Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two years ago, Kareem invested $5,000 in a savings certificate account with a seven- year maturity and an annual interest rate of 9 percent

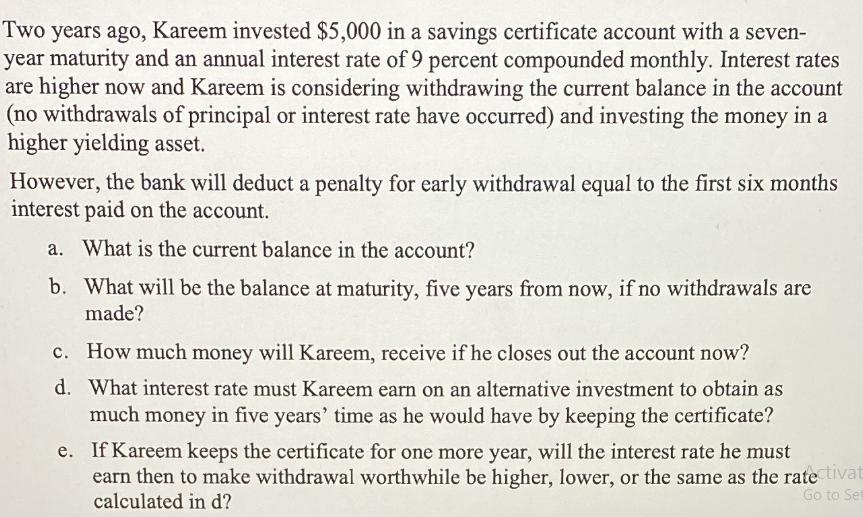

Two years ago, Kareem invested $5,000 in a savings certificate account with a seven- year maturity and an annual interest rate of 9 percent compounded monthly. Interest rates are higher now and Kareem is considering withdrawing the current balance in the account (no withdrawals of principal or interest rate have occurred) and investing the money in a higher yielding asset. However, the bank will deduct a penalty for early withdrawal equal to the first six months interest paid on the account. a. What is the current balance in the account? b. What will be the balance at maturity, five years from now, if no withdrawals are made? c. How much money will Kareem, receive if he closes out the account now? d. What interest rate must Kareem earn on an alternative investment to obtain as much money in five years' time as he would have by keeping the certificate? e. If Kareem keeps the certificate for one more year, will the interest rate he must earn then to make withdrawal worthwhile be higher, lower, or the same as the rate tivat calculated in d? Go to Set

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem well use the formula for compound interest A P1 rnnt Where A the final amount P the principal amount initial investment r the an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started