Answered step by step

Verified Expert Solution

Question

1 Approved Answer

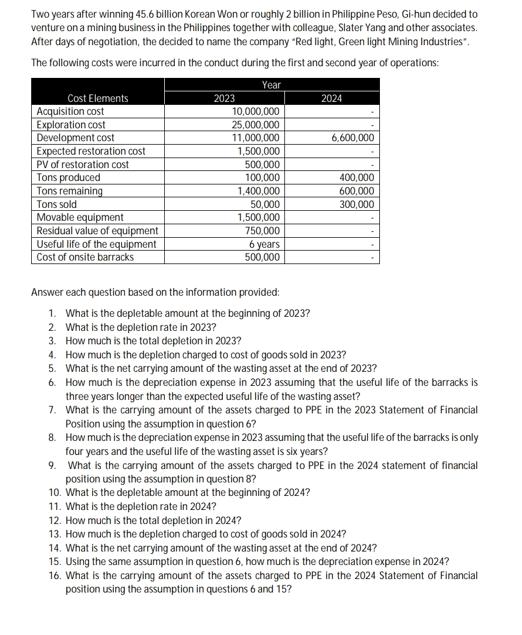

Two years after winning 45.6 billion korean Won or roughly 2 billion in Philippine Peso, Gi-hun decided to venture on a mining business in

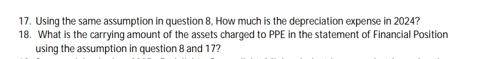

Two years after winning 45.6 billion korean Won or roughly 2 billion in Philippine Peso, Gi-hun decided to venture on a mining business in the Philippines together with colleague, Slater Yang and other associates. After days of negotiation, the decided to name the company "Red light, Green light Mining Industries". The following costs were incurred in the conduct during the first and second year of operations: Year Cost Elements Acquisition cost Exploration cost Development cost Expected restoration cost PV of restoration cost Tons produced Tons remaining Tons sold Movable equipment Residual value of equipment Useful life of the equipment Cost of onsite barracks 2023 10,000,000 25,000,000 11,000,000 1,500,000 500,000 100,000 1,400,000 50,000 1,500,000 750,000 6 years 500,000 2024 6,600,000 400,000 600,000 300,000 Answer each question based on the information provided: 1. What is the depletable amount at the beginning of 2023? 2. What is the depletion rate in 2023? 3. How much is the total depletion in 2023? 4. How much is the depletion charged to cost of goods sold in 2023? 5. What is the net carrying amount of the wasting asset at the end of 2023? 6. How much is the depreciation expense in 2023 assuming that the useful life of the barracks is three years longer than the expected useful life of the wasting asset? 7. What is the carrying amount of the assets charged to PPE in the 2023 Statement of Financial Position using the assumption in question 6? 8. How much is the depreciation expense in 2023 assuming that the useful life of the barracks is only four years and the useful life of the wasting asset is six years? 9. What is the carrying amount of the assets charged to PPE in the 2024 statement of financial position using the assumption in question 8? 10. What is the depletable amount at the beginning of 2024? 11. What is the depletion rate in 2024? 12. How much is the total depletion in 2024? 13. How much is the depletion charged to cost of goods sold in 2024? 14. What is the net carrying amount of the wasting asset at the end of 2024? 15. Using the same assumption in question 6, how much is the depreciation expense in 2024? 16. What is the carrying amount of the assets charged to PPE in the 2024 Statement of Financial position using the assumption in questions 6 and 15? 17. Using the same assumption in question 8, How much is the depreciation expense in 2024? 18. What is the carrying amount of the assets charged to PPE in the statement of Financial Position using the assumption in question 8 and 17?

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answers for each question based on the information provided Given Acquisition cost Php 10000000 2023 Php 25000000 2024 Exploration cost Php 11000000 2023 Php 6600000 2024 Development cost Php 1500000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started