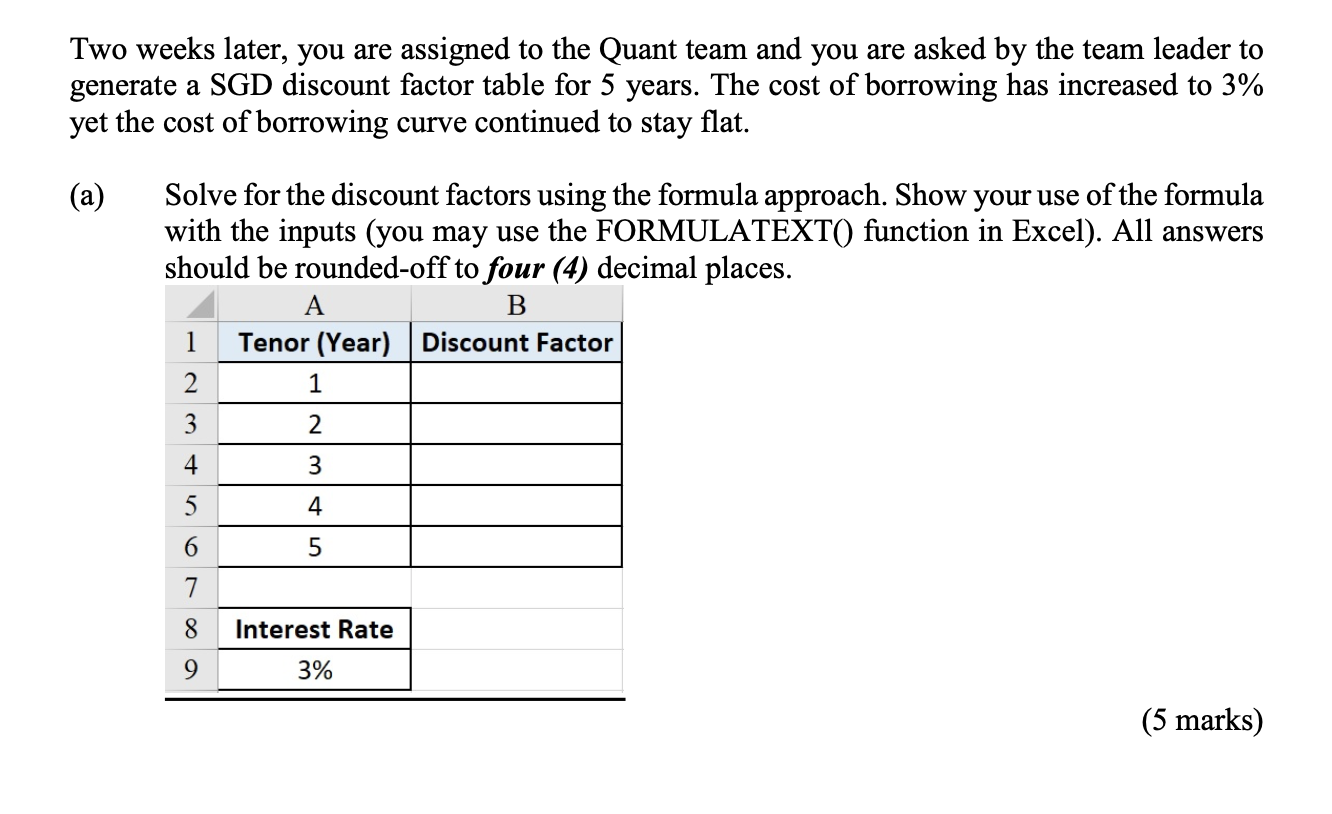

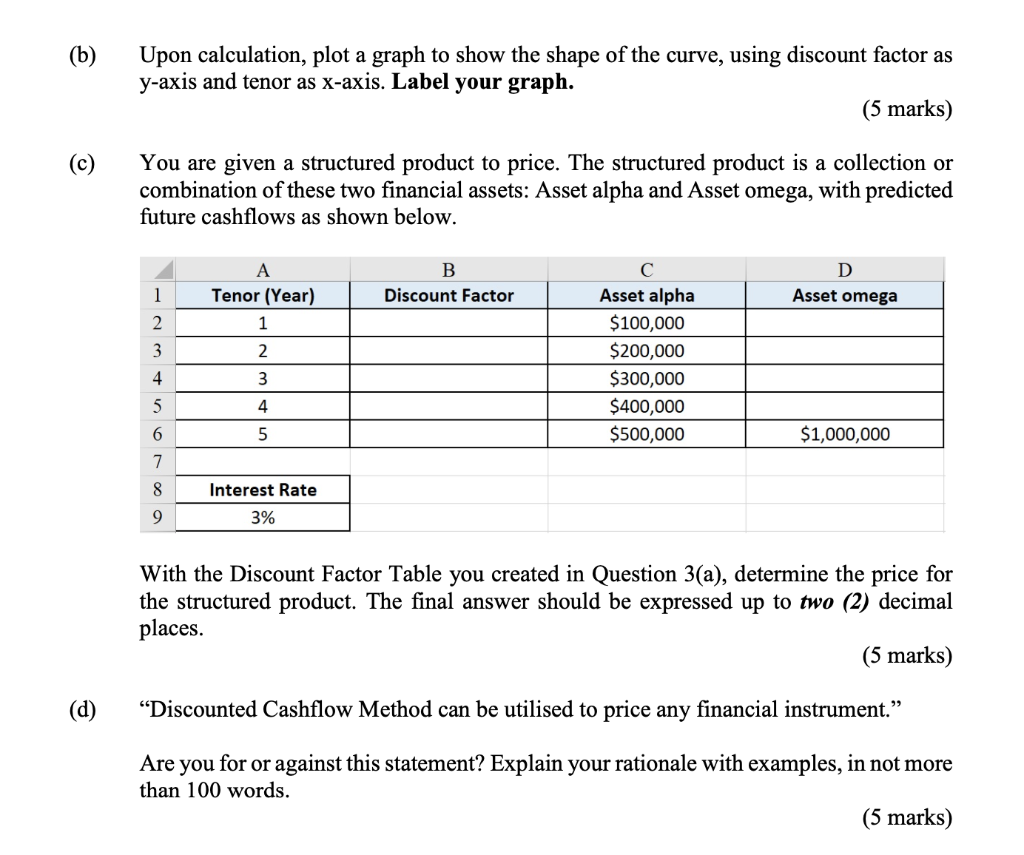

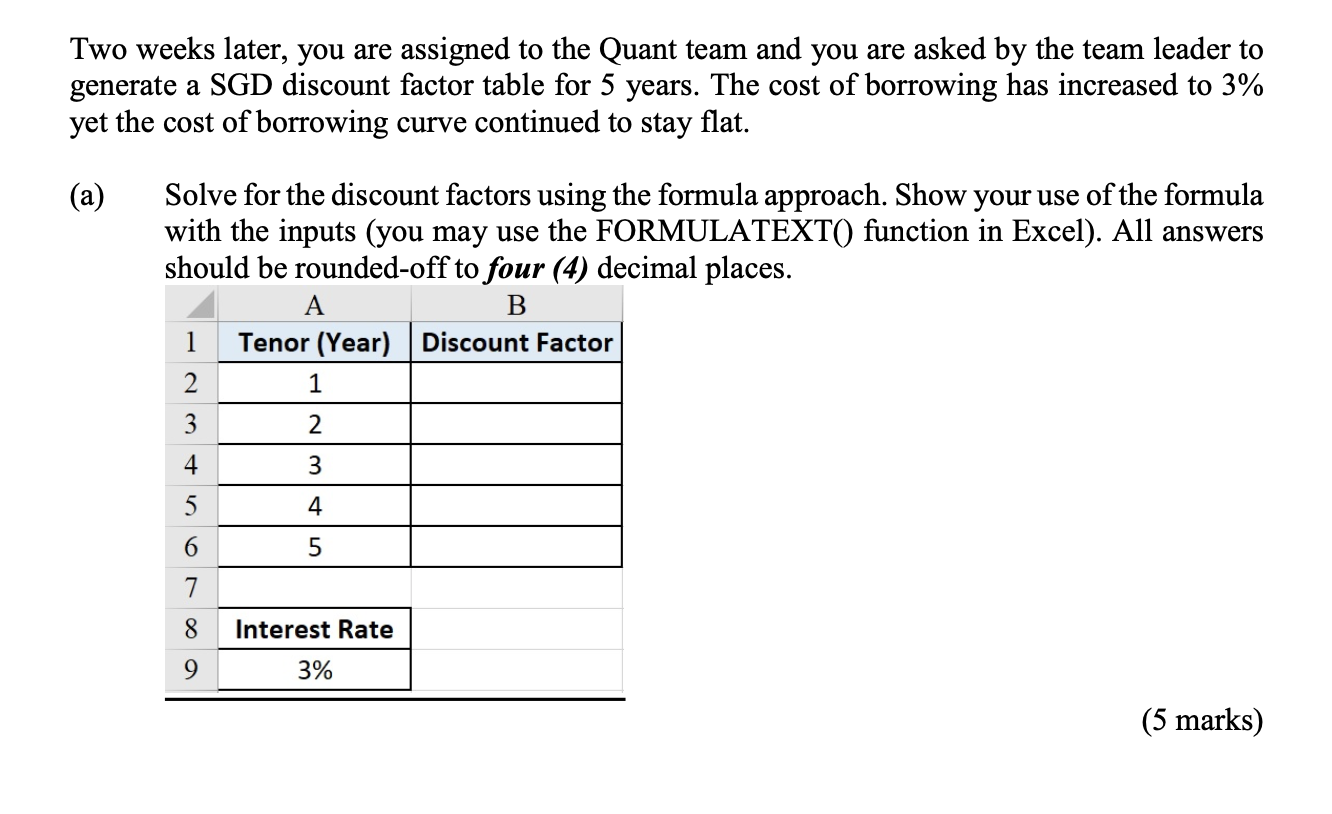

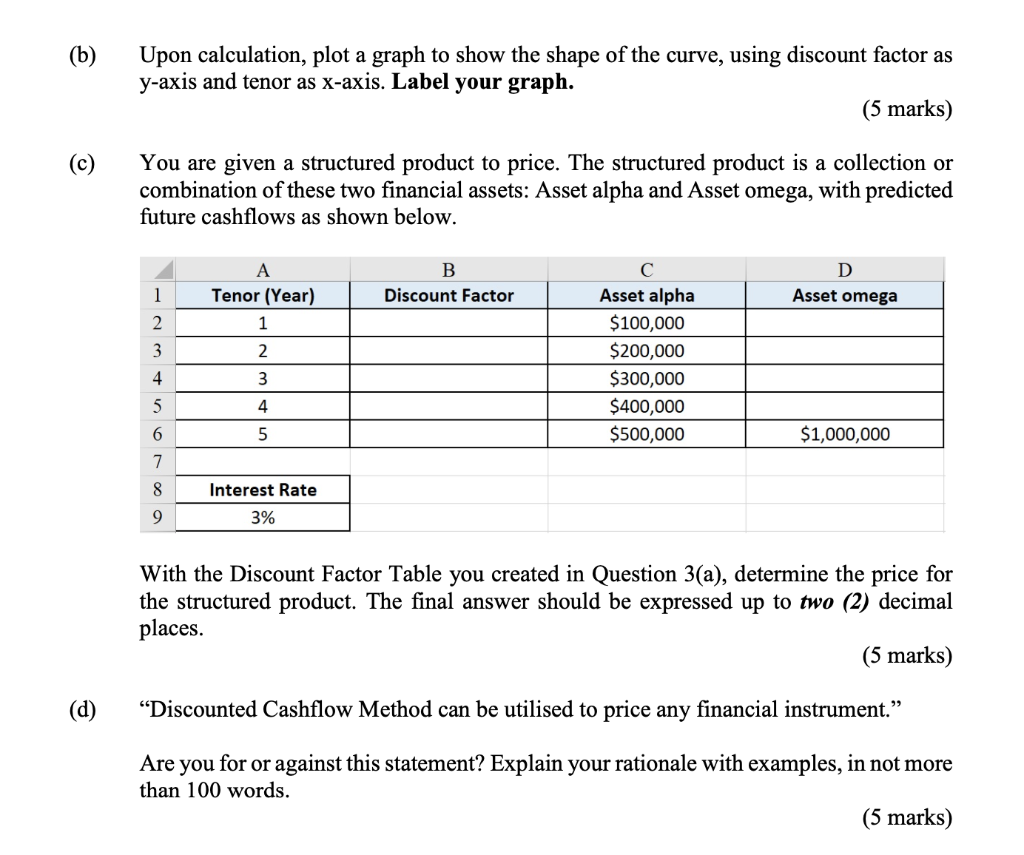

Two weeks later, you are assigned to the Quant team and you are asked by the team leader to generate a SGD discount factor table for 5 years. The cost of borrowing has increased to 3% yet the cost of borrowing curve continued to stay flat. (a) Solve for the discount factors using the formula approach. Show your use of the formula with the inputs (you may use the FORMULATEXT() function in Excel). All answers should be rounded-off to four (4) decimal places. A B Tenor (Year) Discount Factor 1 2 1 3 2 4 3 5 4 6 5 7 8 Interest Rate 9 3% (5 marks) (b) Upon calculation, plot a graph to show the shape of the curve, using discount factor as y-axis and tenor as x-axis. Label your graph. (5 marks) (c) You are given a structured product to price. The structured product is a collection or combination of these two financial assets: Asset alpha and Asset omega, with predicted future cashflows as shown below. A Tenor (Year) 1 B Discount Factor 1 2 3 D Asset omega 2 Asset alpha $100,000 $200,000 $300,000 $400,000 $500,000 3 4 5 4 6 5 $1,000,000 7 8 9 Interest Rate 3% With the Discount Factor Table you created in Question 3(a), determine the price for the structured product. The final answer should be expressed up to two (2) decimal places. (5 marks) Discounted Cashflow Method can be utilised to price any financial instrument. Are you for or against this statement? Explain your rationale with examples, in not more than 100 words. (5 marks) Two weeks later, you are assigned to the Quant team and you are asked by the team leader to generate a SGD discount factor table for 5 years. The cost of borrowing has increased to 3% yet the cost of borrowing curve continued to stay flat. (a) Solve for the discount factors using the formula approach. Show your use of the formula with the inputs (you may use the FORMULATEXT() function in Excel). All answers should be rounded-off to four (4) decimal places. A B Tenor (Year) Discount Factor 1 2 1 3 2 4 3 5 4 6 5 7 8 Interest Rate 9 3% (5 marks) (b) Upon calculation, plot a graph to show the shape of the curve, using discount factor as y-axis and tenor as x-axis. Label your graph. (5 marks) (c) You are given a structured product to price. The structured product is a collection or combination of these two financial assets: Asset alpha and Asset omega, with predicted future cashflows as shown below. A Tenor (Year) 1 B Discount Factor 1 2 3 D Asset omega 2 Asset alpha $100,000 $200,000 $300,000 $400,000 $500,000 3 4 5 4 6 5 $1,000,000 7 8 9 Interest Rate 3% With the Discount Factor Table you created in Question 3(a), determine the price for the structured product. The final answer should be expressed up to two (2) decimal places. (5 marks) Discounted Cashflow Method can be utilised to price any financial instrument. Are you for or against this statement? Explain your rationale with examples, in not more than 100 words