Question

two-parts Part A and Part B. You will be submitting a written project in part A and a project presentation in part B. Here is

two-parts Part A and Part B. You will be submitting a written project in part A and a project presentation in part B.

Here is the detailed instruction:

PART A:

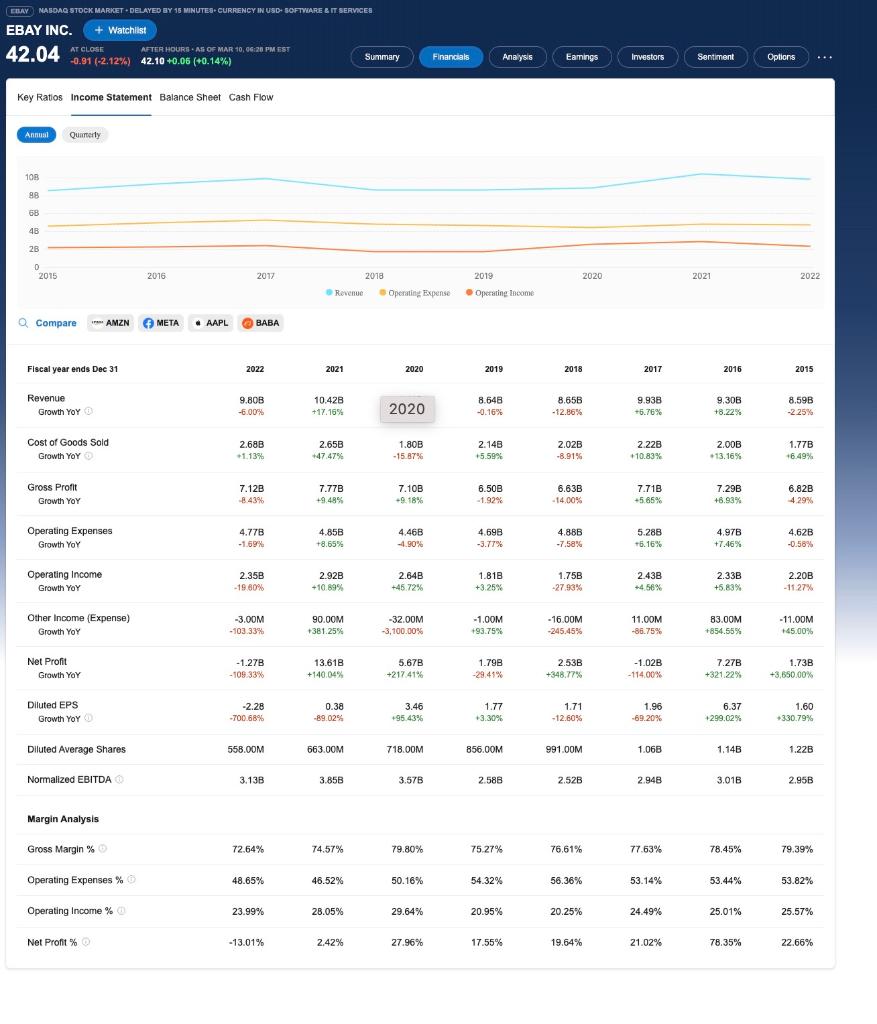

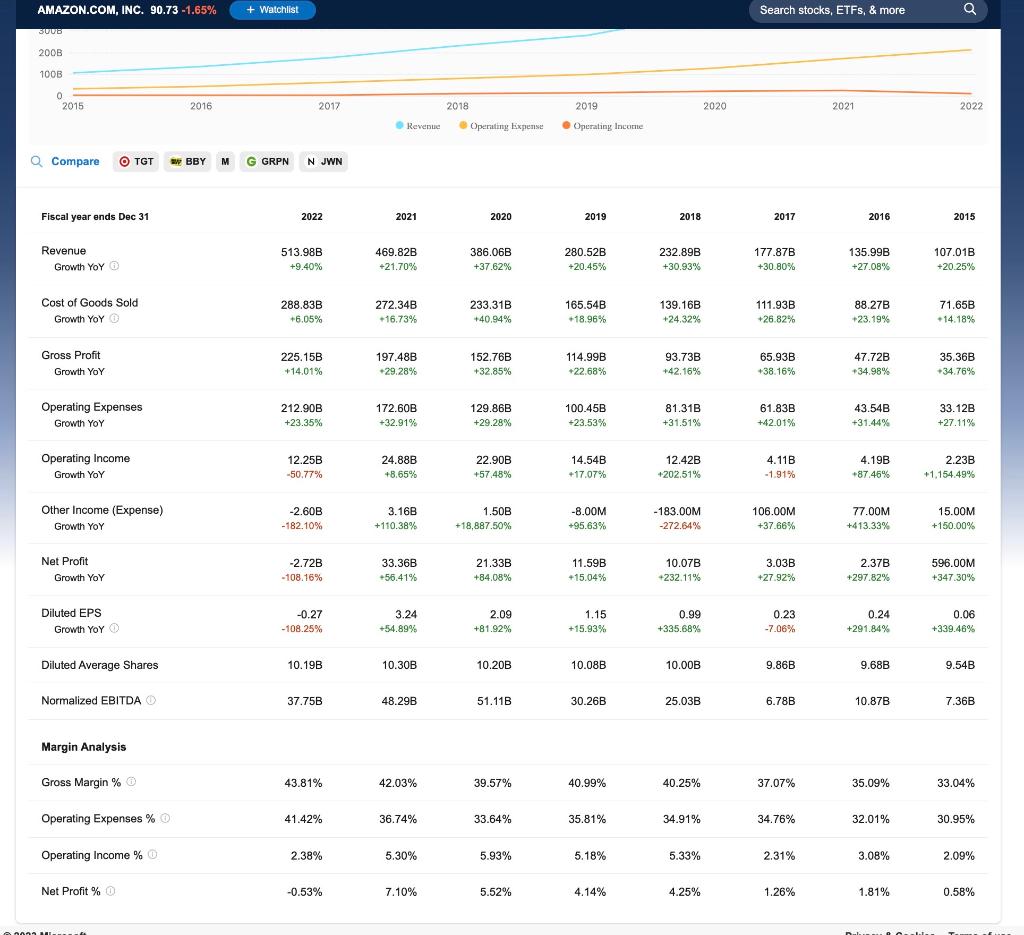

In this part you will create a complete analysis of two different companies in the same industry (for

example, Amazon and eBay). You can locate information about the two companies: annual financial.

statements for the most recent year available. To do so, go to one of the many financial sites on the

Internet to download their reports.

MSN Money

Yahoo Finance

The requirement here is to address the following items:

What are the primary lines of business of these two companies as shown in their notes to the financial statement?

Which company has the dominant position in their industry?

What are the gross profits, operating profits, and net income for these two companies?

Compute both companies' cash coverage ratio, current ratio, and free cash flow.

What ratios do each of these companies use in the Management's Discussion and Analysis section of the annual report to explain their financial condition related to debt financing?

What are the gross profits, net income, EBIT, EBITDA and free cash flow (FCF) for these two companies?

For both companies, compute:

Current ratio;

Quick ratio;

Total debt ratio;

Debt-equity ratio;

Total asset turnover;

Inventory turnover;

Days sales in inventory;

Profit margin on sales;

Return on assets; and

Return on equity.

Explain what each ratio is indicating relevant to your firm's financial position.

After calculating the ratios, compare/contrast the ratios with the other company

Using any two of the several valuation models we have studied in this course, demonstrate whether the stock is overvalued, undervalued, or correctly valued by the market.

PART B:

In addition to your written project, explain your findings, identify whether or not you would invest in these companies, if so, why, if not, why not.

ETWY. MAEDAA STDCK MARKET + DELAYED EY 15 MNUTE + CURFENCY IN USD- SCFTVEARE E I SERVEEE EBAY INC. + watchilst 42.04 Key Ratios Income Statement Balance Sheet Cash Flow Annual Quamerly Margin Analysis Gross Margin \% 43.81%41.42%2.38%0.53%42.03%36.74%5.30%7.10%39.57%33.64%5.93%5.52%40.99%35.81%5.18%4.14%40.25%34.91%5.33%4.25%37.07%34.76%2.31%1.26%35.09%32.01%3.08%1.81%33.04%30.95%2.09%0.58% ETWY. MAEDAA STDCK MARKET + DELAYED EY 15 MNUTE + CURFENCY IN USD- SCFTVEARE E I SERVEEE EBAY INC. + watchilst 42.04 Key Ratios Income Statement Balance Sheet Cash Flow Annual Quamerly Margin Analysis Gross Margin \% 43.81%41.42%2.38%0.53%42.03%36.74%5.30%7.10%39.57%33.64%5.93%5.52%40.99%35.81%5.18%4.14%40.25%34.91%5.33%4.25%37.07%34.76%2.31%1.26%35.09%32.01%3.08%1.81%33.04%30.95%2.09%0.58%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started